The 47th GST Council met under the chairmanship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in Chandigarh on 28th and 29th of June, 2022. The meeting was also attended by Union Minister of State for Finance Shri Pankaj Choudhary besides Finance Ministers of States & UTs and senior officers of the Ministry of Finance & States/ UTs.

Recommendations of 47th GST Council Meeting

The 47th GST Council met under the chairmanship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in Chandigarh on 28th and 29th of June, 2022. The meeting was also attended by Union Minister of State for Finance Shri Pankaj Choudhary besides Finance Ministers of States & UTs and senior officers of the Ministry of Finance & States/ UTs.

The GST Council has inter-alia made the following recommendations relating to changes in GST rates on supply of goods and services and changes related to GST law and procedure:

I. Recommendations relating to GST rates on goods and services

A. Rate Rationalization to remove inverted duty structure [Approval of recommendations made by GoM on rate rationalization]

B. Other GST rate changes recommended by the Council

- All rate changes recommended by the 47th GST Council will be made effective from 18th July, 2022

C. Withdrawal of exemptions [Approval of recommendations made by GoM on rate rationalization]

C1. Hitherto, GST was exempted on specified food items, grains etc when not branded, or right on the brand has been foregone. It has been recommended to revise the scope of exemption to exclude from it prepackaged and pre-labelled retail pack in terms of Legal Metrology Act, including pre-packed, pre-labelled curd, lassi and butter milk.

C.2 In case of the following goods, exemption from GST will be withdrawn:

C.3 In case of the following goods, the exemption in form of a concessional rate of GST is being rationalized:

C4. In case of Services, following exemptions are being rationalized:

D. GST on casinos, race courses and online gaming

The Council directed that the Group of Ministers on Casino, Race Courses and Online Gaming re-examine the issues in its terms of reference based on further inputs from States and submit its report within a short duration.

E. Clarification on GST rate

E1. Goods

1. Electric vehicles whether or not fitted with a battery pack, are eligible for the concessional GST rate of 5%.

2. All fly ash bricks attract same concessional rate irrespective of fly ash content

3. Stones covered in S. No.123 of Schedule-I (such as Napa stones), even if they are ready to use and polished in minor ways [not mirror polished], attract concessional GST rate of 5%.

4. The GST rate on all forms of mango under CTH 0804, including mango pulp (other than mangoes sliced, dried) attract GST rate of 12%. Entry is also being amended to make this amply clear. Raw or fresh mangoes continue to be exempt.

5. Sewage treated water is exempted from GST and is not the same as purified water provided in S. No. 99 of notification 2/2017-CT(Rate). The word 'purified' is being omitted to make this amply clear.

6. Nicotine Polarilex Gum attracts a GST rate of 18%.

7. The condition of 90% fly ash content with respect to fly ash bricks applies only to fly ash aggregate, and not fly ash bricks. As a simplification measure, the condition of 90% content is being omitted.

E2. Clarification in relation to GST rate on Services

1. Due to ambiguity in GST rates on supply of ice-cream by ice-cream parlours, GST charged @ 5% without ITC on the same during the period 1.07.2017 to 5.10.2021 shall be regularized to avoid unnecessary litigation.

2. Application fee charged for entrance or for issuance of eligibility certificate for admission or issuance of migration certificate by universities is exempt from GST.

3. Ginned or baled fibre is covered in entry 24B of notification No. 12/2017- Central Tax (Rate) dated 28.06.2017 in the category of raw vegetable fi The exemption under this entry is being rationalized

4. Services associated with transit cargo both to and from Nepal and Bhutan are covered by exemption under entry 9B of notification No. 12/2017-CT(R) dated 28.06.2017.

5. Activity of selling of space for advertisement in souvenirs published in the form of books is eligible for concessional GST at 5%.

6. Renting of vehicle with operator for transportation of goods on time basis is classifiable under Heading 9966 (rental services of transport vehicles with operators) and attracts GST at 18%.GST on such renting where cost of fuel is included in the consideration charged is being prescribed at 12%.

7. Allowing choice of location of a plot is part of supply of long-term lease of plot of land. Therefore, location charge or preferential location charges (PLC) are part of consideration charged for long term lease of land and shall get the same treatment under GST.

8. Services provided by the guest anchors to TV channels in lieu of honorarium attract GST.

9. Additional fee collected in the form of higher toll charges from vehicles not having Fastag is essentially payment of toll for allowing access to roads or bridges to such vehicles and shall be given the same tax treatment as given to toll charges.

10. Services in form of Assisted Reproductive Technology (ART)/ In vitro fertilization (IVF) are covered under the definition of health care services for the purpose of exemption under GST.

11. Sale of land after leveling, laying down of drainage lines etc. is sale of land and does not attract GST.

12. Renting of motor vehicles for transport of passengers to a body corporate for a period (time) is taxable in the hands of body corporate under RCM.

13. The expression 'public transport' used in the exemption entry at SI No. 17(d) of notification No. 12/2017-CT(R), which exempts transport of passengers by public transport other than predominantly for tourism purpose, in a vessel between places located in India, means that such transport should be open to public for point to point transport [e.g., such transport in Andaman and Nicobar Islands].

Other miscellaneous changes

1. All taxable service of Department of Posts would be subject to forward charge. Hitherto certain taxable services of Department of post were taxed on reverse charge basis.

2. Goods transport agency (GTA) is being given option to pay GST at 5% or 12% under forward charge; option to be exercised at the beginning of Financial Year. RCM option to continue.

3. Service provided by Indian Tour operator to a foreign resident for a tour partially in India and partially outside India is to be subject to tax proportionate to the tour conducted in India for such foreign tourist subject to conditions that this concession does not exceed half of tour duration.

The rate changes recommended by the 47 GST Council will be made effective from 18th July, 2022.

II. Further, the GST Council has inter-alia made the following recommendations relating to GST law and procedure:

A. Measures for Trade facilitation:

1. In-principle approval for relaxation in the provisions for suppliers making supplies through E-Commerce Operators (ECOs)

I Waiver of requirement of mandatory registration under section 24(ix) of CGST Act for person supplying goods through ECOs, subject to certain conditions, such as-

I the aggregate turnover on all India basis does not exceed the turnover specified under sub-section (1) of section 22 of the CGST Act and notifications issued thereunder.

ii the person is not making any inter-State taxable supply

II Composition taxpayers would be allowed to make intra-State supply through e-commerce operators subject to certain conditions.

The details of the scheme will be worked out by the Law Committee of the Council. The scheme would be tentatively implemented with effect from 01.01.2023, subject to preparedness on the portal as well as by ECOs.

2 Amendment in formula prescribed in sub-rule (5) of rule 89 of CGST Rules, 2017 for calculation of refund of unutilized Input Tax Credit on account of inverted rated structure

a Change in formula for calculation of refund under rule 89(5) to take into account utilization of ITC on account of inputs and input services for payment of output tax on inverted rated supplies in the same ratio in which ITC has been availed on inputs and input services during the said tax period. This would help those taxpayers who are availing ITC on input services also.

3 Amendment in CGST Rules for handling of pending IGST refund claims: In some cases where the exporter is identified as risky exporter requiring verification by GST officers, or where there is a violation of provisions of Customs Act, the refund claims in respect of export of goods are suspended/withheld.

Amendment in rule 96 of the CGST Rules has been recommended to provide for transmission of such IGST refund claims on the portal in a system generated FORM GST RFD-01 to the jurisdictional GST authorities for processing. This would result in expeditious disposal of such IGST refund claims, after due verification by GST officers, thus benefitting such exporters.

4 Re-credit of amount in electronic credit ledger to be provided in those cases where erroneous refund amount sanctioned to a taxpayer on account of accumulated ITC or on account of IGST paid on zero rated supply of goods or services, in contravention of rule 96(10) of the CGST Rules, is deposited by him along with interest and penalty, wherever applicable. A new FORM GST PMT-03A is introduced for the same.

This will enable the taxpayers to get re-credit of the amount of erroneous refund, paid back by them, in their electronic credit ledger.

5 Clause (c) of section 110 and section 111 of the Finance Act, 2022 to be notified by Central Government at the earliest. These provisions relate to-

a retrospective amendment in section 50(3) of CGST Act, with effect from 01.07.2017, to provide that interest will be payable on the wrongly availed ITC only when the same is utilized;

b amendment in sub-section (10) of section 49 of CGST Act to provide for transfer of balance in electronic cash ledger of a registered person to electronic cash ledger of CGST and IGST of a distinct person.

The rules providing for the manner of calculation of interest under section 50 of CGST Act have also been recommended for more clarity. This will remove ambiguities regarding manner of calculation of interest and will also provide for transfer of balance in CGST and IGST cash ledgers between distinct persons, thereby improving liquidity and cash flows of such taxpayers.

6 Waiver of late fee for delay in filing FORM GSTR-4 for FY 2021-22 and extension of due date for filing FORM GST CMP-08 for Q1 of FY 2022-23:

a To extend the waiver of late fee under section 47 for delay in filing FORM GSTR-4 for FY 2021-22 by approximately four more weeks, i.e. till 28.07.2022 (The existing waiver is for the period from 01.05.2022 till 30.06.2022)

b To extend the due date of filing of FORM GST CMP-08 for the 1st quarter of FY 2022-23 from 18.07.2022 to 31.07.2022.

GSTN has also been asked to expeditiously resolve the issue of negative balance in Electronic Cash Ledger being faced by some of the composition taxpayers.

7 Present exemption of IGST on import of goods under AA/EPCG/EOU scheme to be continued and E-wallet scheme not to be pursued further.

8 Issuance of the following circulars in order to remove ambiguity and legal disputes on various issues, thus benefiting taxpayers at large:

a Clarification on issue of claiming refund under inverted duty structure where the supplier is supplying goods under some concessional notification.

b Clarification on various issues relating to applicability of demand and penalty provisions under the CGST Act in respect of transactions involving fake invoices.

c Clarification on mandatory furnishing of correct and proper information of inter-State supplies and amount of ineligible/blocked Input Tax Credit and reversal thereof in return in FORM GSTR-3B.

d Clarification in respect of certain GST related issues:

i Clarification on the issues pertaining to refund claimed by the recipients of supplies regarded as deemed export;

ii Clarification on various issues relating to interpretation of section 17(5) of the CGST Act;

iii Clarification on the issue of perquisites provided by employer to the employees as per contractual agreement;

iv Clarification on utilization of the amounts available in the electronic credit ledger and the electronic cash ledger for payment of tax and other liabilities.

9 Exemption from filing annual return in FORM GSTR-9/9A for FY 2021-22 to be provided to taxpayers having AATO upto Rs. 2 crores.

10 Explanation 1 after rule 43 of CGST Rules to be amended to provide that there is no requirement of reversal of input tax credit for exempted supply of Duty Credit Scrips by the exporters.

11 UPI & IMPS to be provided as an additional mode for payment of Goods and Services Tax to taxpayers under Rule 87(3) of CGST Rules.

12 In respect of refunds pertaining to supplies to SEZ Developer/Unit, an Explanation to be inserted in sub-rule (1) of rule 89 of CGST Rules to clarify that "specified officer" under the said sub-rule shall mean the "specified officer" or "authorized officer", as defined under SEZ Rules, 2006.

13 Amendment in CGST Rules to provide for refund of unutilized Input Tax Credit on account of Export of Electricity. This would facilitate the exporters of electricity in claiming refund of utilized ITC on zero rated supplies.

14 Supplies from Duty Free Shops (DFS) at international terminal to outgoing international passengers to be treated as exports by DFS and consequential refund benefit to be available to them on such supplies. Rule 95A of the CGST Rules, Circular No. 106/25/2019-GST dated 29.06.2019 and related notifications to be rescinded accordingly.

B Measures for streamlining compliances in GST

1 Provision for automatic revocation of suspension of registration in cases where suspension of registration was done by the system under Rule 21A(2A) of CGST Rules, for non-compliance in terms of clause (b) or clause (c) of sub-section (2) of section 29[continuous non-filing of specified number of returns], once all the pending returns are filed on the portal by the taxpayer. (Amendment in rule 21A)

2 Proposal for comprehensive changes in FORM GSTR-3B to be placed in public domain for seeking inputs/suggestions of the stakeholders.

3 Time period from 01.03.2020 to 28.02.2022 to be excluded from calculation of the limitation period for filing refund claim by an applicant under section 54 and 55 of CGST Act, as well as for issuance of demand/ order (by proper officer) in respect of erroneous refunds under section 73 of CGST Act. Further, limitation under section 73 for FY 2017-18 for issuance of order in respect of other demands linked with due date of annual return, to be extended till 30th September, 2023.

C The Council has decided to constitute a Group of Ministers to address various concerns raised by the States in relation to constitution of GST Appellate Tribunal and make recommendations for appropriate amendments in CGST Act.

D The GST Council approved ad-hoc apportionment of IGST to the extent of Rs. 27,000 crores and release of 50% of this amount, i.e. Rs. 13,500 crore to the States.

E The GoM on IT Reforms, inter alia, recommended that the GSTN should put in place the AI/ML based mechanism to verify the antecedents of the registration applicants and an improved risk-based monitoring of their behavior post registration so that non-compliant tax payers could be identified in their infancy and appropriate action be taken so as to minimize risk to exchequer.

Note: The recommendations of the GST Council have been presented in this release containing major item of decisions in simple language for information of all stakeholders. The same would be given effect through relevant Circulars/ Notifications/ Law amendments which alone shall have the force of law.

Source: PIB Press Release dated 29. 06.2022

GST Revenue collection for June, 2022

Rs. 1,44,616 crore gross GST Revenue collection for June, 2022; increase of 56% year-on-year

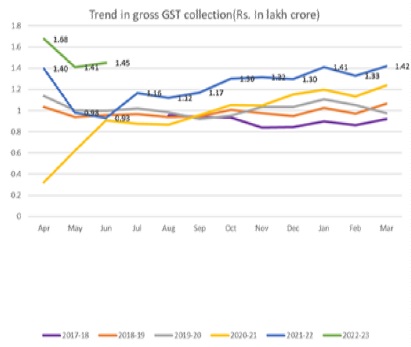

The gross GST revenue collected in the month of June, 2022 is Rs. 144,616 crore of which CGST is Rs.25,306 crore, SGST is Rs.32,406 crore, IGST is Rs.75887 crore (including Rs.40102 crore collected on import of goods) and cess is Rs.11,018 crore (including Rs. 1197 crore collected on import of goods). The gross GST collection in June, 2022 is the second highest collection next to the April, 2022 collection of Rs.1,67,540 crore.

The government has settled Rs.29,588 crore to CGST and Rs.24,235 crore to SGST from IGST. In addition, Centre has also settled Rs.27,000 crore of IGST on ad-hoc basis in the ratio of 50:50 between Centre and States/UTs in this month. The total revenue of Centre and the States in the month of June, 2022 after regular and adhoc settlement is Rs.68,394 crore for CGST and Rs.70,141 crore for the SGST.

The revenues for the month of June, 2022 are 56% higher than the GST revenues in the same month last year of !92,800 crore. During the month, revenues from import of goods was 55% higher and the revenues from domestic transaction (including import of services) are 56% higher than the revenues from these sources during the same month last year.

This is the fifth time the monthly GST collection crossed Rs. 1.40 lakh crore mark since inception of GST and fourth month at a stretch since March, 2022. The collection in June, 2022 is not only be the second highest but also has broken the trend of being low collection month as observed in the past. Total number of e-way bills generated in the month of May, 2022 was 7.3 crore, which is 2% less than 7.4 crore a-way bills generated in the month of April, 2022.

The average monthly gross GST collection for the first quarter of the FY 2022-23 has been Rs.1.51 lakh crore against the average monthly collection of Rs. 1.10 lakh crore in the first quarter of the last financial year showing an increase of 37%. Coupled with economic recovery, anti-evasion activities, especially action against fake billers have been contributing to the enhanced GST. The gross cess collection in this month is the highest since introduction of GST.

The chart below shows trends in monthly gross GST revenues since 2017-18.

Source: PIE Press Release dated 01. 07.2022

Notifications

> Notification no. 08/2022-Central Tax dated 07.06.2022 providing for waiver of interest for specified electronic commerce operators for specified tax periods

The Government vide the said Notification has provided for waiver of interest for specified class of electronic commerce operators for specified tax periods.

The rate of interest leviable on late furnishing of GSTR Form 8 for the month of December 2020 has been waived off in case of specified registered persons (60 GSTINs notified in Sl. No 1, column 2 of the Table given in Notification) who could not file their return by the due date due to technical glitch but had deposited the collected TCS of said month in the electronic cash ledger.

The rate of interest leviable on late furnishing of GSTR Form 8 for the months starting from September, 2020 till January, 2021 has been waived off in case of specified registered persons (12 GSTINs notified in Sl. No 2, column 2 of the Table given in Notification)

The interest has been waived for the period starting from the date of depositing TCS in electronic cash ledger till the date of filing of statement under sub-section (4) of Section 52.

> Notification No. 1/2022–Compensation Cess dated 24.06.2022 providing for extension of GST Compensation Cess levy till 31.03.2026.

The Government has notified the Goods and Services Tax (Period of Levy and Collection of Cess) Rules, 2022 which shall be effective from 1st July, 2022. Further, Government vide the said notification has extended GST Compensation Cess levy till 31.03.2026 which was coming to an end on 30th June 2022.

Instruction

> The Government vide Instruction No. 03/2022-GST dated 14.06.2022 has issued detailed instructions//guidelines for sanction, review and post-audit of refund claims.

In order to ensure uniformity across field formations with respect to the procedure followed regarding sanction, review and post audit of refund claims, the CBIC has vide Instruction No. 03/2022-GST dated 14.06.2022 issued detailed guidelines/instructions for sanction, review and post audit of refund claims.

Under sub category of Sanction of refund the instruction broadly focuses on the following areas:

1 Details for all category of refund claims

2 Additional details in case of the refund of accumulated ITC (on account of zero-rated supplies/inverted rated structure) and refund of IGST paid on account of zero-rated supplies.

3 Additional details in case of refund of tax paid on supplies regarded as deemed export

4 Additional details in case of refund of excess balance in cash ledger

5 Additional details in case of refund files under other categories of refund except above mentioned

Under sub category of post-audit and review the instruction broadly focuses on the following areas:

1. Considering the large number of refund claims filed in GST, it has been decided that post-audit may henceforth be conducted only for refund claims amounting to Rs. 1 lakh or more till further instruction.

2. The following are the guidelines for post-audit and review of refund claims:

a. All the refund orders are to be transmitted in online facility mentioned above after issuance of refund order in RFD-06. The review and post audit officers shall have access to all documents/statement on ACES-GST Portal.

b. To undertake the post-audit of a refund order, a Post-Audit Cell under a Deputy Commissioner/Assistant Commissioner along with superintendents and inspectors may be created in Commissionerate Headquarters.

c. Post audit should be concluded within 03 months from the date of issuance of RFD-06 order and the findings shall be communicated to the review branch within the said time period of 03 months.

d. The review of refund order shall be completed at least 30 days before the expiry of the time limit for filing of appeal under section 107(2).

GST Portal Updates

Module wise new functionalities deployed on the GST Portal for taxpayers

Various new functionalities are implemented on the GST Portal, from time to time, for GST stakeholders. These functionalities pertain to different modules such as Registration, Returns, Advance Ruling, Payment, Refund and other miscellaneous topics. Various webinars are also conducted as well informational videos prepared on these functionalities and posted on GSTNs dedicated YouTube channel for the benefit of the stakeholders.

To view module wise functionalities deployed on the GST Portal and webinars conducted/ Videos posted on YouTube channel, refer to table below:

Portal update on 06.06.2022

Advisory for taxpayers not to Avail ITC on duplicate invoices appearing twice in GSTR2B

For some of the taxpayers, there was an issue in relation to duplicate entries in GSTR2B which has since been fixed and correct GSTR 2B has been generated. In this regard, taxpayers while filing GSTR3B are advised to check and ensure that the value of ITC they are availing is correct as per the law.

The correct ITC value can be checked from download of auto drafted ITC statement GSTR2B or System Generated GSTR3B or on the ITC observed on the mouse hover of Table 4 in GSTR3B,

particularly in any such case where there is any difference observed between the correct figures available at places as stated above and the prefilled GSTR3B observed on screen.

Portal update on 18.06.2022

Best Practices by States

The Tamil Nadu GST Department vide Circular No: 10/2022 dated June 07, 2022 has issued instructions regarding the identification and verification of bill traders in the newly applied cases for registrations under the Tamil Nadu Goods and Services Tax Act, 2017 ("the TNGST Act") referring to Notification No. 6/2022, dated June 07, 2022.

Under the Goods and Service Tax Acts, the registration process has been simplified as a part of ease of doing business and there is no mandatory requirement of pre-verification of business premises. Taking advantage of the same, many unscrupulous persons have taken multiple registrations to indulge in bill trading activities thereby causing loss of revenue to the State exchequer. In Tamil Nadu, the department has detected around 771 bill traders who were involved in such activities involving revenue of Rs. 1,648 crores and their registrations were cancelled, and action is being pursued on the beneficiaries.

The State's experience shows that the bill traders after getting registrations, issue invoices without supply of goods or services for huge amount within a short span of time. These activities come to the notice of the department only after the filing of return by the person on 20th day of the subsequent month and by that time, the person either disappears from the place or becomes non-existent, leaving behind no trail for follow up. Again, the bill traders come into system with different name and continue the same bill trading activity. The State government has vide Circular No: 10/2022 issued detailed instructions to be followed in cases of new registrations under the TNGST Act in order to strengthen the scrutiny of the new registration applications in a robust manner and to identify the bill traders at the entry level itself.

TNGST Rules 8 and 9 have been amended to implement the process of Aadhaar Authentication in new registration cases. The proviso (b) to rules 9(1) and 9(2) of the Tamil Nadu Goods and Services Tax Rules states that "provided that where the proper officer, with the approval of an officer authorised by the Commissioner not below the rank of Assistant Commissioner, deems it fit to carry out physical verification of places of business, the registration shall be granted within thirty days of submission of application, after physical verification of the place of business in the presence of the said person, in the manner provided under rule 25 and verification of such documents as the proper officer may deem fit."

The instructions mandate that the details provided in the application for new registration filed shall undergo the process of matching with the database against the following six parameters pertaining to cancelled registration.

i. Place of business,

ii. PAN,

iii. Mobile number,

iv. e-mail ID,

v. Authorized signatory and

vi. Bank account number.

If the details provided in application are found matching with any of the parameters relating to cancelled registration, the jurisdictional proper officer as mentioned in the Notification No. 6/2022 will undertake pre-verification of the business premises so as to deter the bill traders from applying for new registration.

The Notification mandates that the IT wing shall make available the above list to the proper officer of the base circle on a daily basis.