The gross GST revenue collected in the month of July, 2022 is ₹1,48,995 crore of which CGST is ₹25,751 crore, SGST is ₹32,807 crore, IGST is ₹79,518 crore (including ₹41,420 crore collected on import of goods) and cess is ₹10,920 crore (including ₹ 995 crore collected on import of goods). This is second highest revenue since introduction of GST.

GST Revenue collection for July, 2022

₹1,48,995 crore gross GST revenue collected in the month of July, 2022

The gross GST revenue collected in the month of July, 2022 is ₹1,48,995 crore of which CGST is ₹25,751 crore, SGST is ₹32,807 crore, IGST is ₹79,518 crore (including ₹41,420 crore collected on import of goods) and cess is ₹10,920 crore (including ₹ 995 crore collected on import of goods). This is second highest revenue since introduction of GST.

The government has settled ₹ 32,365 crore to CGST and ₹ 26,774 crore to SGST from IGST. The total revenue of Centre and the States in the month of July, 2022 after regular settlement is ₹ 58,116 crore for CGST and ₹ 59,581 crore for the SGST.

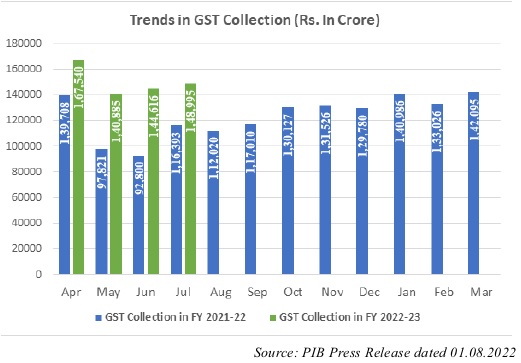

The revenues for the month of July, 2022 are 28% higher than the GST revenues in the same month last year of ₹ 1,16,393 crore. During the month, revenues from import of goods was 48% higher and the revenues from domestic transaction (including import of services) are 22% higher than the revenues from these sources during the same month last year.

For five months in a row now, the monthly GST revenues have been more than ₹ 1.4 lakh crore, showing a steady increase every month. The growth in GST revenue till July, 2022 over the same period last year is 35% and displays a very high buoyancy. This is a clear impact of various measures taken by the Council in the past to ensure better compliance. Better reporting coupled with economic recovery has been having positive impact on the GST revenue collections on a consistent basis. During the month of June, 2022, 7.45 crore e-way bills were generated, which was marginally higher than 7.36 crore in May, 2022.

The chart below shows trends in monthly gross GST revenues during the current year.

Smt. Sitharaman thanked the five representatives from trade for making presentations on five topics relating to the implementation of GST and how timely amendments have met the need of the hour. She noted that the GST Collections are buoyant and consistent which is a result of efforts of all officers. Smt. Sitharaman paid homage to all those who lost their lives during pandemic. On the occasion, the Finance Minister also mentioned that the gross GST collection has been Rs.1.44 lakh crore for June, 2022 which is 56% more than the same month of the previous year.

Minister of State for Finance, Shri Pankaj Chaudhary highlighted the salient features of GST and in particular the removal of multiple taxes to implement the concept of One Nation One Tax. He was appreciative of the five presentations made by representatives highlighting the salient features of GST and achievements made in these five years.

Revenue Secretary Sh. Tarun Bajaj complimented the five presenters from Trade who made presentations on GST. He congratulated the awardees for receiving commendation certificate on GST Day for exemplary service. He noted that CBIC is responsive of suggestions made by trade and would work on it to provide solutions.

Chairman CBIC, Shri Vivek Johri said that all suggestions made by trade representatives in their presentations have been duly noted. He highlighted that GST Council has been making changes as and when required. He highlighted that NACIN has been conducting one of the biggest training programmes since implementation of GST for both Central and State Government officers and that Indian GST model has been one of the most successful as compared to other federal structures anywhere in the world. He stated that CBIC would enhance usage of Artificial Intelligence and better data analysis in times to come.

Member GST Sh. D P Nagendra Kumar in his address said that both Central and State GST regimes have been continuously working for better tax administration and bringing about changes for betterment of taxpayers.

The occasion also saw presentations by thematic groups from trade and industry who shared their experience with GST for the past 5 years on its 5 edifices.

Ms. Sulajja Firodia Motwani, CEO, Kinetic Green Energy & Power Solutions Limited made the first presentation on Impact of GST on inter-state Trade. She highlighted that GST been a revolution towards much improved inter-state trade.

The second presentation was made by Mr. Shrinivas Garimella, Chairman of Industrial Development Committee, FTACCI- Hyderabad on Impact of GST on MSME sectors. He said that due to GST the MSMEs are the biggest beneficiaries of online business processes.

The fourth presentation was given by Sh. DD Goyal, Member CII Tax Committee & Executive Advisor Maruti Suzuki on simplification of procedures. He said that simplification of procedures related to Registration, Seamless ITC, Payment of Tax, Filing of Returns and refunds has enhanced Ease of Doing Business.

A Film on GST – एक कर, एक बाजार@5 was played at the event showcasing the efforts made in past 5 years to streamline indirect taxation regime and reduce compliance burden.

A booklet [email protected] – ………………………… compiled by the Directorate General of Taxpayer Services, CBIC elucidating the various facets of GST reforms and its benefits like Digitalization, simplification, reduction in tax evasion etc. over the past 5 years was released by Hon'ble Finance Minister.

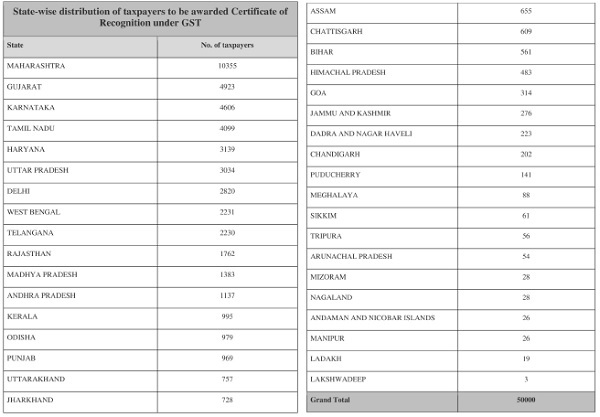

On the occasion of the 5th GST day, CBIC, Ministry of Finance, Government of India also recognized the contribution of all the compliant taxpayers to nation building. 50,000 (Fifty Thousand) compliant taxpayers have been identified representing all Industry sectors of the economy. The MSME sector, which is the growth engine of the economy and the largest contributor to job creation had more than 72% awardees: 6% from Micro, 51% from Small and 16% from medium enterprises.

Five such taxpayers were felicitated by the Finance Minister at the event.

These taxpayers have demonstrated compliance in prompt filing of GST Returns and payment of their GST liabilities during the financial year 2021-22. Along with significantly improved collection of GST revenue, there has been clear improvement in the compliance behavior, which has been a result of various measures taken by the indirect tax administration to nudge taxpayers to file their returns timely, making compliance easier and smoother; strict enforcement action against errant taxpayers identified by data analytics and artificial intelligence.

On the occasion, commendation certificates were also presented by Hon'ble Finance Minister to 32 officers who have contributed to the successful implementation of the GST by their continued devotion and commitment to duty.

GST Day celebrations at Vidhana Soudha in Bengaluru, Karnataka

The Chief Minister of Karnataka Shri. Basavaraj Bommai participated in the 5th GST Day celebrations at Vidhana Soudha in Bengaluru on 01.07.2022. During the course of the event 64 officers and staff of Commercial Tax Department were felicitated for rendering exemplary service in implementation of GST.

GST compensation to States

GST compensation to States for loss of revenue arising on account of implementation of GST for a period of five years

As per Section 18 of the Constitution (One Hundred and First Amendment) Act, 2016, Parliament shall, by law, on the recommendation of the Goods and Services Tax Council, provide for compensation to the States for loss of revenue arising on account of implementation of the Goods and Service Tax for a period of five years. This was stated by Union Minister of State for Finance Shri Pankaj Chaudhary in a written reply to a question in Rajya Sabha on 19.07.2022.

The Minister stated that the issue of compensation to States/UTs and augmenting resources under GST were discussed in detail in the 45th GST Council meeting held in Lucknow. Consequent to the decision of the Council, two Group of Ministers (GoMs), namely GoM on GST System Reforms and GoM on Rate Rationalization have been constituted. GoM on Rate Rationalization has submitted its interim report, recommending certain inverted duty corrections and pruning of exemptions, which was discussed and considered in the last GST Council meeting held at Chandigarh.

As a result, the Minister stated, the continued reforms in GST undertaken by Centre and States, on the recommendations of the GST Council,

buoyancy in GST revenue has been achieved in the recent months. The average monthly gross GST collection for the first quarter of the FY 2022-23 has been ₹1.51 lakh crore against the average monthly collection of ₹1.10 lakh crore in the first quarter of the last Financial year showing an increase of 37%, the Minister stated.

The Minister stated that a few States have requested for extension of payment of GST compensation beyond transition period of five years.

The Minister further stated that as per Section 7 of the GST (Compensation to States) Act, 2017, the States are required to be compensated for loss of revenue due to implementation of GST (w.e.f. 01.07.2017) for 5 years' period. During transition period, the States' revenues are protected at 14% growth rate per annum over the base year revenue (2015-16). Accordingly, the States are being compensated for any shortfall against their protected revenue. The details of GST compensation due and released to States/ UTs for the year 2017-18 to 2022-23 is as per ANNEXURE.

Annexure

Details of GST Compensation released to States/ UTs for the year

(in Rs. Crore)

Source: PIB Press Release dated 19. 07.2022

–

Circular

GST Portal Updates

Advisory on Upcoming Changes in GSTR-3B

1. The Government vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 has notified few changes in Table-4 of Form GSTR-3B requiring taxpayers to report information on ITC correctly availed, reversal thereof and declaring ineligible ITC in Table 4 of GSTR-3B. The detailed Notification can be viewed by Central Goods and Services Tax (Amendment) Rules, 2022.

2. The notified changes in Table 4 of GSTR-3B are being implemented on the GST Portal and will be available shortly. Until these changes are implemented on the GST Portal, taxpayers are advised to continue to report their ITC availment, reversal of ITC and ineligible ITC as per the current practice.

3. The taxpayers will be duly informed once these changes are made available on the GST Portal.

Introducing new Table 3.1.1 in GSTR-3B for reporting supplies u/s 9(5)

According to Section 9(5) of CGST Act, 2017, Electronic Commerce Operator (ECO) is required to pay tax on supply of certain services notified by the government such as Passenger Transport Service, Accommodation services, Housekeeping Services & Restaurant Services, if such services are supplied through ECO. For reporting of such supplies a new Table 3.1.1 is being added in GSTR-3B as per Notification No. 14/2022 – Central Tax dated 05th July, 2022 wherein both ECOs and registered persons can report their supplies made under Section 9(5) respectively.

For detailed advisory in this regard please click here

Implementation of mandatory mentioning of HSN codes in GSTR-1

Vide Notification No. 78/2020 – Central Tax dated 15th October, 2020, it is mandatory for the taxpayers to report minimum 4 digits or 6 digits of HSN Code in Table-12 of GSTR-1 on the basis of their Aggregate Annual Turnover (AATO) in the preceding Financial Year. To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST Portal. For detailed advisory please click here

Removal of negative balance in cash ledgers of some composition taxpayers

Due to the reversal of amount in the cash ledger of some composition taxpayers, the balance in the cash ledgers had become negative. The government has now decided that the negative balance in the cash ledgers of such taxpayers should be nullified. Accordingly, the negative balance has been nullified. All such taxpayers have been informed through email also.

Webinar on Tax liabilities and ITC comparison Tool

1. For creating awareness amongst all the stakeholders, GSTN held webinars to show demo on the following functionalities:

- Liability Comparison – Comparison of liabilities declared in GSTR-1/IFF and liabilities actually paid in GSTR-3B

- ITC Comparison – Comparison of ITC eligible as per GSTR-2B/GSTR-2A and ITC actually availed in GSTR-3B

Recording of these sessions are available on GSTNs dedicated YouTube channel, at https://www.youtube.com/channel/UCFYp Ok92qurlO5t-Z_y-bOQ for viewing.

Portal update on 11.07.2022

FAQ / Order

FAQs on GST applicability on 'pre-packaged and labelled' goods- reg

The changes relating to GST rate, in pursuance of recommendations made by the GST Council in its 47th meeting, came into effect from 18th July, 2022. One such change is that GST which was earlier leviable on specified goods when bearing a registered brand or brand in respect of which an actionable claim or enforceable right in a court of law is now leviable on the specified goods when they are "pre-packaged and labelled". Certain representations have been received seeking clarification on the scope of this change, particularly in respect of food items like pulses, flour, cereals, etc.

(specified items falling under the Chapters 1 to 21 of the Tariff), as has been notified vide notification No. 6/2022-Central Tax (Rate), dated the 13th of July, 2022, and the corresponding Notifications for SGST and IGST. The FAQs have been issued to clarify these issues.

Authorisation under clause (c) of Sub-rule (4) of rule 96 of the Central Goods and Services Tax Rules, 2017 vide Order No. 01/2022-GST dated 21st July, 2022.

The Central Government vide Order No. 01/2022-GST dated 21st July, 2022 has authorized the Principal Director General/ Director General of Directorate General of Analytics and Risk Management ("DGARM"), to withhold the refund of Integrated tax paid on goods or services exported out of India under Rule 96(4)(c) of the Central Goods and Services Tax Rules, 2017, where on the basis of data analysis and risk parameters, they are of the opinion that verification of credentials of the exporter, including the availment of Input Tax Credit by the exporter, is considered essential before grant of refund, in order to safeguard the interest of revenue. It is pertinent to mention that this order is applicable throughout the territory of India.

States Best Practices

Disposal of refunds within the stipulated time framework and payment of interest amount on delayed refunds.

The Delhi Government has issued Order vide F.3(433)/GST/Policy/2022/1407-13 dated 20th July, 2022 for disposal of refunds within the stipulated time framework and payment of interest amount on delayed refunds.

The aforesaid order provides that:

1. The Hon'ble Delhi High Court issued directions, dated 20th May, 2022 in the matter of WP (C) 7110/2022 (Lord Krishna Traders Private Limited Vs Commissioner of Delhi Goods & Services Tax), that the Commissioner, DGST, will convene a formal meeting with Petitioner's counsel and other practitioners, so that a robust mechanism is put in place for timely disposal of refund claims.

2. The disposal of refund applications in a time bound manner is an integral part of the VAT/GST mechanism. In this regard, attention is drawn to Section 38 of Delhi Value Added Tax Act, 2004 and Section 56 of the DGST Act as per which, if any tax is to be refunded under Sub-section 5 of Section 54 but is not refunded within 60 days from the receipt of application under Sub-section (1) of that Section, States Best Practices interest at such rates not exceeding six percent as may be Instructions issued by State of UP w.r.t Local Authorities. interest at such rates not exceeding six percent as may be

specified in the Notification issued by the Government, shall be payable in respect of such refunds from the next day of the sixtieth day of the receipt of application. Similarly, under Section-42 of Delhi Value Added Tax Act, 2004, interest is liable to be paid on delayed refunds. Therefore, it becomes imperative upon the concerned refund sanctioning authority/proper officer that all refund applications are processed and decided within the prescribed time frame in order to avoid undue interest liability on the department.

3. In this regard, departmental instructions/orders/circulars were issued from time to time and a grievance redressal mechanism has already been circulated vide Circular No. F.3(433)/GST/Policy/2022/1268-77, dated 13th May, 2022.

4. All Ward in charges/Proper Officers/Zonal in charges are hereby directed to adhere, to departmental guidelines issued by the department for timely disposal of all types of refunds and take utmost care to dispose off the refund application within the stipulated time period.

5. Non-compliance will invite stringent action.

Instructions issued by State of UP w.r.t Local Authorities.

The Uttar Pradesh Government vide letter no. GST/2022- 23/225/2223030 dated 15.07.2022, has instructed the concerned authorities to take an account of taxable payments made towards availment of goods and services by the Panchayat Samitis under various schemes such as MGNREGA. The concerned officer shall ensure that if the said payments are found to be taxable and eligible for TDS deductions, then TDS amount shall be duly deducted from the said amount as per Section 51 of UPGST Act. They shall ensure that such Gram Panchayat/local authorities are duly registered with the GST Department. They shall also take an account of payments made towards availment of goods and services by departments such as Health, Irrigation, Education, etc and ensure that such departments are duly registered as Tax Deductors and their GSTR-7 returns are timely filed. Further, appropriate action is to be taken against parties who are not compliant of these instructions. Instructions issued by State of UP w.r.t Local Authorities.