- 22 Nov 2022 05:35 PM

- New

Panel may recommend 28% GST on online gaming, tweak in calculation method

New Delhi: The panel of state finance ministers is likely to recommend a uniform GST levy of 28 per cent on online gaming irrespective of whether it is a game of skill or game of chance, sources said.

However, it is likely to suggest a revised formula for calculating the amount on which the Goods and Services Tax (GST) would be levied.

- 21 Nov 2022 05:42 PM

- New

Mamata Banerjee likely to meet PM Modi on 5 Dec, discuss key issues

On the sidelines of the Chief Minister's meeting, West Bengal Chief Minister Mamata Banerjee is likely to meet PM Modi on 5 December and discuss sensitive issues like the release of state's dues by the Union government, erosion by river Ganga and arrears pending for the implementation of MGNREGA in West Bengal, an official informed on Sunday.

Read More

- 21 Nov 2022 05:49 PM

- New

Mandatory furnishing of correct ineligible ITC & reversal thereof in Form GSTR-3B

Mandatory furnishing of correct and proper information of ineligible Input Tax Credit and reversal thereof in Form GSTR-3B

Read More

- 18 Nov 2022 05:21 PM

The big stories of the week gone by – in charts

Source: https://www.livemint.com/economy/data-recap-exports-dip-population-crosses-8-bn-11668701435390.html

Every Friday, Plain Facts publishes a compilation of data-based insights, complete with easy-to-read charts, to help you delve deeper into the stories reported by Mint in the week gone by. Merchandise exports contracted for the first time in nearly two years in October, while inflation cooled off on the back of a favourable base. Meanwhile, the world population hit 8 billion.

Read More

- 17 Nov 2022 06:09 PM

Amit Mitra presses for a meeting of GST Council

Source: https://www.livemint.com/economy/amit-mitra-presses-for-gst-council-meeting-11668616026467.html

NEW DELHI : West Bengal chief minister Mamata Banerjee’s principal chief adviser and former member of the Goods and Services Tax (GST) Council, Amit Mitra, on Wednesday urged Union finance minister Nirmala Sitharaman to hold the meeting of the council and decide on outstanding tax policy issues on a consensus basis.

Read More

- 16 Nov 2022 06:20 PM

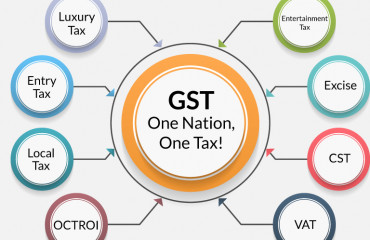

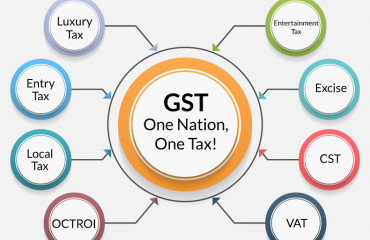

Why is GST revenue running ahead of overall economy?

Source: https://www.livemint.com/economy/breaking-down-the-surge-in-gst-revenues-11668531458502.html

Revenues from the goods and services tax (GST)—the countrywide indirect tax since June 2017—have been on a tear. In October, GST revenues touched ₹1.5 trillion, the second-highest monthly collection ever, after April 2022. Monthly GST revenues have exceeded ₹1.4 trillion for eight straight months, a statistic the central government has been playing up. Why have GST revenues risen this fast, outpacing even direct tax collections? Are there certain segments pulling performance? And what do GST trends tell us about the regional spread of economic activity post-covid?

Read More

- 15 Nov 2022 06:08 PM

Govt to bring fuel under GST, says Petroleum minister

Petroleum and Natural Gas Minister Hardeep Singh Puri said on Monday that the Central government is ready to bring petrol and diesel under the Goods and Services Tax (GST) regime. Hardeep Puri also said that it was unlikely that the states would agree to this move as liquor and energy are revenue-generating items for the states. But if the states make the move, “we are ready", Hardeep Puri said.

Read More

- 14 Nov 2022 06:24 PM

Why merging GST NAA with CCI may not be a prudent move

The proposed merger of the two regulatory bodies may seem logical given the perceived commonality between the two – namely, regulation of economic laws and protection of consumer interests.

Read More

- 14 Nov 2022 06:29 PM

GST Council Newsletter for the month of October, 2022

Source: https://taxguru.in/goods-and-service-tax/gst-newsletter-october-2022.html

It is heartening to see the buoyancy in revenue collection for the past eight months where the monthly GST revenue collections were reported above 1.4 lakh crores. The revenue collection for the month of October, 2022 stood at 1,51,718 crore indicating a 16.6% year-on-year rise as well being the second highest level of tax collection since the rollout of the indirect tax regime and this augurs well for the economy.

Read More

- 12 Nov 2022 06:00 PM

India has become centre of hope for entire world: PM Modi

New Delhi: Prime Minister Narendra Modi on Saturday that India has become a beacon of hope for the entire world as a result of the government’s policies and decisions aimed at improving the lives of ordinary citizens.

Read More