- 16 May 2024 06:24 PM

- New

Worried broker queries FM Nirmala Sitharaman about high taxes in share market, real estate. She replies…

Union Finance Minister Nirmala Sitharaman attracted strong criticism on the internet because of her cryptic response over the issue of high taxes levied on stock market brokers along with real estate transactions.

Read More

- 16 May 2024 06:19 PM

- New

Real Estate Investments: How are retail investors benefiting from small and medium REITs?

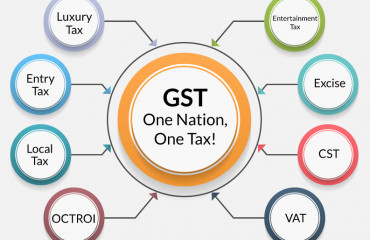

Indian regulators are pro-actively driving a dynamic and multifaceted transformation within the real estate sector. A wave of progressive regulatory reforms including implementation of the RERA Act (2016) for enhancing developer responsibility, GST for streamlining taxation, REIT regulations (2014) for paving a new asset class have all helped in fostering accessibility, transparency and stability for discerning investors.

Read More

- 13 May 2024 06:19 PM

- New

Live webinar: Block Credit in GST under Section 17(5)

Source: https://taxguru.in/goods-and-service-tax/live-webinar-block-credit-gst-section-17-5.html

Unlock the complexities of GST with our upcoming live webinar on “Block Credit in GST u/s 17(5).” Led by renowned expert CA Ruchika Bhagat, this session aims to provide comprehensive insights into Input Tax Credit (ITC) under GST, particularly focusing on Section 17(5) and its implications.

Read More

- 13 May 2024 06:14 PM

5 Ways a GST Calculator Can Boost Your e-Commerce Business

This last decade has witnessed a steady growth in e-commerce businesses in India. With all services and products being available digitally, this ecosystem has flourished in the last few years. However, with the ease of running e-commerce businesses, there come unique operational challenges as well.

Read More

- 09 May 2024 07:24 PM

जीएसटी अपीलीय न्यायाधिकरण (GSTAT) में अध्यक्ष नियुक्त किया गया

Source: https://taxguru.in/goods-and-service-tax/chairman-appointed-gst-appellate-tribunal-gstat.html

केंद्र सरकार द्वारा सेवानिवृत्त न्यायाधीश संजय कुमार मिश्रा को वस्तु एवं सेवा कर अपीलीय न्यायाधिकरण (जीएसटीएटी) का अध्यक्ष नियुक्त किया गया है। इस कदम का उद्देश्य व्यवसायों से संबंधित विवादों के समाधान को कुशलतापूर्वक सुव्यवस्थित करना है। खोज-सह-चयन समिति की सिफारिश के आधार पर कैबिनेट द्वारा नियुक्त समिति ने नियुक्ति प्रदान की हैं, चार साल के कार्यकाल के लिए प्रति माह 2.50 लाख रुपये के वेतन के साथ। Also Read: Nirmala Sitharaman Swears in Sanjaya Kumar Mishra as GSTAT President जीएसटीएटी के अध्यक्ष की नियुक्ति खोज-सह-चयन समिति (एससीएससी) की सिफारिश पर कैबिनेट की नियुक्ति समिति ने सेवानिवृत्त न्यायमूर्ति संजय कुमार मिश्रा की नियुक्ति को मंजूरी दे दी।

Read More

- 08 May 2024 06:50 PM

Small caps continue to outperform as Nifty Microcap 250, Nifty Smallcap 250 surged over 10% in April

Indian markets witnessed significant growth in the first month of FY25 with various indices indicating positive trends. Meanwhile, Nifty Microcap 250 and Nifty Smallcap 250 emerged as the best performing indices, exhibiting impressive growth rates of 10.6% and 10.5% respectively,showed Motilal Oswal Asset Management Company report.

Read More

- 07 May 2024 06:43 PM

GST contributes considerably to state revenues: Nirmala Sitharaman in X post

While showering heaps of praise on Goods and Services Tax (GST), Union Finance Minister Nirmala Sitharaman shared her views extensively on X platform about the legislation which came into force on July 1, 2017. She said that the tax legislation exemplifies Cooperative Federalism in India, and empowers states.

Read More

- 07 May 2024 06:35 PM

India’s economy: Off to a flying start

Source: https://www.livemint.com/opinion/quick-edit/indias-economy-off-to-a-flying-start-11715019334360.html

Going by high frequency indicators, India’s economy seems to have got off to an impressive start in 2024-25. On Monday, the services sector purchasing managers’ index (PMI) was reported at 60.8 in April. Though this is a slip from 61.2 in March, total sales and output are among the strongest in 14 years. Earlier, the PMI for manufacturing also showed similar strength at 58.8, the second highest since the beginning of 2021.

Read More

- 06 May 2024 07:00 PM

Nirmala Sitharaman Swears in Sanjaya Kumar Mishra as GSTAT President

In a significant development for India’s tax administration, Union Finance Minister Nirmala Sitharaman has officiated the swearing-in ceremony of Justice (Retd.) Sanjaya Kumar Mishra as the inaugural President of the GST Appellate Tribunal (GSTAT) in New Delhi. This event marks a crucial milestone in the operationalization of the GSTAT, aimed at expediting the resolution of GST-related disputes.

Read More

- 04 May 2024 06:04 PM

At 6.1% of GDP, GST revenue for FY24 still not above pre-GST level after 7 years, says former CEA Arvind Subramanian

After India's goods and services tax (GST) collections touched record high-mark at ₹2.10 lakh crore in April 2024, Arvind Subramanian, former Chief Economic Adviser (CEA) to the central government has now highlighted that the despite the high collections, GST revenue for fiscal 2023-24 (FY24) has still not surpassed the pre-GST level.

Read More