- 08 Jan 2024 05:55 PM

- New

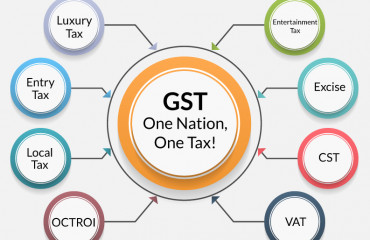

Supreme Court issues notice to Centre on 28% GST for online gaming companies

NEW DELHI : The Supreme Court on Monday issued a notice to the government seeking a response to a plea filed by online gaming companies on tax demands adding up to ₹1.5 lakh crore. The court, however, did not issue a stay on the tax notices issued by the government.

Read More

- 08 Jan 2024 06:06 PM

- New

GST Crackdown: 29,273 Bogus Firms Exposed, Evading Rs. 44,015 Cr; 121 Arrests Made

Source: https://taxguru.in/goods-and-service-tax/gst-crackdown-bogus-firms-evade-tax.html

Introduction:

In an intensified effort against tax evasion, the Goods and Services Tax (GST) formations, led by the Central Board of Indirect Taxes and Customs (CBIC) and State/UT Governments, have unearthed 29,273 sham firms involved in suspected Input Tax Credit (ITC) evasion amounting to Rs. 44,015 crore since May 2023. This crackdown, aimed at non-existent taxpayers, has resulted in 121 arrests, marking a significant stride in curbing GST fraud.

- 08 Jan 2024 06:10 PM

- New

Pay GST With Credit Card or Debit Card

Source: https://taxguru.in/goods-and-service-tax/pay-gst-credit-card-debit-card.html

Introduction: In an era where digital transactions govern financial landscapes, the Goods and Services Tax Network (GSTN) has taken a significant stride by introducing a streamlined method for taxpayers to settle their GST liability. This novel approach allows individuals and businesses to leverage the convenience of Credit Cards or Debit Cards. However, it’s crucial to note that this option is currently available in specific states. This comprehensive article delves into the intricacies of this payment method, providing a detailed analysis of the steps involved, associated transaction charges, and the states where this facility is presently accessible.

Read More

- 08 Jan 2024 05:35 PM

Mint Primer: What the surprise manufacturing slowdown means

Source: https://www.livemint.com/economy/what-the-surprise-manufacturing-slowdown-means-11704645690648.html

What was surprising about the PMI data?

The manufacturing PMI for December came in at 54.9 as against 56 in November. It was also the lowest since October 2022 when the index fell to 55.3. A reading above 50 means expansion while that lower than 50 means contraction. This surprised many as the economy had just registered a strong 7.6% growth in the July-September quarter on the back of a 7.8% growth in the April-June quarter. The just-concluded festive season, if consumer goods companies are to be believed, has been good, with outstanding retail loans crossing ₹50 trillion for the first time in November last year.

- 08 Jan 2024 05:31 PM

Budget 2024: Skilled Online Games industry stresses for GST review ahead of vote-on-account

As the Indian government prepares for the impending Interim Budget 2024, leaders in the technology and gaming sectors are optimistic and anticipate potential advantages stemming from the forthcoming vote-on-account and the Interim Budget.

Read More

- 05 Jan 2024 05:50 PM

SC issues Notice to to Finance Ministry on GST Return Revision Option on Portal

Pradeep Kanthed Vs. Union of India and Ors (Supreme Court of India)

Introduction: The Supreme Court of India, in the case of Pradeep Kanthed v. Union of India and Ors [Writ Petition (Civil) No. 1006/2023], issued a notice to the Finance Ministry on January 2, 2023. The notice addresses concerns raised by the petitioner regarding the absence of an option for revised returns on the GST portal, creating issues for GST-registered persons and dealers.

- 05 Jan 2024 05:26 PM

Budget 2024: Real estate sector bats for GST revision, tax sops to boost affordable housing — here is a wishlist

As India eagerly awaits Finance Minister Nirmala Sitharaman's sixth Union Budget, to be presented in Parliament on February 1, 2024, the nation’s real estate sector, particularly the affordable housing segment, is poised in anticipation. To realise the government’s vision of ‘Housing for All,’ experts and industry leaders have shared their insights, proposing vital measures to boost the affordable housing landscape. The proposals include revisiting GST rates, tax deductions, land allocation, and fund boost. The upcoming budget is seen as an opportunity to fortify the real estate industry’s pivotal role in India’s economic development.

Read More

- 05 Jan 2024 05:31 PM

Vodafone Idea to contest ₹10.76 crore penalty order under CGST Act, cites 'wrong transition of CENVAT credit'

Vodafone Idea Limited on 4 January announced that it will take appropriate legal action for rectification and reversal of an order it received under the Central Goods and Services Tax Act, 2017, entailing a penalty of ₹10.76 crore.

Read More

- 05 Jan 2024 05:39 PM

Data recap: GST, car sales, shipping cost

Source: https://www.livemint.com/economy/data-recap-gst-car-sales-shipping-cost-11704367376974.html

Every Friday, Plain Facts publishes a compilation of data-based insights, complete with easy-to-read charts, to help you delve deeper into the stories reported by Mint in the week gone by. The Centre’s goods and services tax (GST) collections grew 10.3% year-on-year to ₹1.65 trillion in December. Meanwhile, the recent attacks on vessels in the Red Sea have led to a surge in shipping costs.

Read More

- 05 Jan 2024 05:46 PM

Hat-trick on cards? Dividends from CPSEs may cross ₹50,000 crore this year too: Report

Dividends from central public sector enterprises (CPSEs) are likely to cross ₹50,000 crore during the current fiscal for the third year in a row. It has already exceeded the Budget Estimate (BE) during the current fiscal year, reported Business Line.

Read More