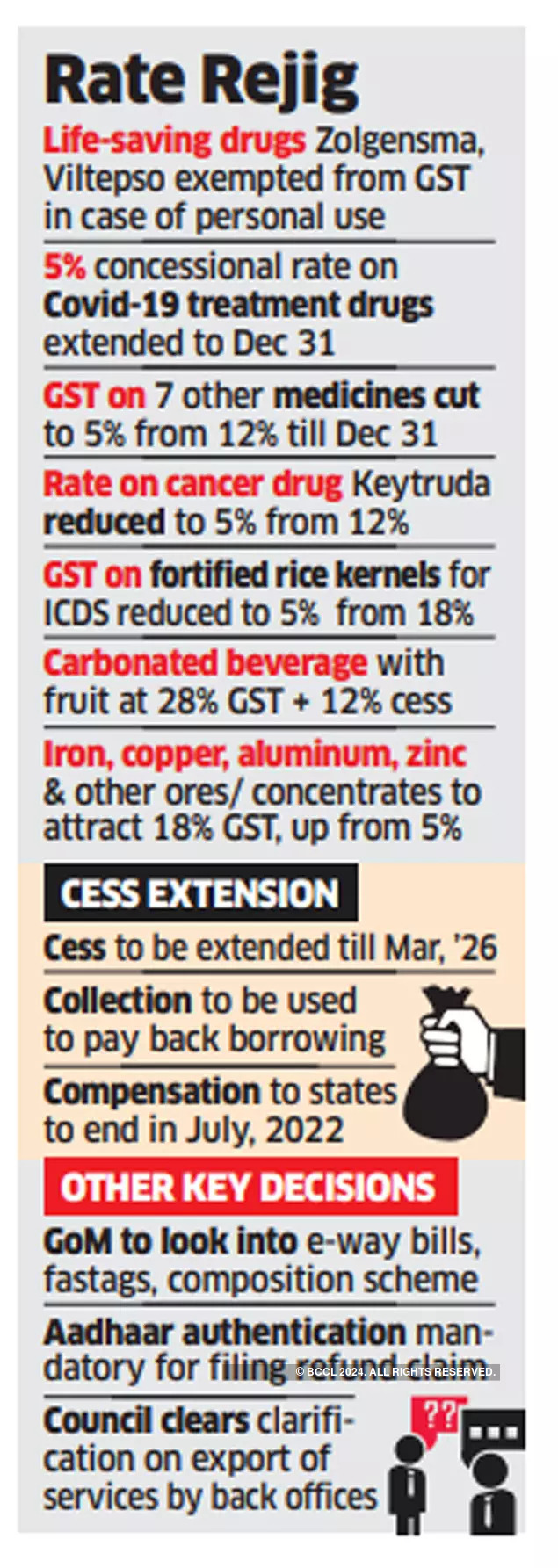

Finance minister Nirmala Sitharaman highlighted that the cess collected from July 2022 till March 2026 will be used solely for repayment of back-to-back loans given to states, totalling Rs 2.69 lakh crore.

The Goods and Service Tax (GST) Council decided against including auto fuels within its ambit following unanimous opposition from states, even as it specified that compensation period would not be extended beyond 2022.

Finance minister Nirmala Sitharaman highlighted that the cess collected from July 2022 till March 2026 will be used solely for repayment of back-to-back loans given to states, totalling Rs 2.69 lakh crore.

"Giving of compensation at 14% was for five years and that ends in July 2022," finance minister Nirmala Sitharaman said after the GST Council meeting on Friday.

"What is getting collected after July '22 is purely for paying that loan that was taken in order to pay the compensation between which was the Covid affected year, and extending till now, in order that the gap that couldn't be paid from our collections, had to be paid from borrowing," she said.

Experts said that the move will impact sectors on which cess is levied, primarily SUVs, tobacco products and cigarettes.

"The big decision to extend the period of GST Compensation Cess till March 2026 in order to service borrowed principal and interest will affect sectors suffering from such cess which expected relief after 5 years," said Santosh Dalvi, Partner and Deputy Head - Indirect Tax, KPMG.

"The extension of compensation cess levy upto March 2026 is expected to impact consumers as the same will be recovered from them," said Rajat Bose, Partner, Shardul Amarchand Mangaldas & Co.

Sitharaman added that a detailed presentation was made on revenue position, generation aspects and correction of inversion duty, since revenue neutral position of 15.5% at the time of introduction of GST had steadily come down to 11.6% due to rate reductions, which was not helping GST collections.

"The Council decided to set up a GoM (Group of Ministers) to examine the issue of correction of inverted duty structure for major sectors; rationalize the rates and review exemptions from the point of view of revenue augmentation, from GST," she said.

The Centre has told states that it would be difficult to continue with the compensation period beyond 2022, and instead suggested that measures to boost revenue through efficiency be considered instead, said people aware of the deliberations.

Petrol/ Diesel

The Council took up for discussion the issue of including auto fuels under GST, however several states opposed the proposition of inclusion, Sitharaman said, adding that the same would be reported to the Court.

Petrol and diesel are currently outside the purview of GST and attract central excise duty by the Centre and value added tax by states at varying rates. The GST Council Secretariat has asked the council to decide on the inclusion, following a Kerala High Court order.

"On the direction of the court it was brought on to the table for discussion… Members spoke very clearly that they wouldn't want it to be included in the GST," Sitharaman said.

"The GST Council felt that it wasn't the time for them to bring the petroleum products into the GST. So we shall report that to the court," she added.

Experts said that the indecision will affect petroleum industry and consumers with continual cascading of taxes, with consumers continuing to reel under record-high prices of petrol and diesel, which in some states had crossed Rs 100 per litre for petrol.

"As long as petroleum products remain outside the purview of GST, a large part of the economy continues to suffer from cascading effect. However, to bring it within GST's ambit, a large number of issues and constraint need to be resolved for an efficient outcome," said Bipin Sapra, partner at EY.

A separate Group of Ministers will be constituted on e-way bills, fastags, use of technology, compliances, plugging of loopholes, composition scheme.

Intermediary services

The Council will issue a circular to clarify the scope of intermediary services. The issue has been hanging fire since there is lack of clarity on whether back-office services BPO companies provide to foreign clients as exports is not liable for tax or whether it is an intermediary service to be charged 18% tax.

The clarity is crucial for the over $180-billion business process outsourcing (BPO) sector that operates on thin margins and faces competition from other low-cost markets such as the Philippines and Malaysia.

"We expect this to lay at rest a long pending issue for the BPM industry and ensure that BPM exports /RnD exports and IT services related exports will no longer be denied the export status by the enforcement authorities," industry body Nasscom said.

The Council said that subsidiaries or group companies - companies entities incorporate in India – will be treated as separate entities and be eligible for export status for exports to their foreign parent or group companies.

"This will settle the cloud of uncertainty for the GCC centres in India… The council's decision will provide a great impetus for the industry," said the industry body which has been advocating this issue for the last few years.

Supply of services between establishment of distinct persons from India to overseas is not entitled for the zero rated export status. In some States, the tax authorities have sought to deny export status for services provided by a subsidiary to parent transactions by treating a subsidiary to effectively be a branch.

"In this backdrop, the decision of the GST Council to issue a circular clarifying the scope of distinct establishment, is definitely an important and a much needed one. This should settle the ground level disputes which could have turned into unwarranted long drawn litigations," said Mahesh Jaising, Partner, Deloitte India.

Rate changes

The Council also decided to extend the concessional rate on some Covid treatment drugs and medicines till December 31 and lowered the rate from 12% to 5% on more drugs. It also changed tax rates for a bunch of products in order to correct inverted duty structure.

The Council decided that food delivery apps such as Zomato and Swiggy will pay tax on behalf of restaurants for services supplied through them. "There is no new tax," the finance minister said.

Amphotericin B and Tocilizumab have been exempted from GST and the reduced rate of 5% will be applicable on Remdesivir, anti-coagulants such as Heparin, and other drugs such as Itolizumab, Posaconazole, Infliximab, Bamlanivimab, Etesevimab, Casirivimab, Imdevimab, 2-Deoxy-D-Glucose and Favipiravir drugs till December 31.

The Council also reduced rate on Keytruda used for treatment of cancer to 5% from 12%.

Drugs Zolgensma and Romidepsin for personal use have been exempted, which are very expensive for consumers.

The Council approved a number of rate rationalisation recommendations made by the fitment committee for correcting inverted duty structure, including raising the GST on solar PV modules or renewable equipment to 12% from 5%, on diesel electric locomotives to 18% from 12% and copper concentrates and other metals to 18% from present 5%. All kinds of pens and their parts will be charged at 18%. The changes have been done to correct inverted duty structure, which will allow businesses to avail input tax credit.

The Council also decided to correct inverted duty structure on footwear and textiles, which will come into effect from January 1, 2022.

The Council approved reduction in GST on biodiesel to OMCs for blending with diesel to 5% from present 12%, on fortified rice for ICDS to 5% from 18%, on oncology medicine to 5% from 12%.

The supply of bricks will attract a higher rate of 12% from present 5%, from April 1, 2022, 28% GST and 12% compensation cess will be levied on carbonated beverage with fruit juice.

Transport of export goods by air vessels exempted till Sept 30, keeping in view of pandemic, exemption extended by one year, so that exporters do not suffer.

States charge national permit fee to operate throughout India has been exempted from GST. IGST has been exempted on import of aircraft or any other goods for leasing purposes. This will help aviation and domestic industry. The exemption will be allowed for those located in special economic zones.