- 06 Jan 2025 06:16 PM

- New

Govt should lower GST on cement at 18 pc, frame policy to boost demand: JK Lakshmi

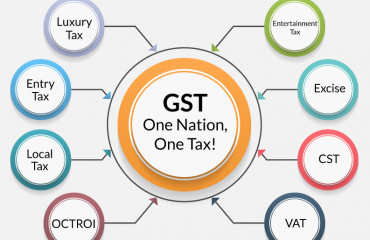

Patna, Jan 5 (PTI) The government should reduce GST on cement to 18 per cent from 28 per cent and take some policy measures in the upcoming Budget to boost consumption of this key building material, a senior official of JK Lakshmi Cement said.

Read More

- 03 Jan 2025 06:20 PM

- New

Still not packaged well: GST adds to manufacturing woes, calls for simplification grows

Late in December 2024, the munchy popcorn found itself in the spotlight amid different tax rates proposed by the GST Council based on its sugar or salt component. As per the clarification, the GST rate on popcorn mixed with salt and spices will be 5%, while it will be 12% on prepackaged and labelled popcorn and 18% on caramelised popcorn.

Read More

- 02 Jan 2025 06:21 PM

- New

’Shirt ka button khula rakhoge toh GST’: Man pranks people with ’weird rules’ amid continued row over popcorn tax

India's new ingredient-based tax on popcorn has triggered widespread outrage and memes online.

Read More

- 02 Jan 2025 06:17 PM

Stock market today: Sensex, Nifty 50 surge nearly 2% each. What’s behind the rally? Explained with 5 reasons

The equity benchmark indices continued their upward trend for the second day in a row, with the Sensex rising by 1,436 points to close at 79,944, and the Nifty climbing 446 points to 24,189.

Read More

- 01 Jan 2025 05:59 PM

GST collection rises 7.3% to ₹1.77 lakh crore in December 2024

The total gross GST revenue grew 7.3 per cent to ₹1.77 lakh crore in December as compared to ₹1.65 lakh crore in the same month a year ago

Read More

- 30 Dec 2024 05:56 PM

Businesses need to brace for tougher regulatory landscape in 2025

Corporations must brace for heightened regulatory scrutiny in 2025 with various regulators preparing to enforce stricter oversight and actions.

Read More

- 28 Dec 2024 06:47 PM

The week in charts: Informal jobs, GST tangle, export reset

A new report released this week showed job creation had slowed in the informal sector in 2023-24. Meanwhile, the Indian stock market this month is seeing the second-worst December performance in a decade and the GST council’s decision to tax popcorn differently has kicked up a storm.

Read More

- 28 Dec 2024 06:50 PM

Orry takes a dig at 18% GST on caramel popcorn, says ‘I am 18% GST’ | WATCH

Social media influencer Orhan Awatramani, popularly known as Orry, takes a dig at the GST Council's decision to tax caramelised popcorn at a higher tax bracket. Netizens reacted as they found the influencer's posts hilarious. Watch…

Read More

- 28 Dec 2024 06:54 PM

CBI Arrests CGST Inspector in Bribery Case

Source: https://taxguru.in/goods-and-service-tax/cbi-arrests-cgst-inspector-bribery-case.html

Bribery Case: CGST Inspector and Private Firm Representative Arrested: The Central Bureau of Investigation (CBI) arrested a CGST Inspector from the Tirupati GST Commissionerate and a representative of a Chittoor-based private firm for accepting a Rs. 3.2 lakh bribe. The arrests followed allegations of public servants demanding illegal payments in exchange for favorable treatment during inspections of firms and establishments.

Read More

- 26 Dec 2024 05:55 PM

GST on used vehicles apply differently on businesses

The GST Council last week recommended harmonizing the tax rate on used cars at 18%, which meant the rate for used small cars, including electric vehicles moved up from 12%.

Read More