Stating that the GST has become a nightmare for doing business in India, Congress leader Rahul Gandhi said on Friday that the saffron front turned his party's 'Genuine Simple Tax' into a 'Gabbar Singh Tax'.

Stating that the GST has become a nightmare for doing business in India, Congress leader Rahul Gandhi said on Friday that the saffron front turned his party's 'Genuine Simple Tax' into a 'Gabbar Singh Tax'.

"Congress' Genuine Simple Tax was turned into Gabbar Singh Tax by the BJP. Six rates, 1,000 plus changes in 1,826 days! Ease? It's a nightmare to do business, especially for MSMEs," Gandhi took to Twitter to say.

"Congress will revive business and jobs with GST 2.0 - single, low rate, shared fairly with States," he said using the hashtag #5YearsofGSTMess.

Stating that the GST has become a nightmare for doing business in India, Congress leader Rahul Gandhi said on Friday that the saffron front turned his party's 'Genuine Simple Tax' into a 'Gabbar Singh Tax'.

"Congress' Genuine Simple Tax was turned into Gabbar Singh Tax by the BJP. Six rates, 1,000 plus changes in 1,826 days! Ease? It's a nightmare to do business, especially for MSMEs," Gandhi took to Twitter to say.

"Congress will revive business and jobs with GST 2.0 - single, low rate, shared fairly with States," he said using the hashtag #5YearsofGSTMess.

Gandhi has on earlier occasions also dubbed the GST as "Gabbar Singh Tax" to allege it is harsh on businesses.

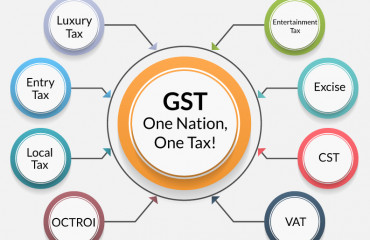

His latest remarks came as the Goods and Service Tax (GST) regime completes five years of implementation on 1 July.

Congress has been against the BJP-led NDA government's GST, saying it is "flawed" and has caused harm to the economy and the industry in the country.

Earlier in the day, Congress leader P Chidambaram said the GST "celebrates" its fifth birthday on Friday but there is nothing really to celebrate.

"The GST had serious birth defects. In the last five years these defects have only become worse and all those touched by GST have been seriously injured," the former finance minister said.

The Congress wishes to make it absolutely clear that the so-called GST that is in force today was not the GST envisaged by the UPA government, he said.

"The GST that we have today is a complex web of many rates, conditions, exceptions and exemptions that will leave even an informed taxpayer completely bewildered. Not all registered dealers are informed taxpayers; as a result, they are at the mercy of the tax-collector," he said.

A flawed GST has led to "large-scale destruction" of MSMEs, a sector that contributes up to 90 per cent of the jobs in the manufacturing sector, he said.

The worst consequence of the GST brought in by the government has been a complete breakdown of trust between the Centre and states, he said.

"As far as the Congress Party is concerned, we reject the current GST and, as promised in the Election Manifesto of 2019, we will work toward the replacement of the current GST by GST 2.0 that will be single, low-rate," Chidambaram said.