The 49 GST Council met under the Chairpersonship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in New Delhi on 18.02.2023. During the meeting several recommendations were made by the Council relating to disbursement of GST compensation, GST Appellate Tribunal, capacity-based taxation and Special Composition Scheme, along with a few changes in the GST rates and trade facilitation measures.

GST Council Secretariat, New Delhi

The 49 GST Council met under the Chairpersonship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in New Delhi on 18.02.2023. During the meeting several recommendations were made by the Council relating to disbursement of GST compensation, GST Appellate Tribunal, capacity-based taxation and Special Composition Scheme, along with a few changes in the GST rates and trade facilitation measures.

The GST Council has set in motion the process to tackle rising GST litigation through the introduction of GSTAT. This would pave way for resolving the pending demand for tribunal under GST. Further, it will help in reducing the burden of Writ Courts as earlier taxpayers had to invoke Writ Jurisdiction under Article 226 of the Indian Constitution post issuance of order by the authorities. In a welcome move for the taxpayers the Council has recommended rationalization of late fees for delayed filing of annual returns in FORM GSTR-9 for FY 2022-23 onwards, for registered persons having aggregate turnover in a financial year up to Rs 20 crore. Further, to provide relief to a large number of taxpayers the Council has also recommended that an amnesty may be provided in the past cases, where registration has been cancelled on account of non-filing of the returns, but application for revocation of cancellation of registration could not be filed within the specified time period.

Furthermore, the GST Council has also made the recommendation to rationalize the place of supply of services for transportation of goods under Section 13 of the Integrated Goods and Services Tax Act, 2017 ("the IGST Act") i.e. Place of supply of services where the location of supplier or location of recipient is outside India, by deletion of section 13(9) of IGST Act, 2017 so as to provide that the place of supply of services of transportation of goods, in cases where the location of supplier of services or location of the recipient of services is outside India, shall be the location of the recipient of services.

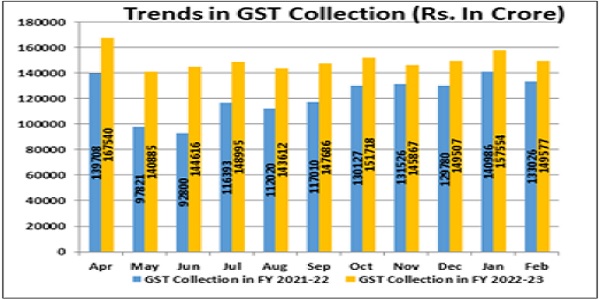

It is also heartening to note that, the GST revenue collections continued to ascend the growth ladder as the revenues grew 12.7% in January 2023 to hit almost ₹1.59 lakh crore, the second highest monthly collections on record.

Pankaj Kumar Singh,

Additional Secretary

49 GST Council Meeting

Recommendations of 49th GST Council Meeting

The 49 Meeting of GST Council was held under the Chairpersonship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in New Delhi on 18.02.2023. The meeting was also attended by Union Minister of State for Finance Shri Pankaj Chaudhary besides Finance Ministers of States & Union Territories (with legislature) and other senior officers of the Ministry of Finance & States/ UTs.

The GST Council has, inter-alia, made the following recommendations relating to GST compensation, GST Appellate Tribunal, approval of the Report of Group of Ministers (GoM) on Capacity Based Taxation and Special Composition Scheme in certain Sectors on GST, recommendations relating to GST rates on Goods and Services and other measures for facilitation of trade:

I. GST Compensation

Government of India has decided to clear the entire pending balance GST compensation of ₹. 16,982 crore for June, 2022 as shown in the table below. As no amount was available in the GST compensation Fund, Centre decided to release this amount from its own resources and the same will be recouped from the future compensation Cess collection. With this release, Centre would clear the entire provisionally admissible compensation due for five years as envisaged in the GST (Compensation to States) Act, 2017. In addition, Centre would also clear the admissible final GST compensation to those States who have provided the revenue figures as certified by the Accountant General of the States amounting to ₹. 16,524 crore.

II. GST Appellate Tribunal The report of the Group of Ministers on GSTAT was accepted by the Council with certain modifications. The final draft amendments to the GST laws shall be circulated to Members for their comments. The Chairperson has been authorised to finalise the same.

III. Approval of the Report of GoM on Capacity Based Taxation & Special Composition Scheme in certain Sectors on GST:

- With a view to plug the leakages and improve the revenue collection from the commodities such as pan masala, gutkha, chewing tobacco, the Council approved the recommendations of the GoM including, inter alia, that

- the capacity-based levy not to be prescribed;

- compliance and tracking measures to be taken to plug leakages/evasions;

- exports of such commodities to be allowed only against LUT with consequential refund of accumulated ITC;

- compensation cess levied on such commodities to be changed from ad valorem to specific tax-based levy to boost the first stage collection of the revenue

IV. Recommendations relating to GST rates on Goods and Services

Changes in GST rates of Goods

Other changes relating to Goods and Services

1. It has been decided to regularize payment of GST on 'rab' during the past period on "as is basis" on account of genuine doubts over its classification and the applicable GST rate.

2. It was decided to suitably amend Notification No. 104/94-Customs dated 16.03.1994 so that if a device like tag-tracking device or data logger is already affixed on a container, no separate IGST shall be levied on such affixed device and the 'nil' IGST treatment available for the containers under Notification No. 104/94-Customs dated 16.03.1994 shall also be available to the such affixed device subject to the existing conditions.

3. It has been decided to amend Entry at Sl. No. 41A of Notification No. 1/2017-Compensation Cess (Rate) so that exemption benefit covers both coal rejects supplied to and by a coal washery, arising out of coal on which compensation cess has been paid and no input tax credit thereof has been availed by any person.

4. It has been decided to extend the exemption available to educational institutions and Central and State educational boards for conduct of entrance examination to any authority, board or a body set up by the Central Government or State Government including National Testing Agency for conduct of entrance examination for admission to educational institutions.

5. It has been decided to extend the dispensation available to Central Government, State Governments, Parliament and State Legislatures with regard to payment of GST under reverse charge mechanism (RCM) to the Courts and Tribunals also in respect of taxable services supplied by them such as renting of premises to telecommunication companies for installation of towers, renting of chamber to lawyers etc.

V. Measures for facilitation of trade

1. Extension of time limit for application for revocation of cancellation of registration and one-time amnesty for past cases: The Council has recommended amendment in Section 30 of CGST Act, 2017 and Rule 23 of CGST Rules, 2017 so as to provide that –

- the time limit for making an application for revocation of cancellation of registration be increased from 30 days to 90 days;

- where the registered person fails to apply for such revocation within 90 days, the said time period may be extended by the Commissioner or an officer authorised by him in this behalf for a further period not exceeding 180 days.

The Council has also recommended that an amnesty may be provided in the past cases, where registration has been cancelled on account of non-filing of the returns, but application for revocation of cancellation of registration could not be filed within the time specified in Section 30 of CGST Act, by allowing such persons to file such application for revocation by a specified date, subject to certain conditions.

2. Amendment to Section 62 of CGST Act, 2017 to extend timelines under sub-section (2) thereof and one-time amnesty for past cases: As per sub-section (2) of Section 62 of CGST Act, 2017, the best judgment assessment order issued under sub-section (1) of the said section is deemed to be withdrawn, if the relevant return is filed within 30 days of service of the said assessment order. The Council recommended to amend Section 62 so as to increase the time period for filing of return for enabling deemed withdrawal of such best judgment assessment order, from the present 30 days to 60 days, extendable by another 60 days, subject to certain conditions.

The Council has also recommended to provide an amnesty scheme for conditional deemed withdrawal of assessment orders in past cases where the concerned return could not be filed within 30 days of the assessment order but has been filed along with due interest and late fee upto a specified date, irrespective of whether appeal has been filed or not against the assessment order, or whether the said appeal has been decided or not.

3. Rationalization of Late fee for Annual Return: Presently, late fee of ₹ 200 per day (₹ 100 CGST + ₹ 100 SGST), subject to a maximum of 0.5% of the turnover in the State or UT (0.25% CGST + 0.25% SGST), is payable in case of delayed filing of annual return in FORM GSTR-9. The Council recommended to rationalize this late fee for delayed filing of annual return in FORM GSTR-9 for FY 2022-23 onwards, for registered persons having aggregate turnover in a financial year upto ₹ 20 crore, as below:

- Registered persons having an aggregate turnover of up to ₹ 5 crores in the said financial year: ₹ 50 per day (₹ 25 CGST + ₹ 25 SGST), subject to a maximum of an amount calculated at 0.04 per cent. of his turnover in the State or Union territory (0.02% CGST + 0.02% SGST).

- Registered persons having an aggregate turnover of more than ₹. 5 crores and up to ₹ 20 crores in the said financial year: ₹ 100 per day (₹ 50 CGST + ₹ 50 SGST), subject to a maximum of an amount calculated at 0.04 per cent. of his turnover in the State or Union territory (0.02% CGST + 0.02% SGST).

4. Amnesty in respect of pending returns in FORM GSTR-4, FORM GSTR-9 and FORM GSTR-10: To provide relief to a large number of taxpayers, the Council recommended amnesty schemes in respect of pending returns in FORM GSTR-4, FORM GSTR-9 and FORM GSTR-10 by way of conditional waiver/ reduction of late fee.

5. Rationalization of provision of place of supply of services of transportation of goods: The Council recommended to rationalize the provision of place of supply for services of transportation of goods by deletion of Section 13(9) of IGST Act, 2017 so as to provide that the place of supply of services of transportation of goods, in cases where location of supplier of services or location of recipient of services is outside India, shall be the location of the recipient of services.

Source: PIB Press release dated 18.02.2023

GST Revenue Collection

₹1,49,577 crore gross GST revenue collected in February, 2023; 12% higher than GST revenues in same month last year

The gross GST revenue collected in the month of February, 2023 is ₹ 1,49,577 crore of which CGST is ₹ 27,662 crore, SGST is ₹ 34,915 crore, IGST is ₹ 75,069 crore (including ₹ 35,689 crore collected on import of goods) and Cess is ₹ 11,931 crore (including ₹ 792 crore collected on import of goods)

The government has settled ₹ 34,770 crore to CGST and ₹ 29,054 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States after regular settlements in the month of February, 2023 is ₹ 62,432 crore for CGST and ₹ 63,969 crore for the SGST. In addition, Centre had also released balance GST compensation of ₹ 16,982 crore for the month of June, 2022 and ₹ 16,524 crore to States/UTs which have sent AG certified figures for previous period.

The revenues for the month of February, 2023 are 12% higher than the GST revenues in the same month last year, which was ₹ 1,33,026 crore. During the month, revenues from import of goods was 6% higher and the revenues from domestic transaction (including import of services) are 15% higher than the revenues from these sources during the same month last year. This month witnessed the highest cess collection of ₹11,931 crore since implementation of GST. Normally, February being a 28-day month, witnesses a relatively lower collection of revenue.

The chart below shows trends in monthly gross GST revenues during the current year.

Notifications

> Notification No. 04/2023-Central Tax (Rate) dated 28.02.2023 seeking to amend Notification no. 2/2017-Central Tax (Rate), dated 28.06.2017.

The Government vide the said Notification has reduced the rate of GST from 18% to 5% in case of 'Rab' when it is sold in prepackaged and labelled form and in all other cases the rate of tax will be 'Nil'. This Notification came into force with effect from 1 March, 2023.

> Notification No. 03/2023-Central Tax (Rate) 28.02.2023 amending Notification no. 1/2017-Central Tax (Rate), dated 28.06.2017

The Central Government vide the said Notification has reduced the rate of GST from 18% to 12 % in case of pencil sharpeners. This Notification came into force with effect from 1st March, 2023.

> Notification No. 02/2023- Central Tax (Rate) dated 28.02.2023 amending Notification No. 13/2017- Central Tax (Rate).

The Central Government vide the said Notification has provided that services provided by Courts and Tribunals which are commercial in nature like renting of space to telecom towers and renting of lawyers' chambers etc. shall be covered under RCM and that provisions of RCM notification shall apply to Courts and Tribunals as applicable to the Central Government and State Governments. This Notification came into force with effect from 1st March, 2023

> Notification No. 01/2023- Central Tax (Rate) dated 28.02.2023 amending Notification No. 12/2017- Central Tax (Rate).

The Central Government vide the said Notification has inserted an Explanation in Notification No. 12/2017- Central Tax (Rate) by which any authority, board or body set up by the Central Government or State Government including National Testing Agency for conduct of entrance examination for admission to educational institutions shall be treated as educational institution for the limited purpose of providing services by way of conduct of entrance examination for admission to educational institutions. This Notification came into force with effect from 1st March, 2023

> Notification No. 01/2023-Compensation Cess (Rate) dated 28.02.2023 seeking to amend Notification No. 1/2017-Compensation Cess (Rate).

The Central Government vide the said Notification has amended the entry at Sl. No. 41 A of Notification No. 1/2017-Compensation Cess (Rate) so that exemption benefit covers both coal rejects supplied to and by a coal washery, arising out of coal on which compensation cess has been paid and no input tax credit thereof has been availed by any person. This Notification came into force with effect from 1st March, 2023.

GST Outreach Programmes

Directorate General of GST Intelligence (DGGI) and the National Forensic Sciences University (NFSU) sign a Memorandum of Understanding (MoU) for setting up of digital forensic laboratories

The Directorate General of GST Intelligence (DGGI) and the National Forensic Sciences University (NFSU) signed a Memorandum of Understanding (MoU) for setting up of digital forensic laboratories along with exchange of information and knowledge, technological advancement and skill development in the field of digital forensics. The MoU was signed by Shri Surjit Bhujabal, Pr. Director General, DGGI and Dr. J. M. Vyas, Vice Chancellor, NFSU, Gandhinagar.

DGGI is the apex intelligence organisation under Central Board of Indirect Taxes and Customs (CBIC) for collection and dissemination of information and for taking necessary measures to check evasion of GST. NFSU is an institution of national importance established by Parliament of India to promote studies and research in forensic sciences and related fields. NFSU is the first and only institute in the field of forensic sciences and has the state-of-the-art technology in the field of digital forensics and capabilities to study and analyse digital evidence. It has established cooperation in the field of digital forensics with various national agencies like Enforcement Directorate, DRDO and Central Bureau of Investigation etc. as well several countries and their institutions.

DGGI, being premier investigation wing of the CBIC, extensively uses data analytical tools and cutting-edge technologies for detecting substantial tax evasion and busting huge fake invoice rackets and arrests many masterminds in these cases. This MoU will be a force multiplier for the DGGI in the field of investigation and digital forensics and will assist the agency for launching effective prosecutions and securing convictions of the guilty. Quick and effective convictions of the serious tax offenders not only secure the government revenues and plug leakages but also ensure trade facilitation by ensuring fair tax regime to the honest tax payer. This will be a significant step for DGGI towards having requisite physical infrastructure, skills sets and know how in the field digital forensic.

The MoU will facilitate DGGI and NFSU to establish digital forensic laboratories as well as collaborate in research and training programmes and provide technical assistance to each other.

> Advisory on opting for payment of tax under the forward charge mechanism by a Goods Transport Agency (GTA)

In compliance of Notification No. 03/2022-Central Tax (Rate), dated 13th July, 2022, an option is being provided on the GST portal to all the existing taxpayers providing Goods Transport Agencies Services, desirous of opting to pay tax under the forward charge mechanism to exercise their option. They can navigate Services > User Services > Opting Forward Charge Payment by GTA (Annexure V), after login, to submit their option on the portal.

Option in Annexure V FORM is required to be submitted on the portal by the Goods Transport Agencies every year before the commencement of the Financial Year. The Option once filed cannot be withdrawn during the year and the cut-off date for filing the Annexure V FORM is 15th March of the preceding financial year.

Annexure V has been made available on the portal for GTA's to exercise their option for the Financial Year 2023-24, which would be available till 15th March, 2023.

Portal update on 25.02.2023

> Advisory on New e-Invoice Portal

GSTN has onboarded four new IRPs (Invoice Reporting Portals) for reporting e-invoices in addition to NIC-IRP. As a result, the beta launch of a new e-Invoice portal (www.einvoice.gst.gov.in), has been done where taxpayers can find comprehensive information on e-invoice compliance in a user-friendly format, such as check their enablement status, self-enable themselves for invoicing, search for IRNs, web links to all IRP portals – all the relevant links/information in one convenient location. Taxpayers can log in to the new e-invoice portal using their GSTN credentials for select services pertaining to their GSTIN profiles.

The portal

Portal update on 25.02.2023

Advisory on Geocoding of Address of Principal Place of Business

The functionality for geocoding the principal place of business address (i.e. the process of converting an address or description of a location into geographic coordinates) is now available on the GST Portal. This feature is introduced to ensure the accuracy of address details in GSTN records and to streamline the address location and verification process.

This functionality can be accessed under the Services/Registration tab in the FO portal. The system-generated geocoded address will be displayed, and taxpayers can either accept it or update it as per their requirements of their case. In cases where the system-generated geocoded address is unavailable, a blank will be displayed, and taxpayers can directly update the geocoded address.

The geocoded address details will be saved separately under the "Principal Geocoded" tab on the portal. They can be viewed under My profile>>Place of Business tab under the heading "Principal Geocoded" after logging into the portal. It will not change the existing addresses.

The geocoding link will not be visible on the portal once the geocoding details are submitted by the taxpayer. This is a onetime activity, and once submitted, revision in the address is not allowed and the functionality will not be visible to the taxpayers who have already geocoded their address through new registration or core amendment. The address appearing on the registration certificate can be changed only through core amendment process. This geocoding functionality would not impact the previously saved address record.

This functionality is available for normal, composition, SEZ units, SEZ developers, ISD, and casual taxpayers who are active, cancelled, and suspended. It will gradually be opened for other types of taxpayers. Further, this functionality is currently being made available for taxpayers registered in Delhi and Haryana only, and it will gradually be opened for taxpayers from other States and Uts.

The Manual can be accessed on this link

Portal update on 24.02.2023

Introduction of Negative Values in Table 4 of GSTR-3B

The Government vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 has notified few changes in Table 4 of Form GSTR-3B for enabling taxpayers to report correct information regarding ITC availed, ITC reversal and ineligible ITC in Table 4 of GSTR-3B. According to the changes, the net ITC is to be reported in Table 4(A) and ITC reversal, if any, is to be reported in Table 4(B) of GSTR-3B.

Currently in GSTR-3B, credit note (CN) is being auto-populated in Table 4B(2), as ITC reversal. Now in view of the said changes, the impact of credit notes are also to be accounted on net off basis in Table 4(A) of GSTR-3B only. Accordingly following changes have been made in the GST Portal from January-2023 period onwards and shall be applicable from tax period –

January, 2023 onwards.

a. The impact of credit note & their amendments will now be auto-populated in Table 4(A) instead of Table 4(B) of GSTR-3B . In case the value of credit notes becomes higher than sum of invoices and debit notes put together, then the net ITC would become negative and the taxpayers will be allowed to report negative values in Table 4(A). Also, taxpayers can now enter negative values in Table 4D(2) of GSTR-3B.

b. Consequent updates/ modification in the advisory, messages, instructions, and help-text in form GSTR-2B, without any structural changes in form GSTR-2B summary or tables have also been done in GSTR-2B.

c. The calculation logic of Comparison Report has now been changed accordingly.

Portal update on 17.02.2023

State Best Practices

> Karasamadhana Scheme Amnesty by Karnataka

Aiming to resolve pre-GST legacy tax disputes and for prompt collection of arrears without litigation, CM Basavaraj Bommai proposed the 'Karasamadhana Scheme' to waive off interest and penalty payable by a dealer on making full payment of tax arrears on or before October 30, 2023.

Legal Corner

> Ignorantia juris non-excusat

The maxim ignorantia juris non excusat originated from ancient Roman law and it means that ignorance of a law or a lack of knowledge of laws is not an excuse in a court of law. It implies that the court presumes that every party is aware of the law of the land and therefore, precludes them from claiming ignorance of the law as a defense to escape liability. This maxim is based on the notion of legal literacy that every individual must know their rights and duties. This maxim is a legal fiction that is created out of necessity for if the maxim is relaxed, then any defendant can claim that he had no knowledge of the law on his part. Therefore, it will be almost impossible for the prosecution to prove the offence. Ignorentia facti doth excusat is another maxim that is closely related to this and it provides that ignorance of a fact is a ground for excuse while fixing the liability of a person.

These principles are incorporated in Indian Penal code through Section 76 and Section 79. Section 76 provides that nothing is an offence which is done by a person who is, or who by reason of a mistake of fact and not by reason of a mistake of law in good faith believes himself to be, bound by law to do it. Section 79 provides that nothing is an offence which is done by a person who by an error of fact and not by mistake of law in good faith believes himself to be justified by law, in doing it. Thus, it can be seen that the law provides general defense to a party who does an act in good faith even when he is acting on a mistake of fact. But the same protection is not accorded to a person who acts on a mistaken belief of law or knowledge of law. In these two sections, the general defense is extended only to persons who have acted on an error of fact that they are bound by law or justified by law in doing that act.