- 08 Feb 2025 06:18 PM

- New

GST on Health Insurance: Government Review Underway

Source: https://taxguru.in/goods-and-service-tax/gst-health-insurance-government-review-underway.html

Government of India acknowledged concerns regarding the 18% GST on health and life insurance policies. In response, the issue was discussed in the 54th GST Council meeting held on September 9, 2024. The Council decided to form a Group of Ministers (GoM) to review GST on life and health insurance comprehensively. The GoM, led by Bihar Deputy CM Samrat Chaudhary, was tasked with examining potential changes to tax rates. During the 55th GST Council meeting on December 21, 2024, the GoM requested additional time to finalize its recommendations. The Council agreed to extend the timeline, and as of now, no decision has been made regarding a reduction or removal of GST on health or term insurance policies. Any future changes will depend on the GoM’s recommendations and the Council’s approval.

Read More

- 07 Feb 2025 06:10 PM

- New

Big Brother watching: Optional GST invoice reconciliation to be made mandatory

NEW DELHI : An optional, online system to reconcile transaction details for availing GST credit may soon be made mandatory, according to two persons aware of the development.

Read More

- 07 Feb 2025 06:17 PM

- New

India’s taxation crisis: Can 1% bear such a large country’s burden?

With just about 1% of Indians expected to fund about a third of the government’s gross tax revenue next fiscal year, India has a taxation problem. It is not about high rates, but about who actually pays.

Read More

- 03 Feb 2025 05:44 PM

Net GST collection in January rises 11% to ₹1.71 trillion

The gross collection last month stood at ₹1.95 trillion, the highest since the record ₹2.1 trillion recorded in the same month last fiscal. This upward movement in revenue collection comes after a drop in December, when collections fell to a three-month low.

Read More

- 03 Feb 2025 05:56 PM

Arvind Chari: This is a budget to optimize growth within constraints

The first full-year budget of India’s new National Democratic Alliance government, sworn in after the 2024 general election, was presented against the backdrop of a noticeable slowdown in economic growth over the last four quarters. I discussed the issue of whether this slowdown is cyclical or structural in a recent column for Mint, summarizing it as being an issue of expectations.

Read More

- 03 Feb 2025 05:59 PM

‘We are putting money back in the hands of taxpayers’

With this budget we’re stating one thing very clearly, that credit availability is essential for people, for running their businesses, said the finance minister.

Read More

- 03 Feb 2025 06:09 PM

Budget 2025 Key Announcements: New tax bill, income tax slab, ITR extension, more from FM Nirmala Sitharaman. Full list

Budget 2025 Key Announcements: FM Nirmala Sitharaman announced a new tax bill, changed income tax slab, ITR extension, and more in Budget 2025. We take a look at the full list of key announcements.

Read More

- 03 Feb 2025 06:01 PM

Ajit Ranade: The budget’s consumption stimulus will stand India in good stead

The big story of finance minister Nirmala Sitharaman’s record eighth budget was its consumption stimulus. This was given by raising the ceiling of tax-free income. No tax is payable for anyone earning an income up to ₹12 lakh. This significant jump in the maximum permissible tax-free income came after a gap of five years—it was raised to ₹7 lakh in 2019.

Read More

- 03 Feb 2025 06:21 PM

Budget proposal for 200 cancer care centres not enough: skilled oncologists, nurses and equipment needed, say experts

District daycare centres will decentralize cancer care, but India needs thousands more oncologists, specialist nurses and equipment, experts said. Besides, the GST on indigenous cancer drugs need to be removed entirely, said Biocon chairperson Kiran Mazumdar Shaw.

Read More

- 03 Feb 2025 06:18 PM

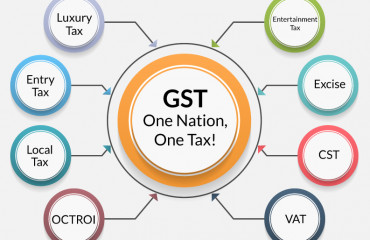

GST rate rationalisation needed: Finance SecyGST rates need to be rationalised: Finance Secretary

New Delhi, Feb 3 (PTI) Finance Secretary Tuhin Kanta Pandey on Monday said enough experience has been gained with regard to implementation of GST and now the rates need to be rationalised in consultation with states.

Read More