The gross GST revenue collected in the month of September, 2022 is ₹1,47,686 crore of which CGST is ₹25,271 crore, SGST is ₹31,813 crore, IGST is ₹80,464crore (including ₹41,215 crore collected on import of goods) and Cess is ₹10,137 crore (including ₹ 856 crore collected on import of goods).

GST Council Secretariat, New Delhi

GST Revenue collection for September, 2022

₹1,47,686 crore gross GST revenue collected in the month of September, 2022

The gross GST revenue collected in the month of September, 2022 is ₹1,47,686 crore of which CGST is ₹25,271 crore, SGST is ₹31,813 crore, IGST is ₹80,464crore (including ₹41,215 crore collected on import of goods) and Cess is ₹10,137 crore (including ₹ 856 crore collected on import of goods).

The government has settled ₹ 31,880 crore to CGST and ₹ 27,403 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States after regular settlements in the month of September, 2022 is ₹ 57,151 crore for CGST and ₹ 59,216 crore for the SGST.

The revenues for the month of September, 2022 are 26% higher than the GST revenues for the same month last year. During the month, revenues from import of goods was 39% higher and the revenues from domestic transaction (including import of services) are 22% higher than the revenues from these sources during the same month last year.

This is the eighth month and for seventh months in a row now, that the monthly GST revenues have been more than the ₹ 1.4 lakh crore mark. The growth in GST revenue till September, 2022 over the same period last year is 27%. During the month of August, 2022, 7.7 crore e-way bills were generated, which was marginally higher than 7.5 crore in July, 2022.

This month witnessed the second highest single day collection of ₹ 49,453 crore on 20 September with second highest number of 8.77 lakh challans filed, next only to ₹ 57,846 crore collected on 20 July, 2022 through 9.58 lakh challans, which pertained to end of the year returns. This clearly shows that the GST portal maintained by GSTN has fully stabilized and is glitch free. September also saw another milestone getting crossed when more than 1.1 crore e-way bills and e-invoices, combined (72.94 lakh e-invoices and 37.74 lakh e-way bills), were generated without any glitch on the portal run by NIC on 30 September, 2022.

The chart below shows trends in monthly gross GST revenues during the current year.

Notification

Notification No. 18/2022-Central Tax dated 28.09.2022 notifying certain provisions of the Finance Act 2022

The Central government vide the said Notification has notified 01.10.2022 as the date on which provisions of Sections 100 to 114, except clause (c) of Section 110 and Section 111 of Finance Act, 2022 shall come into force. Pertinently, 110(c) and 111 were already notified by Notification No. 9/2022-CT dated 05.07.2022 consequently with insertion of Rule 88B and sub-rule 87(14) and were notified vide Notification no. 14/2022-Central Tax, dated 05.07.2022.

Notification No. 19/2022-Central Tax dated 28.09.2022 notifying amendments (Second Amendment, 2022) to the CGST Rules, 2017.

The Central government vide the said Notification has notified the following rules to amend the Central Goods and Services Tax Rules, 2017:

Time limit for suspension of registration in case of regular registration has been prescribed vide Rule 21 (h) as 6 months from the due date of GSTR 3B.

Time limit for suspension of registration in case of composition levy has been prescribed vide Rule 21 (i) as 3 months from the due date of GSTR 4.

Rule 36, Rule 37, Rule 38, Rule 42, Rule 43, Rule 60, Rule 83, Rule 85, Rule 96 and Form PCT-05 are being amended due to omission of Sections 42,43 and Section 43A and to align the said Rules with the GSTR-1/GSTR2B/3B return filing system.

Further, Rule 69, 70, 71, 72,73,74,75,76,77 and 79 has been omitted due to omission of Section 42,43 and 43A of CGST Act so as to do away with two-way communication in return filing. FORM GSTR-1A, FORM GSTR-2 and FORM GSTR-3 of the said rules is omitted.

Relevant changes have been made in Rule 89 to prescribe RFD 01 for refund relating to balance in electronic cash ledger.

Reference of GSTR 3 has been omitted in Rule 96 i.e. Refund of IGST paid on exports.

Notification No. 20/2022-Central Tax 28.09.2022 seeking to rescind Notification No. 20/2018-CT dated 28.03.2018.

Relevant changes have been made for GST practitioners in the FORM GST PCT-05 and Rule 83.

Vide the said Notification the Central Government, on the recommendations of the GST Council, has notified rescission of Notification No.20/2018-Central Tax, dated 28th March, 2018 which dealt with time limit of 18 months for the refund to the Unique Identity Numbers category etc. Now, the said period is extended to two years vide Notification No. 19/2022-Central Tax dated 28.09.2022. The said notification further states that the abovementioned change won't hamper the things done or omitted to be done before such rescission.

Circular

Circular No. 180/12/2022-GST dated 09.09.2022 regarding Guidelines for filing/revising TRAN-1/ TRAN-2 in terms of Order of the Hon'ble Supreme Court.

Vide the said Circular the Government has issued guidelines for filing/revising TRAN-1/TRAN-2 in terms of Order dated 22.07.2022 & 02.09.2022 of Hon'ble Supreme Court in the case of Union of India vs. Filco Trade Centre Pvt. Ltd. In accordance with the directions of Hon'ble Supreme Court, the facility for filing TRAN-1/ TRAN-2 or revising the earlier filed TRAN-1/TRAN-2 on the common portal by an aggrieved registered assessee is being made available by GSTN for the period 01.10.2022 to 30.11.2022. In order to ensure uniformity in implementation of the directions of Hon'ble Supreme Court, the Government in exercise of powers conferred under Section 168(1) of the CGST Act, 2017 has issued clarifications pertaining to filing TRAN-1/TRAN-2 or revising earlier filed TRAN-1/TRAN-2.

Instructions

Instruction No. 04/2022-23 [GST-Inv.] dated 01.09.2022 regarding guidelines for launching of prosecution under the CGST Act, 2017.

The Government vide the said instruction has issued guidelines for initiation of the prosecution under the Central GST Act, 2017. Section 132 of the Central Goods and Services Tax Act, 2017 (CGST Act, 2017) codifies the offences under the Act which warrant the institution of criminal proceedings and prosecution.

Instructions

It provides that whoever commits any of the offenses specified under Sub-Section (1) and Sub-Section (2) of Section 132 of the CGST Act, 2017, can be prosecuted. It further provides that prosecution should normally be launched where amount of tax evasion, or misuse of ITC, or fraudulently obtained refund in relation to offences specified under Sub-Section (1) of section 132 of the CGST Act, 2017 is more than five hundred lakh rupees.

Additionally, the instruction further provides that the said monetary limit shall not be applicable in certain cases such as in the cases investigated by DGGI, except for cases pertaining to single/multiple taxpayer(s) under Central Tax administration in one Commissionerate where arrests have not been made and the prosecution is not proposed prior to issuance of show cause notice, prosecution complaints shall be filed and followed up by DGGI. In other cases, the complaint shall be filed by the officer at level of Superintendent of the jurisdictional Commissionerate, authorized by Pr. Commissioner/ Commissioner of CGST. It provides that in all cases investigated by DGGI, the prosecution shall continue to be sanctioned by appropriate officer of DGGI. Further, it provides for detailed clarifications regarding appeal against court order in case of inadequate punishment/acquittal, procedure for withdrawal of prosecution, publication of names of persons convicted, monitoring of prosecution, compounding of offence, inspection of prosecution work by the Directorate General of Performance Management, etc.

State Best Practice

A Convergence meet on GST organized in North Kashmir

State Taxes Department of Jammu & Kashmir has commenced a series of outreach programs in the form of Convergence meet for raising awareness about GST among various stakeholders with a view to enhance GST compliance and to address genuine grievances at operations level.

First such meet was organized on 15 September, 2022 and it covered the North Kashmir districts of Baramullah, Sopore, Kupwara and Bandipura with the venue located at Baramulla District Headquarter. Large number of entrepreneurs, traders, office bearers of Association of Commerce and Industry, contractor associations and tax practitioners attended the program. The program was presided over by Dr Rashmi Singh, IAS, Commissioner State Taxes Department, J&K. Other senior officers included Additional Commissioner, Deputy Commissioner from CGST, Deputy Commissioners of SGST, besides State Tax Officers and other field functionaries of the department.

The focus of the meet was to enhance Tax payers Awareness about different GST provisions, especially the latest updates, issues related with Small and Medium Sector Enterprises, GST return filing, new registrations etc.

Commissioner, State taxes Department appreciated the taxpayer's cooperation in the smooth implementation of GST and congratulated them on being valuable stakeholders in the successful completion of 5 years of ONE TAX, ONE NATION. She stated that the department is sensitive towards issues of trade and industry and emphasized that while the voluntary tax compliance is the life line of GST tax administration and the department functions in that spirit, there will be zero tolerance to cases of tax evasion or fraudulent claims. She said that the feedback collected from the stakeholders during the course of the proceedings will be utilized to fine-tune the department's response and also strategize future awareness programs.

Some of the grievances could be addressed on spot and exchange of information also cleared some of the doubts on latest developments especially post 47 GST council meeting held at Chandigarh. The technical glitches pointed out regarding GST portal was taken up on case-to-case basis. The demand from taxpayers for updating the website with latest information was well received and it was decided that a compendium of latest circulars/ relevant orders will be published and put on the Department's website. On policy issues raised by associations a free and frank discussion was allowed and it was assured that wherever feasible the department would scale up issues to appropriate forum including the GST council.

In pictures above Dr Rashmi Singh, IAS Commissioner, State Taxes, J and K with other officers seen interacting with stakeholders who has come from different regions of North Kashmir for the Convergence Meet

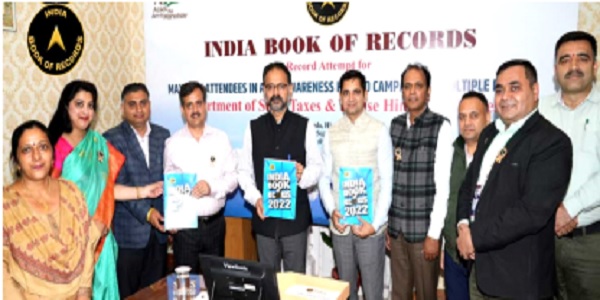

> State-wide Awareness Programme on GST enters India Book of Records

The Department of State Taxes and Excise, Himachal Pradesh organized GST awareness programmes simultaneously at 38 locations cross the State on 07 September, 2022 with participation of 4,400 stakeholders. The said event has been adjudged as a unique record by INDIA BOOK OF RECORDS. The Certificate in this regard was presented to Shri Subhasish Panda, Principal Secretary of the department by Shri Bhanu Pratap adjudicator of India Book of Records at the H.P. Secretariat.

In the picture above Shri Subhasish Panda, Principle Secretary State Taxes and Excise reciving the certificate.

While addressing the concluding session Principal Secretary State Taxes and Excise Shri Subhasish Panda said that voluntary tax compliance is life line of modern tax administration and that the department has taken a number of initiatives after implementation of GST to strengthen this life line.

The Tax HAAT Program launched by the Hon'ble Chief minister in January, 2022 was latest such initiative in this direction, he said. He hoped that this unique initiative of the department registered as a record by the prestigious India Book of Record will help generate greater awareness of GST provisions for ensuring improved voluntary tax compliances. He congratulated the department for being sensitive to issues of trade and industry and for successfully organizing the event.

Commissioner of State Taxes and Excise Shri Yunus informed that the event was attended by entrepreneurs, members of trade and industry from across all segments. He said that the event was very well received by trade and industry.

Himachal Pradesh Government Press Release No. 927/2022-PUB dated 07.09.2022

> Government of Jammu & Kashmir has issued Guidelines for Deductions and Deposits of TDS by the DDOs under Goods and Services Tax Law.

The Finance Department of J&K has issued guidelines for Draw and Disbursing Officers (DDOs) in Jammu and Kashmir regarding deductions and deposit of Tax Deducted at Source (TDS) under Goods and Service Tax (GST).

As per the guidelines, the amount deducted as tax under Section 51 of the Jammu and Kashmir GST Act, 2017 shall be paid to the Government by the deductor within ten days after the end of the month in which such deduction is made along with a return in Form GSTR-7 giving the details of deductions and deductees. The guidelines have been issued for strict compliance by all the Government Departments of Union Territory of Jammu & Kashmir.

Source: Circular dated 16.09.2022 on www.jakfinance.nic.in

GST Portal Updates

> Introducing Single Click Nil Filing of GSTR-1

Single click Nil filing of GSTR-1 has been introduced on the GSTN portal to improve the user experience and performance of GSTR-1/IFF filing. Taxpayers can now file NIL GSTR-1 return by simply ticking the checkbox File NIL GSTR-1 available at GSTR-1 dashboard. For the detailed advisory please click here.

Portal Update on 02.09.2022

Portal Update on 02.09.2022

- • The Government vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 has notified few changes in Table 4 of Form GSTR-3B for enabling taxpayers to correctly report information regarding ITC availed, ITC reversal and ineligible ITC in Table 4 of GSTR-3B.

- • The Notified changes of Table 4 of GSTR-3B have been incorporated in GSTR-3B and are available on GST Portal since 01.09.2022. The taxpayers are advised to report their ITC availment, reversal of ITC and ineligible ITC correctly as per new format of Table 4 of GSTR-3B at GST Portal for the GSTR-3B to be filed for the period August 2022 onwards.

- For the detailed advisory, please click here.

> Module wise new functionalities deployed on the GST Portal for taxpayers

Various new functionalities are implemented on the GST Portal, from time to time, for GST stakeholders. These functionalities pertain to different modules such as Registration, Returns, Advance Ruling, Payment, Refund and other miscellaneous topics. Various webinars are also conducted as well informational videos prepared on these functionalities and posted on GSTNs dedicated YouTube channel for the benefit of the stakeholders.

To view module wise functionalities deployed on the GST Portal and webinars conducted/ Videos posted on GSTNs dedicated YouTube channel, refer to table below:

Portal Update on 12.09.2022

Portal Update on 02.09.2022

Legal Corner

> Pari Materia:

The maxim "Pari Materia" is derived from Latin and it translates to "of the same matter or on the same subject". When employed as a means of statutory construction, this principle provides that, Statutes that deal with the same matter or subject should be read and construed together as a unitary and harmonious whole. It implies that when there is any uncertainty about interpretation of any law it shall be perceived in the sense in which they best harmonize with the subject of enactment and the object of the legislature is to be taken into consideration. The principle is based on the idea that it is permissible to read the provisions of the two Acts together when the same are complementary to each other as there is continuity of legislative approach in such Acts. It is a well-established external aid of interpretation of statute and it further implies that if two provisions of two different statutes deal with the same subject matter and form part of the same subject matter they can be read in consonance.

The doctrine of "Pari Materia" is used as an aid for interpretation in order to avoid contradiction or conflict amongst different statutes dealing with the same subject matter. It helps to interpret the words of the later statute in light of earlier statutes in the same context. Moreover, if the words of a statute have been recognized and interpreted by the Judiciary in a particular way and it has already gained an authoritative value, then it is understood that the statue having similar words/ context will be dealt in the same manner.

> Mutatis Mutandis:

The maxim 'Mutatis mutandis' is derived from the Latin and it translates to 'all necessary changes having been made' or 'with consideration of respective differences'. The phrase in simple terms implies that while interpreting a particular law although it may be necessary to make some changes to take account of different situations, the main point remains the same.

The maxim is a well-known legislative device, employed for the purpose of adaptation of a law in an altered context. In legal terms the maxim implies that the extension of an earlier Act 'mutatis mutandis' to a later Act brings in the idea of adaptation, but so far only as it is necessary for the purpose, making a change without altering the essential nature of the thing changed, subject of course to express provisions made in the later Act. The Maxim is ordinarily used to indicate the applicability of a principle to a different situation, having made appropriate adjustments.

Meeting with Stake Holders

> Meeting with representatives of with representatives of Cantonment Board

A meeting was held on 05.09.2022 with the representatives of Cantonment Board wherein they raised several issues that were being faced by the Board post implementation of GST. One such issue that was deliberated upon during the meeting was that GST has subsumed taxes like local body tax, entry tax, entertainment tax, octroi and so on in its ambit which were earlier collected by "local authorities' including Cantonment Boards thereby leading to considerable revenue loss. They further stated that State Compensation Acts that were enacted to alleviate the revenue loss that accrued to Local bodies has no specific provision to take care of the loss of revenue to Cantonment Boards.

They further stated that since the introduction of the GST in the year 2017, other than deeming that Cantonment Boards are included in the meaning and definition of local bodies however, there is no specific provision in any of the subsequent enactments regarding compensation to take care of the loss of revenue to Cantonment Boards on account of introduction of the GST. In light of these they suggested that the peculiar situation that is presently in place with respect to Cantonment Boards need to be reconsidered and requested that a mechanism be put in place for compensation on account of loss of revenue to the cantonment boards.

> Meeting with representatives of All India Transporters Welfare Association (AITWA)

A meeting was held on 15.09.2022 with the representatives of AITWA at the office of GST Council Secretariat. The Association raised various issues that were being faced by the trade on the tax front. During the discussion the association raised the issue regarding the extension of e-way bill on its expiry as many times on account of various factors the transporter is not able to reach the destination prior to expiry of e-way bill. A request was made to consider the possibility of extension of validity of e-way bill after 8 hours of its expiry. Another suggestion made was regarding making Table 4B of GSTR 1 optional in case of Goods Transport Agency (GTA) as it increases the compliance burden on the registered GTA who has not opted for forward charge.

> Meeting with representatives of Schlumberger

A meeting was held on 26.09.2022 with the representatives of Schlumberger at the Office of GST Council Secretariat. Various issued that were being faced by the trade were raised by them during the course of meeting. The representatives of Schlumberger requested that a clarification should be issued regarding the Essentiality Certificate ('EC') required from the Directorate General of Hydrocarbons ('DGH') for import of goods under Customs and GST. Notification 2/2022 – Customs has amended Notification 50/2017 – Customs and the amended condition provides that there is no mandatory requirement of Essential Certificate ('EC') issued by Directorate General of Hydrocarbons ('DGH') for claiming benefit of concessional rate of duty under Customs and that the Letter issued by the licensee at the time of import of goods that the goods are intended for specified purpose shall be sufficient for the same. However, under Notification 3/2017 – CT (Rate) the requirement for EC is still in place for GST. It was submitted that the industry has been facing problems on account of lack of parity between the two notifications under GST and Customs. They requested that similar modification may also be made in Notification 3/2017 – CT (Rate) to ensure uniformity of practice across GST and Customs and also, for improving ease of doing business.