- 03 Feb 2025 05:44 PM

- New

Net GST collection in January rises 11% to ₹1.71 trillion

The gross collection last month stood at ₹1.95 trillion, the highest since the record ₹2.1 trillion recorded in the same month last fiscal. This upward movement in revenue collection comes after a drop in December, when collections fell to a three-month low.

Read More

- 01 Feb 2025 06:44 PM

- New

Budget 2025 | 100% FDI in insurance a positive for the sector but not for its stocks

The government in its Union Budget for 2025-26 proposed raising the foreign direct investment (FDI) limit for India’s insurance sector to 100% from 74%—meeting a long-awaited industry demand. So why did the stocks of most Indian insurance companies end the day flat to negative? The simple reason for that being that well-established life insurance companies in India don’t need the expertise of foreign players through strategic stake sale any longer.

Read More

- 01 Feb 2025 04:36 PM

- New

Budget 2025 | Seven key factors to track in the budget speech

Finance minister Nirmala Sitharaman will on Saturday deliver her eighth Union budget in a row as the National Democratic Alliance government that returned to office last year with reduced majority in Lok Sabha seeks to add vigor to economic growth and create more jobs. It is easy for a government to usher in reforms early into its term as there may not be any immediate political risks. Mint takes a look at key factors to watch out for in the Union budget for 2025-26.

Read More

- 01 Feb 2025 04:43 PM

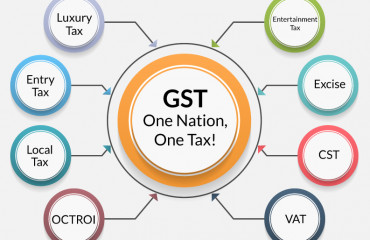

Budget 2025-26 Proposes 8 Key GST Amendments

Source: https://taxguru.in/goods-and-service-tax/budget-2025-26-proposes-key-gst-amendments.html

Union Budget 2025-26 introduces key amendments to GST laws to enhance trade facilitation. Starting from April 1, 2025, input tax credit distribution will be allowed by Input Service Distributors for inter-state supplies subject to reverse charge. A new clause will define Unique Identification Marking for implementing Track and Trace mechanisms. Additionally, the Budget proposes a provision for the reversal of input tax credit in cases of credit notes used to reduce supplier tax liability. A 10% pre-deposit requirement for penalties in appeals before Appellate Authorities is introduced for cases involving only penalties. Penalties will also be imposed for violations of Track and Trace provisions. The Budget further clarifies that goods warehoused in Special Economic Zones or Free Trade Warehousing Zones will not be treated as supply until cleared for export or to the Domestic Tariff Area, with no tax refund available for such transactions, effective from July 1, 2017. The inclusion of definitions for “Local Fund” and “Municipal Fund” and other amendments will also be made, with changes to take effect after coordination with the GST Council and States.

Read More

- 01 Feb 2025 04:38 PM

Direct, indirect taxes comprise 66 paise of every rupee in govt coffer: Budget documents

New Delhi, Feb 1 (PTI) For every rupee in the government coffer, the biggest pie of 66 paise will come from direct and indirect taxes, according to the Union Budget 2025-26 documents.

Read More

- 31 Jan 2025 06:21 PM

Budget 2025: India set to achieve fiscal deficit target of 4.5% by 2026, says BofA

India is set to meet its 4.5% fiscal deficit target by 2026, balancing economic growth and fiscal prudence, said BofA. The upcoming budget may boost capital expenditure to reignite private sector growth while maintaining a stable revenue outlook and achieving medium-term fiscal objectives.

Read More

- 30 Jan 2025 06:47 PM

Budget 2025: Heavy industries ministry seeks reduction of 28% GST on CNG two-wheelers

New Delhi: The ministry of heavy industries (MHI) has called on the finance ministry to lower the goods and services tax (GST) rate on two-wheelers powered by compressed natural gas (CNG), two people aware of the development said.

Read More

- 30 Jan 2025 06:26 PM

Union Budget 2025: These initiatives can make India more self-reliant in energy

The budget needs to prioritize energy security by reducing fossil fuel dependence and promoting renewable sources. It should also address discom losses and enhance electric mobility, while working towards India's goal of net-zero emissions by 2070.

Read More

- 30 Jan 2025 07:01 PM

Budget 2025 Expectations LIVE: From tax relief to capex boost, all eyes on FM Nirmala Sitharaman on February 1

Budget 2025 Expectations LIVE: In Finance Minister Nirmala Sitharaman's eighth Budget speech on 1 February 2025, the industries and taxpayers are expecting major announcements, including income tax relief, capex push, GST rationalisation, and more, aimed at promoting economic growth.

Read More

- 29 Jan 2025 06:01 PM

Budget 2025: How FM Nirmala Sitharaman could streamline customs duty and GST?

As Union Budget 2025 approaches, stakeholders expect reforms in indirect taxation to enhance economic growth and compliance. Key areas include customs duty rationalization, an amnesty scheme for long-standing litigations, and incentives for electric vehicles.

Read More