- 12 Apr 2024 06:17 PM

- New

India can maintain 8-9% consistent GDP growth: CII president R Dinesh

New Delhi: India can maintain a consistent 8-9% GDP growth in the coming years, and even reach double-digit annual growth between FY29 and FY31 fuelled by government spending on infrastructure, and private investment, which is expected to increase significantly in the coming years, industry body Confederation of Indian Industry's (CII) President R Dinesh said.

Read More

- 12 Apr 2024 06:22 PM

- New

THIS state is the biggest contributor to GST collection at 19.6%, leads per capita consumption spend

GST Collection: Maharashtra, with a 19.6 per cent share in all-India Goods and Services Tax (GST) collection in fiscal 2024 (April-February), is the top contributor to the GST pool, as per latest data on collections across Indian states, cementing its position as the country's economic powerhouse. A Crisil report released on April 11 reveals that after Maharashtra, Karnataka was the second biggest contributor to the GST pool.

Read More

- 11 Apr 2024 05:54 PM

- New

New reporting regime for pan masala to kick in from 15 May

NEW DELHI : Producers of pan masala, certain tobacco types for smoking, and smoking mixtures for pipes and cigarettes will be required to report their production capacity starting 15 May, the Central Board of Indirect Taxes and Customs (CBIC) said in an order issued on Wednesday.

Read More

- 06 Apr 2024 07:15 PM

United Breweries hit with demand order worth ₹264.7 crore from Maharashtra GST dept

United Breweries Ltd (UBL) announced on Friday, April 5, that it had received a tax demand of over ₹263.70 crore, including interest and penalty from the Maharashtra State Goods & Service Tax (GST) Department.

Read More

- 06 Apr 2024 07:10 PM

SBI received ₹10.68 crore in 'commission' for sale, redemption of electoral bonds: Report

The government-owned State Bank of India (SBI) received ₹10.68 crore from the Ministry of Finance for sale and redemption of the electoral bonds, a report said on Friday.

According to a report by The Indian Express, based on a Right to Information (RTI) application, the bank raised vouchers for commission for its bank charges and transaction fees, along with 18 per cent goods and services tax (GST), for the electoral bonds.

- 05 Apr 2024 06:12 PM

SC directs collective hearing for online gaming GST cases

NEW DELHI : The Supreme Court has consolidated multiple pleas challenging the 28% GST on online gaming companies, ordering the transfer of 27 writ petitions to be heard together.

Read More

- 05 Apr 2024 06:04 PM

Data recap: GST mop-up, LPG prices, manufacturing PMI

Every Friday, Plain Facts publishes a compilation of data-based insights, complete with easy-to-read charts, to help you delve deeper into the stories reported by Mint in the week gone by. The growth in goods and services tax (GST) collections moderated in 2023-24 after the post-pandemic surge. Just a few weeks before the Lok Sabha elections, prices of commercial LPG cylinders have been slashed.

Read More

- 04 Apr 2024 06:18 PM

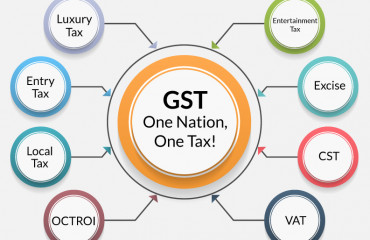

Get GST reform rolling: Review rate slabs

Summary

GST revenue buoyancy should close the chapter of a shortfall cess and prompt reforms aimed at tax simplification. For GST to fulfil its basic promise, start by reducing rate slabs.

- 04 Apr 2024 06:25 PM

Trends and Growth In GST Collection

Source: https://taxguru.in/goods-and-service-tax/trends-growth-gst-collection.html

The financial year 2023-24 has ended on a high note, from GST view point. GST collection has once again been robust in March, 2024. GST collection is second highest monthly Gross GST Revenue collection in March, 2024 at Rs. 1.78 lakh crore which records 11.5% y-o-y growth (18.4% on net basis). FY 2023-24 marks a milestone with total gross GST collection of Rs. 20.14 lakh crore exceeding Rs.20 lakh crore, a 11.7% increase compared to the previous year. The average monthly collection for fiscal year 2023-24 stands at Rs.1.68 lakh crore, surpassing the previous year’s average of Rs.1.5 lakh crore. GST revenue net of refunds as of March, 2024 for the current fiscal year is Rs.18.01 lakh crore which is a growth of 13.4% over same period last year.

Read More

- 03 Apr 2024 05:23 PM

GST upsurge: This tax needs to be tweaked

Summary

For 2023-24, India’s GST revenue crossed ₹20 trillion. If its weak mop-ups are firmly in the past, at long last, we must go for slab and rate reforms.