- 12 Apr 2022 06:18 PM

- New

2- Factor Authentication for e-Way Bill and eInvoice System

Source: https://taxguru.in/goods-and-service-tax/2-factor-authentication-e-way-bill-einvoice-system.html

To enhance the security of the e-Way Bill/e-Invoice System, NIC is introducing 2-Factor Authentication for logging in to the e-Way Bill/e-Invoice system. In addition to username and password, OTP will also be authenticated for login. There are 3 different ways of receiving the OTP. You may enter any of the OTP and login to system.

Read More

- 12 Apr 2022 06:21 PM

- New

One arrested by DGGI Gurugram officials for fraudulently availing IITC

One arrested by DGGI Gurugram officials for fraudulently availing Input Tax Credit of more than Rs 16 crore

Read more at: https://taxguru.in/goods-and-service-tax/arrested-dggi-gurugram-officials-fraudulently-availing-itc.html

Copyright © Taxguru.in

- 11 Apr 2022 06:19 PM

- New

Companies likely to face stiff queries from GST authorities

CBIC chairman Vivek Johri has written to field formations asking them to ensure scrutiny is conducted in a time-bound manner. "Zonal chiefs may like to have the data examined and suitably taken up as per the prescribed SoP (standard operating procedure) in a time-bound manner," Johri said in a letter, dated April 4, seen by ET.

Read More

- 11 Apr 2022 06:27 PM

One person arrested for bogus ITC claim from fake bills of Rs.102 Crores

Maharashtra State GST Department arrests one person for bogus ITC claim from fake bills of Rs.102 Crores

The Maharashtra State GST department arrested one person for bogus ITC claim worth Rs.14 crore from fake bills of around Rs.102 crore. The department has also been able to get revenue of Rs. 8 Crore from the suppliers linked to M/s. Cermix. As a part of Special Anti-Evasion Drive by Maharashtra Goods & Service Tax Department against the fraudsters and tax evaders, Proprietor of M/s. Cermix has been arrested on 07/04/2022, for generating, availing and utilising fraudulent GST Input Tax Credit (ITC) of Rs.14 Crores from bogus invoices of Rs.102 Crores.

- 11 Apr 2022 06:33 PM

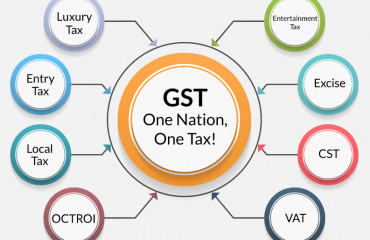

Proposed Amendments in CGST Act 2017

Source: https://taxguru.in/goods-and-service-tax/proposed-amendments-cgst-act-2017.html

Amendments in GST Acts

♦ Certain changes have been proposed in the CGST Act through Finance Bill, 2022 based on the recommendations made by the GST Council.

♦ The Amendments pertaining to GST law are mainly in Clause 99 to 113 of the Finance Bill, 2022, which will come into effect from a date to be notified in coordination with the States and Union Territories with the legislature.

- 09 Apr 2022 04:30 PM

New Functionalities for Taxpayers on GST Portal in March, 2022

Source: https://taxguru.in/goods-and-service-tax/new-functionalities-taxpayers-gst-portal-march-2022.html

Article explains about New Functionalities made available for Taxpayers on GST Portal (March, 2022) which are related to Creation of link for Manipur, Enhancements made in the Search Taxpayer functionality, mandatory Aadhaar authentication/ Aadhaar enrolment ID for Form GST REG-21, Form GST CMP-02, Changes made on the portal for composition taxpayers engaged in supply of Hotel and Restaurant Services, Integration of MMI (Map my India) in address field for Registration applications, Changes in Table 4 (A) of Form GSTR-3B, Displaying payment liability ratio & its calculation and providing Form GST DRC-03 link etc.

Read More

- 07 Apr 2022 06:20 PM

No Discrepancies in payment of GST to States

Source: https://taxguru.in/goods-and-service-tax/discrepancies-payment-gst-states.html

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE LOK SABHA UNSTARRED QUESTION NO-5137 TO BE ANSWERED ON MONDAY, THE 4th APRIL, 2022

Read More

- 06 Apr 2022 06:13 PM

CGST ghaziabad arrested mastermind of GST fraud of Rs. 783 crs

CGST ghaziabad arrested the mastermind in follow up of an earlier case involved in GST fraud of Rs.783 crs. in value & fake ITC of approx 137 crs. by creating 76 bogus firms in connivance with 2 other persons using multiple PAN, mobile no etc. 3 persons have been arrested so far.

Read More

- 06 Apr 2022 06:22 PM

GST Council Newsletter for the month of March, 2022

Source: https://taxguru.in/goods-and-service-tax/gst-council-newsletter-month-march-2022.html

All time high Gross GST collection in March’ 2022, breaching earlier record of Rs. 1,40,986 crore collected in the Month of January, 2022 Rs. 1,42,095 croregross GST revenue collected in the month.

Read More

- 02 Apr 2022 06:22 PM

GST collection at all-time high of Rs 1.42 lakh crore in March

The gross GST revenue collected in March 2022 is Rs 1,42,095 crore, of which CGST is Rs 25,830 crore, SGST is Rs 32,378 crore, IGST is Rs 74,470 crore (including Rs 39,131 crore collected on import of goods) and cess is Rs 9,417 crore (including Rs 981 crore collected on import of goods).

Read More