GOODS AND SERVICES TAX NETWORK

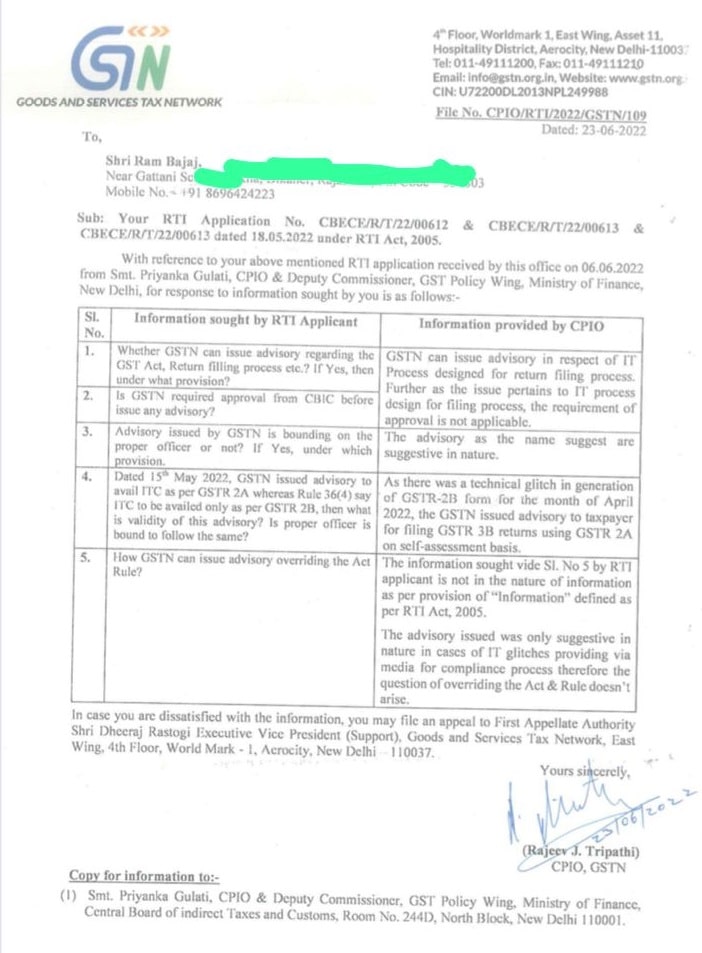

File No. CPIO/RTI/2022/GSTN/109

Dated: 23-06-2022

To,

Shri Ram Bajaj,

Sub: Your RTI Application No. CRECE/R/T/22/00612 and CBECE/R/T/22/00613 and CBECE/R/T/22/00613 dated 18.05.2022 under RTI Act, 2005.

With reference to your above mentioned RTI application received by this office on 06.06.2022 from Smt. Priyanka Gulati, CPIO & Deputy Commissioner, GST Policy Wing, Ministry of Finance, New Delhi, for response to information sought by you is as follows.-

SI. No. | Information sought by RTI Applicant | Information provided by CPIO |

| 1. | Whether GSTN can issue advisory regarding the GST Act Return filling process etc.? If Yes. then under what provision? | GSTN can issue advisory in respect of IT process designed for return filing process. Further as the issue pertains to IT process design for filing process, the requirement of approval is not applicable. |

| 2. | Is GSTN required approval from CBIC before issue any advisory? |

| 3. | Advisory issued by GSTIN is bounding on the proper officer or not? If Yes, under which provision. | The advisory as the name suggest are suggestive in nature. |

| 4. | Dated 15th May 2022, GSTN issued advisory to avail ITC as per GSTR 2A whereas Rule 36(4) say ITC to be availed only as per GSTR B, then what is validity of this advisory? Is proper officer is bound to follow the same? | As there was a technical glitch in generation of GSTR -2B form for the month of April 2022, the GSTN issued advisory to taxpayer for filing GSTR3B returns using GSTR 2A on self-assessment basis. |

| 5. | How GSTN can issue advisory overriding the Act Rule? | The information sought vide Sl. No 5 by RTI applicant is not in the nature of information ac per provision of "Information" defined as per RTI Act. 2005. The advisory issued was only suggestive in nature in cases of IT glitches providing via media for compliance process therefore the question of overriding the Act & Rule doesn't arise. |

In case you are dissatisfied with the information, you may file an appeal to First Appellate Authority Shri Dheeraj Rastogi Executive Vice President (Support). Goods and Services Tax Network, East Wing, 4th Floor. World Mark – I. Aerocity. New Delhi 110037.

Yours sincerely,

(Rajeev J. Tripathi)

CPIO,GSTN

Copy for information to:-

(1) Smt. Priyanka Gulati. CPIO & Deputy Commissioner, GST Policy Wing, Ministry of Finance, Central Board of indirect Taxes and Customs, Room No. 244D, North Block, New Delhi 110001.