iStock

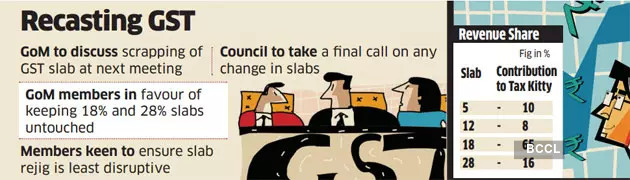

iStockA group of ministers, mandated to look at rate rationalisation by the Goods and Services Tax Council, is mulling doing away with the 12% slab while retaining the 18% and 28% slabs.

People aware of the development told ET that most of the members of the group were of the view that the 12% slab accounts for about 8% of total GST revenues and can be done away with.

"This is one of the options. At present, the 12% slab contributes the least to revenues. It would be easiest to remove it," said one of the persons quoted above.

Butter, ghee, fruit juice, almonds, footwear up to ₹1,000, several processed food items, solar water heaters and hotel accommodation priced up to ₹1,000 per day among others fall within the 12% tax bracket.

The 47th GST Council meeting held in Chandigarh in June moved several items including tetra pak, printing, writing or drawing ink, knives with cutting blades, paper knives, pencil sharpeners and blades, spoons, forks, ladles, skimmers, dairy machinery, power pumps and LED lamps to the 18% slab from 12%.

The person cited above said that the GoM was in the process of assessing the revenue impact of moving items from one slab to another. The GoM is looking to maximise revenues without causing a major disruption, the person said.

The GoM is expected to discuss the option when it meets later this month.

The GST, which subsumed multiple state and central taxes, has four slabs-5%, 12%, 18% and 28%. Apart from the four key slabs, 1.5% and 3% applies to cut diamonds and jewellery and precious metals, respectively, besides a top-up compensation cess is levied on select items such as automobiles. Essential items attract the lowest rate of 5% GST and sin and luxury goods attract the top rate of 28%.

In terms of contribution to the revenue kitty, the 28% slab contributes 16%. The 18% slab has less items but contributes a major chunk or 65% of revenues. The slabs of 5% and 12% contribute 10% and 8% to the kitty.

The GoM, the person said, is not keen on tinkering the 5% or 28% slabs.