NEW DELHI : The goods and services tax collection remained over the ₹1.4 trillion mark for the third straight month in May, sustaining the robust revenue growth momentum in FY23, providing the Union government spending buffer to deal with inflationary pressures.

NEW DELHI : The goods and services tax collection remained over the ₹1.4 trillion mark for the third straight month in May, sustaining the robust revenue growth momentum in FY23, providing the Union government spending buffer to deal with inflationary pressures.

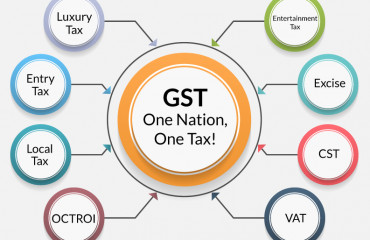

GST collections touched a three-month low of ₹1.41 trillion in May from a record high of ₹1.68 trillion in the previous month, according to the data released by the ministry of finance on Wednesday. It is the fourth time since GST's introduction that the collections have crossed the ₹1.4 trillion mark. Collections for May pertain to transactions done in April.

The robust tax collections were helped by strict enforcement and compliance measures. High inflation also contributed to collections with the transmission of elevated commodity prices to final products.

The GST mop-up in May is 44% higher than the collections of ₹97,821 crore the year earlier.

"The May 2022 GST collections are robust compared to the Q4 FY22 trends, benefitting from improved compliance, market share gains by the organized sector, as well as the transmission of higher commodity prices into output prices," said Aditi Nayar, chief economist, ICRA Ltd. "We expect the central GST (CGST) inflows in FY23 to exceed the budget estimate level by ₹1.15 trillion, helping to absorb a part of the higher subsidy bill," Nayar said.

High revenues provide the government with a cushion amid rising spending pressures to tame inflation. The government last week announced several measures to cool prices, including a cut in central excise duty on petrol by ₹8 per litre and on diesel by ₹6 per litre, costing the exchequer close to ₹1 trillion per year in revenue. Beneficiaries of the Ujjwala scheme will also get a ₹200 per cylinder subsidy on cooking gas, adding ₹6,100 crore to the Centre's subsidy bill. Besides, the government will also provide an additional fertilizer subsidy of ₹1.10 trillion to cushion farmers from the price rise further, taking the fertilizer bill to ₹2.15 trillion in FY23. The GST from import of goods rose 43% from a year earlier, while revenues from domestic transactions increased 44%.

"The collection in May, which pertains to the returns for April, the first month of the fiscal, has always been less than that in April, which pertains to the returns for March, the closing of the fiscal. However, it is encouraging to see that even in May, the gross GST revenues have crossed the ₹1.4 trillion mark," the ministry of finance said in the release.

The total number of e-way bills generated in April was 74 million, which is 4% less than 77 million e-way bills generated in March. E-way bill generation indicates supply in the economy.

"Significant efforts in audits and analytics have also led to a drive against tax evaders, inculcating a tax compliance culture. The reduction in collections compared with the previous months was expected as the collections for March, being the last month of the fiscal year, have always been more than other months of the year," said M.S. Mani, partner, Deloitte India.