- 29 Mar 2024 05:29 PM

- New

No more fishing inquiries, GST officials told

Source: https://www.livemint.com/economy/no-more-fishing-inquiries-gst-officials-told-11711645747088.html

New Delhi: Tax officials must avoid "fishing inquiries" into goods and service tax (GST) related matters, specify the nature of the investigation in formal letters to designated company officials, and avoid vague expressions in letters and summons, under new guidelines from the Directorate General of GST Intelligence (DGGI).

Read More

- 28 Mar 2024 06:03 PM

- New

No tweaks to new online gaming taxation regime till SC decision

New Delhi: The federal indirect tax body is unlikely to make any changes to the 28% goods and services tax (GST) regime on online money gaming until the Supreme Court gives its final order on a bunch of tax disputes for the period prior to its introduction last October, a person informed about the development said.

Read More

- 26 Mar 2024 06:27 PM

- New

States may not borrow as much as they wanted. But that may not be a problem.

New Delhi: State development loans (SDL), or bonds issued by state governments to manage their revenue and fund their fiscal deficit, are unlikely to meet the target for FY24, much like last fiscal.

Read More

- 26 Mar 2024 06:33 PM

GST Council Newsletter for February, 2024

Source: https://taxguru.in/goods-and-service-tax/gst-council-newsletter-february-2024.html

Editor2 26 Mar 2024 141 Views 0 comment Goods and Services Tax | News

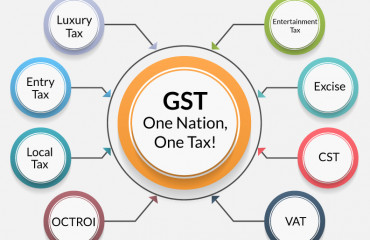

Introduction: The Goods and Services Tax (GST) Council convened its first National Conference of Enforcement Chiefs in New Delhi, marking a significant step in enhancing tax compliance and combating evasion. Led by the Hon’ble Union Minister for Finance and Corporate Affairs, the conference showcased notable achievements, including substantial strides in detecting tax evasion and fostering collaboration among tax authorities. This article delves into the key highlights and outcomes of the conference, shedding light on the evolving landscape of GST enforcement in India.

- 22 Mar 2024 06:17 PM

Future reforms to focus on harnessing potential of the informal sector

New Delhi: Direct and indirect tax changes to help the large informal sector in the country to formalise, scale up and plug into global supply chains will be a key policy goal for the government after the national elections as part of future reforms, according to two persons aware of discussions in the government.

Read More

- 22 Mar 2024 06:04 PM

Hindustan Zinc gets ₹91 crore GST demand, Company plans legal challenge, HZL stocks in green

Hindustan Zinc Limited (HZL), a subsidiary of Vedanta Ltd, disclosed that it has received an order from the Additional Commissioner, Central Excise and CGST Commissionerate, Udaipur, demanding payment under the Central Goods and Services Tax Act, 2017, as per a regulatory filing. The company has been directed to pay ₹91,90,16,104 as GST, along with an equivalent amount of penalty and applicable interest.

Read More

- 22 Mar 2024 06:21 PM

Supreme Court reserves order on Kerala's borrowing limit challenge

The Supreme Court has reserved its judgment in the case regarding borrowing limits between the Union government and the state of Kerala.

Read More

- 22 Mar 2024 06:26 PM

Bihar Settlement of Taxation Disputes Act, 2024

Source: https://taxguru.in/goods-and-service-tax/bihar-settlement-taxation-disputes-act-2024.html

The Bihar Settlement of Taxation Disputes Act, 2024 aims to resolve disputes arising from various taxation proceedings. Enacted against the backdrop of evolving tax laws, it offers a structured mechanism for settling disputes, ensuring efficiency and fairness.The Act covers disputes stemming from a range of tax laws, including the Bihar Finance Act, 1981, Bihar Value Added Tax Act, 2005, and others. It defines crucial terms like ‘dispute,’ ‘settled,’ and outlines the settlement amount calculation methodology.

Read More

- 19 Mar 2024 05:34 PM

GST council postpones review of 28% levy on online gaming; likely to be taken up after Lok Sabha elections 2024

The 28% tax on online gaming was implemented on October 1, 2023, and was scheduled to be reviewed after six months

Read More

- 16 Mar 2024 05:53 PM

CBI Nabs GST, Income Tax Officer and Bank Manager in Bribery cases

Introduction: The Central Bureau of Investigation (CBI) has made significant strides in combating corruption by apprehending several government officials involved in bribery cases. This article delves into the details of these arrests, highlighting the alleged offenses and ongoing investigations.

Read More