- 20 Mar 2025 06:27 PM

- New

GST on Jeevan Rakshak Policy: Government’s Position

Source: https://taxguru.in/goods-and-service-tax/gst-jeevan-rakshak-policy-governments-position.html

Indian government has stated that any decision on abolishing the 18% GST on Jeevan Rakshak life insurance policies will depend on recommendations from the GST Council, which includes representatives from both Union and State governments. The issue of GST on life and health insurance was discussed in the GST Council’s 54th meeting in September 2024, leading to the formation of a Group of Ministers (GoM) to examine the matter further. During the 55th meeting in December 2024, the GoM requested additional time to finalize its recommendations. As a result, no decision has been made regarding GST exemptions for Jeevan Rakshak policies. Additionally, the government has clarified that there is no proposal to extend tax deductions under the Income Tax Act for premiums paid on Jeevan Rakshak life insurance policies. However, deductions for health insurance premiums continue to be available under Section 80D of the Income-Tax Act, 1961.

Read More

- 19 Mar 2025 05:51 PM

- New

India needs a better way to track its micro-enterprises

Even before we could get to see the results of the seventh economic census (conducted in 2019-20), plans are afoot to conduct the eighth one in the coming months. India’s economic census is supposed to be a comprehensive database of all firms in the country, including micro-enterprises. It is supposed to be conducted every five years and serve as a sampling frame for informal-sector surveys. These surveys are then used to estimate the informal sector’s contribution to national output.

Read More

- 17 Mar 2025 06:36 PM

- New

Indian gig workers who offer mobility services deserve GST relief

The Union Budget for 2024-25 rightly focused on promoting inclusive growth and enabling employment-led development in India. With a goal of assisting the poor and vulnerable groups, finance minister Nirmala Sitharaman proposed a scheme for the socioeconomic upliftment of Indian workers as the government tries to help them raise their incomes and attain sustainable livelihoods for a better quality of life.

Read More

- 17 Mar 2025 06:50 PM

GST Exemption for Autism Centres: Current Status & Policy

Source: https://taxguru.in/goods-and-service-tax/gst-exemption-autism-centres-current-status-policy.html

The Government clarified that Autism Centres providing education, care, and counseling without profit are not exempt from GST under existing laws. GST exemptions, as per Notification No. 12/2017, apply only to specific educational institutions, charitable organizations, and healthcare services. Currently, only healthcare services for terminally ill individuals or those with severe physical or mental disabilities (80% or more impairment) qualify as charitable activities for GST exemption. Autism does not automatically fall under this category, though severe autism (ISAA score >153) may be classified as an 80% disability under the RPwD Act, 2016. The decision to expand GST exemptions rests with the GST Council, which has made no such recommendations to date.

Read More

- 17 Mar 2025 07:01 PM

TN Traders Seek GST Cut on Food Items, Camphor & Chit Fund Services Exemption

Government has received requests from trade associations in Tamil Nadu, including the Tamil Nadu Foodgrains Merchants Association and the Camphor Tableters Association, for reductions in GST rates on essential food items and camphor used in religious practices. There is also a request to exempt services provided by chit fund foremen. Additionally, some stakeholders have sought a reduction in GST rates for certain service products from 18% to 12% and 12% to 5%. However, changes in GST rates and exemptions require recommendations from the GST Council, a constitutional body comprising representatives from both the Union and State Governments. Regarding medical equipment, including stents, no recommendations for GST rate reductions have been made by the GST Council at this time.

Read More

- 17 Mar 2025 06:57 PM

Outstanding Tax Dues and Government Recovery Measures

Source: https://taxguru.in/goods-and-service-tax/outstanding-tax-dues-government-recovery-measures.html

As per CAG reports, India’s total outstanding tax dues include ₹14.41 lakh crore in direct taxes (as of March 2021), ₹2.26 lakh crore in central excise and service tax, and ₹42,601 crore in customs duties (as of March 2022). No outstanding GST dues have been reported. The accumulation is attributed to litigation, untraceable defaulters, inadequate assets for recovery, and pending appeals. To improve tax collection, the government has introduced digital reforms, simplified tax laws, widened the tax base, and promoted voluntary compliance. Measures such as pre-filled tax returns, expanded TDS/TCS, and digital payment options have been implemented. For tax recovery, authorities monitor top defaulters, enforce asset tracing, and issue legal notices. Indirect tax recovery efforts include tracking defaulters, restricting e-way bills for non-compliant taxpayers, enforcing biometric verification, and using AI to detect fraudulent transactions. GST reforms, including structural rate changes and compliance enhancements, have contributed to increased collections.

Read More

- 17 Mar 2025 06:42 PM

State-wise list of GST And Other Taxes Received in Year 2019 to 2024

Source: https://taxguru.in/goods-and-service-tax/state-wise-list-gst-taxes-received-year-2019-2024.html

Lok Sabha addressed a query regarding state-wise tax contributions and allocations from 2019 to 2024. It covered GST, direct, and indirect tax collections. Gross CGST collections and net central indirect taxes, including Customs Duty, Union Excise Duty, and Service Tax, showed a year-on-year increase. However, state-wise data for certain components like Customs Duty and Union Excise Duty is unavailable. The government highlighted that the inter-se allocation of taxes is determined by the Finance Commission under Article 280 of the Constitution. Details of funds allocated to states, based on central tax collections, were provided, indicating a systematic distribution over the years. The government also clarified that no changes to the tax allocation formula are currently under consideration despite requests from various states, as the formula follows constitutional and statutory guidelines. Detailed annexures for tax contributions and allocations were included to provide transparency.

Read More

- 17 Mar 2025 06:53 PM

Government has no plans to roll back GST on leased properties

Source: https://taxguru.in/goods-and-service-tax/government-plans-roll-gst-leased-properties.html

The Government has no plans to roll back GST on leased properties, which has been applicable at 18% since 2017. The GST Council, a constitutional body, reviews such policies. In its 54th meeting, the Council shifted GST on non-residential property leases to a reverse charge mechanism. However, concerns were raised that this change increased costs for Composition Scheme taxpayers, as they cannot claim Input Tax Credit (ITC). To address this, the 55th GST Council meeting (Dec 2024) recommended excluding Composition Scheme taxpayers from this requirement. A new notification (No. 07/2025-CT(R)) was issued in January 2025, exempting them from reverse charge GST liability. The Central Government does not maintain nationwide data on leased properties.

Read More

- 17 Mar 2025 06:40 PM

GST Revenue from Andaman & Nicobar Islands: 5-Year Data

Source: https://taxguru.in/goods-and-service-tax/gst-revenue-andaman-nicobar-islands-5-year-data.html

In response to Lok Sabha Unstarred Question No. 1837 on 10th March 2025, the Ministry of Finance provided details on GST revenue collected from the Andaman & Nicobar Islands over the past five years. The gross GST collection, including contributions from the hotel and tourism industry, increased year-on-year, with Rs. 255 crores collected in 2020-21, rising to Rs. 431 crores by February 2025. Net UTGST collections from the region during the same period were also detailed, with Rs. 192 crores collected in 2019-20 and Rs. 190 crores in 2023-24. All GST revenue collected from the Islands is credited to the Consolidated Fund of India. However, specific records of allocation or utilization of these funds for the development and welfare of the Islands are not maintained. The government highlighted the absence of detailed tracking for such allocations.

Read More

- 17 Mar 2025 06:47 PM

GST Revenue Growth and Compliance Measures (2017-2025)

Source: https://taxguru.in/goods-and-service-tax/gst-revenue-growth-compliance-measures-2017-2025.html

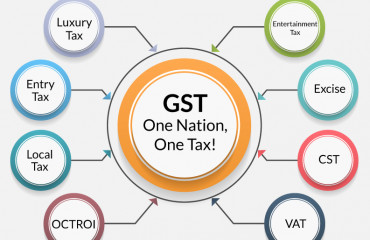

India’s GST collection has shown a steady increase since its implementation in 2017, reflecting its role in enhancing fiscal health and formalizing the economy. The gross GST collection rose from ₹7.41 lakh crore in 2017-18 to ₹20.18 lakh crore in 2023-24. This growth is attributed to streamlining tax credits, reducing cascading taxes, and fostering a unified national market. Maharashtra, Karnataka, and Gujarat are among the top contributors to GST revenue, driven by key sectors like manufacturing and services. The government has implemented various measures to support underperforming states, including targeted reforms and sector-specific interventions. Efforts to curb tax evasion include legal provisions under the CGST Act, data analytics, and enforcement actions, along with technical upgrades to the GST portal for seamless compliance. Challenges such as complexity, ITC mismatches, and compliance burdens persist but are being addressed through structural changes, e-invoicing mandates, and technological integration. These steps have significantly boosted GST compliance and revenue while supporting taxpayers through extended filing periods and grievance redressal mechanisms.

Read More