- 30 Jan 2023 05:22 PM

- New

Budget to bring tax clarity for offshore digital businesses

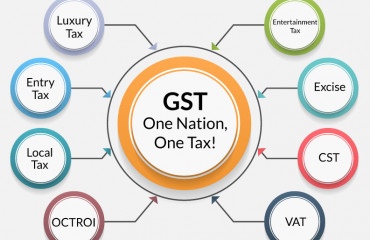

New Delhi: The government plans to amend the GST law to clarify the Integrated Goods and Services Tax (IGST) liability for offshore digital businesses offering services such as online advertising, games, and cloud services to Indian users.

Read More

- 30 Jan 2023 05:29 PM

- New

From audits to notices, untangling the GST regime for taxpayers

Even in cases of streamlined audits, taxpayers are asked to furnish certain information which is already available with tax authorities such as returns (monthly and annual), DRC-03 challans, etc.

Read More

- 26 Jan 2023 06:50 PM

- New

Launch of New GST Reports in ADVAIT

Source: https://taxguru.in/goods-and-service-tax/launch-gst-reports-advait.html

The Principal Chief Commissioner/Chief Commissioners of GST/Customs Zones;

The Principal Director Generals/Director Generals;

The Joint Secretaries/Commissioners of CBIC.

- 25 Jan 2023 05:38 PM

GST compensation cess may support carbon storage plan

NEW DELHI : The government may use the goods and services tax (GST) compensation cess for a clean energy fund to help access low-cost finance as part of India’s carbon capture utilization and storage (CCUS) policy that is currently in the works, said two people aware of the development.

Read More

- 25 Jan 2023 05:45 PM

India's FY24 gross borrowing could be less than expected: Economists

The government's gross borrowing is expected to be a record ₹16 trillion (about $196 billion) for the fiscal year through March 2024, according to economists

Read More

- 24 Jan 2023 05:38 PM

India needs to use its fiscal armoury to fight inequality

The Oxfam 2023 report Survival of the Richest has set the cat among the pigeons. There is outrage from predictable quarters that it maligns India because it exaggerates its poverty and inequality. The report is also sought to be discredited for its wrong methodology in estimating people’s tax burden. For instance, one finding in the report is that the bottom half of India’s income earners pay nearly two-thirds of the goods and services tax (GST). This is an indirect tax and inherently regressive because it pinches the poor more than the rich. That is because the GST paid depends on the price of the product and not on the income of the payer. Naturally, as a proportion of income, it hurts the poor more. But since the rich have higher consumption and buy more expensive goods, their share of the total GST collected should be disproportionately more.

Read More

- 24 Jan 2023 05:43 PM

Swipe, tap or click: How digital payments power our GST intake

The introduction of a goods and services tax (GST) a little over five years ago was undoubtedly the single-biggest reform of indirect taxes in India. Compliances have eased, logistics have improved, tax incidence has steadily declined, and revenue growth as well as buoyancy have shown marked improvement.

Read More

- 24 Jan 2023 05:47 PM

Tax credits for charity spending by businesses may go

The government is likely to introduce amendments to Goods and Services Tax (GST) law through the Finance Bill, 2023, denying businesses credit for the taxes paid while procuring goods and services that they provide to the community under their corporate social responsibility (CSR) obligations.

Read More

- 24 Jan 2023 05:50 PM

Record e-way bills in December point to robust GST receipts in January

Monthly generation of e-way bills or electronic permits required for shipment of goods within and across states has shot up to an all time high in December, suggesting that Goods and Services Tax (GST) collection in January is likely to be robust

Read More

- 24 Jan 2023 05:56 PM

How to resolve mushrooming GST disputes

Under GST, disputes arise from differences in tax paid by the assessees and the computation of tax liability by authorities.

Read More