- 17 Jun 2024 06:15 PM

- New

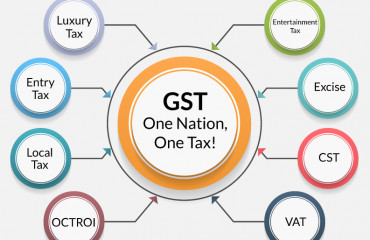

Reset GST to make it a 'good and simple tax'

That cooperative federalism has been in need of rescue, given the shape of Indian politics, is all the more reason for India to put the economy first. Doing so can act as a political unifier, as seen in the run-up to GST adoption back in 2017. The Centre and states must use this Saturday’s GST Council meeting to tackle the task of fixing the flaws of this catch-all tax on goods and services.

Read More

- 14 Jun 2024 06:42 PM

- New

Gujarat Gas, GAIL, and Petronet LNG stocks may gain if natural gas is included in GST

In its latest note, global brokerage house Jefferies highlighted that the Modi government's renewed efforts to include natural gas under GST could benefit companies like Gujarat Gas Ltd, GAIL (India) Ltd, and Petronet LNG Ltd.

Read More

- 14 Jun 2024 06:38 PM

- New

Centre-state talks soon on budget, GST

Source: https://www.livemint.com/economy/centrestate-talks-soon-on-budget-gst-11718279369403.html

The GST Council is scheduled to meet on 22 June in the national capital.

Industry executives expect steps to make tax filings easier, relief for online gaming for their past tax dues and clarifications in the insurance sector.

- 11 Jun 2024 06:24 PM

Modi 3.0 Cabinet: Nirmala Sitharaman retains finance ministry

Nirmala Sitharaman is lauded for her role in advancing second-generation economic reforms. She is credited with reviving the Indian economy hit by the notes ban, implementing the Goods and Services Tax (GST), and reducing the base corporate tax to 22% from 30%

Read More

- 10 Jun 2024 06:47 PM

Flour mixes with additives attract 18% GST, clarifies Gujarat appellate authority

A Gandhinagar-based company selling flour mixes for dishes like idli, dhokla, and dahi vada had argued that these flour mixes should be classified under a category liable to a 5% tax rate

Read More

- 10 Jun 2024 06:55 PM

Mint Explainer: What were the key policy changes in Nirmala Sitharaman’s first five years as finance minister?

New Delhi: The new NDA coalition government will have to shift gears quickly as the Union budget for FY25, scheduled to be presented in about a month, will set the direction of future policies. Among the main challenges are improving living standards and the ease of doing business in India while ensuring macroeconomic stability amid global uncertainties.

Read More

- 07 Jun 2024 06:37 PM

India must tackle illegal offshore gambling platforms

Countries all over the world, including India, are grappling with the issue of offshore betting and gambling platforms as they pose multitudinal threats from individual customers to national security.

Read More

- 06 Jun 2024 06:15 PM

A new excise law to refine 80-year-old rules will make life easier for oil firms

A new law proposed to replace the eight-decade-old Central Excise Act will cut the compliance burden on oil and gas companies that are currently governed by the excise duty regime.

Read More

- 05 Jun 2024 06:28 PM

Modi 3.0: It's time to write a guidebook for tax reforms

Source: https://www.livemint.com/opinion/columns/fiscal-management-of-the-new-government-11717501950893.html

In a year of global elections, all eyes are on India. A lot has been written about the hopes and expectations of the new government. It is now time to set the trajectory for the next five years. The last decade was marked by a series of reforms and economic setbacks from covid-19. As the new government sets its eye on the future, its economic legacy must shape fiscal policy thinking.

Read More

- 05 Jun 2024 06:32 PM

New central excise law in the offing

Source: https://www.livemint.com/news/india/new-central-excise-law-in-the-offing-11717511855332.html

A new central excise law will replace the existing eight-decade-old Central Excise Act, the finance ministry said on Tuesday while seeking public comments on a draft bill.

Read More