- 30 Aug 2022 06:34 PM

- New

Request to reconsider method of implementation of Punjab State Development Tax

Representation with humble request to reconsider the method of implementation of Punjab State Development Tax (PSDT) in the interest of taxpayers

Read More

- 27 Aug 2022 06:11 PM

- New

Right tax structure for online gaming industry can boost domestic cos: Report

The proposed levy of higher goods and services tax on the online gaming industry could lead to a decline in active users and discourage domestic gaming companies, according to a report by Assocham and EY. An optimal tax structure on the industry will support animation, visual effects, gaming and comic sector vision of the government, the report added .

Read More

- 27 Aug 2022 06:16 PM

- New

India facing inflation as BJP using all money to buy MLAs: Arvind Kejriwal in Delhi Assembly

NEW DELHI : AAP national convenor and Delhi chief Minister Arvind Kejriwal accused the Narendra Modi-led Bharatiya Janata Party (BJP) of trying to topple the AAP government in national capital Delhi. Calling BJP a "serial killer of governments", the Delhi CM requested a trust vote in the Assembly to ‘show people that not even one (AAP MLA) went away’.

Read More

- 27 Aug 2022 06:21 PM

India's GDP will grow at 7.4% in FY 2022-23, says Nirmala Sitharaman

The Finance Minister was of the opinion that since the corporate tax collection has been high, it cannot be without private investment.

Read More

- 27 Aug 2022 06:24 PM

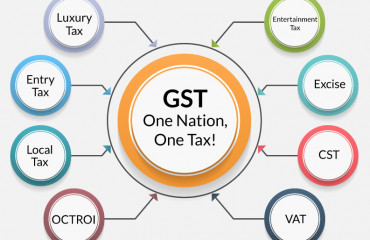

There’s GST on daily essentials as Centre needs money to buy MLAs: Arvind Kejriwal

Arvind Kejriwal said on Twitter that imposing Goods and Service Tax (GST) on daily essentials would bring in ₹7,500 crore annually to the exchequer of the Central government. The chief minister of Delhi asserted that the Narendra Modi administration had spent ₹6,300 crore to overthrow the state governments. Otherwise, he claimed, the Centre would not have added GST to necessities.

Read More

- 27 Aug 2022 06:27 PM

'Didn't have to impose GST on food items if...': Kejriwal accuses BJP of spending ₹6,300 crore in toppling govts

Delhi Chief Minister Arvind Kejriwal, on Saturday took a sarcastic jibe on Bhartiya Janta Party (BJP) claiming that the Centre did not have to impose GST on food items if the "BJP had not spent a whopping ₹6,300 crore on toppling governments" in other non-BJP ruled states in the country.

Read More

- 24 Aug 2022 05:42 PM

Revenue of states may grow 7-9% this fiscal: Report

New Delhi: Overall revenue of top 17 states in the country, which account for 85-90% of aggregate gross state domestic product (GSDP), is likely to grow at 7-9% this fiscal, Crisil Ratings said on Wednesday.

Read More

- 23 Aug 2022 06:20 PM

Govt to investigate fraudulent misuse of PAN for GST registration

Recent reports in a section of the media have highlighted a case of Sh. Girish Yadav, a resident of Khagaria, Bihar having received a letter from the jurisdictional GST authorities for recovery of GST amounting to Rs. 37.5 lakh alongwith applicable interest and penalty.

Read More

- 22 Aug 2022 06:21 PM

CGST Bhiwandi arrests 2 persons for bogus invoices of Rs. 55 crore

CGST Bhiwandi Commissionerate arrests two persons for availing and passing on fake ITC on bogus invoices of Rs. 55 crore

Read More

- 22 Aug 2022 06:26 PM

CGST Navi Mumbai arrests one for availing & passing on fake ITC

Source: https://taxguru.in/goods-and-service-tax/cgst-navi-mumbai-arrests-availing-passing-fake-itc.html

CGST Navi Mumbai arrests one person for availing and passing on fake ITC on bogus invoices

Read More