Enforcement Authorities South Zone, CTD have raided the residential and business premises of a GST Auditor at Bangalore and Davanagere based on field intelligence, data analytics and Police FIR and busted a fake ITC case.

Enforcement Authorities South Zone, CTD have raided the residential and business premises of a GST Auditor at Bangalore and Davanagere based on field intelligence, data analytics and Police FIR and busted a fake ITC case.

The Auditor has collected money in the name of tax from more than 12 registered tax payers and the same was adjusted towards fraudulently claimed ITC amounting 10 crore there by causing revenue loss to the exchequer.

Enforcement authorities have recovered Rs. 5.31 crore so far and further investigation is under process. Tax payers are hereby advised to exercise due care and diligence while paying taxes through third person and utilize services of help desk and LGSTO's to safeguard themselves

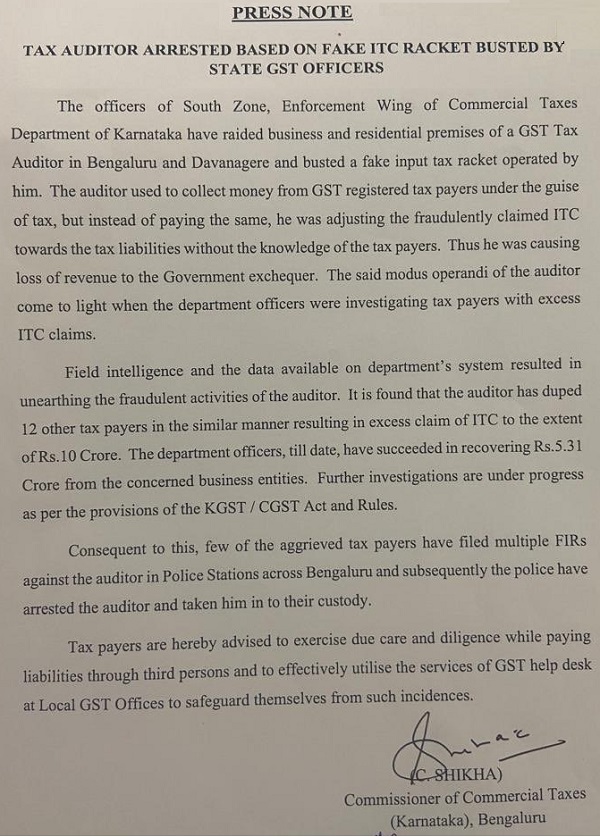

PRESS NOTE

TAX AUDITOR ARRESTED BASED ON FAKE ITC RACKET BUSTED BY STATE GST OFFICERS

The officers of South Zone, Enforcement Wing of Commercial Taxes Department of Karnataka have raided business and residential premises of a GST Tax Auditor in Bengaluru and Davanagere and busted a fake input tax racket operated by him. The auditor used to collect money from GST registered tax payers under the guise of tax, but instead of paying the same, he was adjusting the fraudulently claimed ITC towards the tax liabilities without the knowledge of the tax payers. Thus he was causing loss of revenue to the Government exchequer. The said modus operandi of the auditor come to light when the department officers were investigating tax payers with excess ITC claims.

Field intelligence and the data available on department's system resulted in unearthing the fraudulent activities of the auditor. It is found that the auditor has duped 12 other tax payers in the similar manner resulting in excess claim of ITC to the extent of Rs.10 Crore. The department officers, till date, have succeeded in recovering Rs.5.31 Crore from the concerned business entities. Further investigations are under progress as per the provisions of the KGST /CGST Act and Rules.

Consequent to this, few of the aggrieved tax payers have filed multiple FIRs against the auditor in Police Stations across Bengaluru and subsequently the police have arrested the auditor and taken him in to their custody.

Tax payers are hereby advised to exercise due care and diligence while paying liabilities through third persons and to effectively utilise the services of GST help desk at Local GST Offices to safeguard themselves from such incidences.

(C.SHIKHA)

Commissioner of Commercial Taxes

(Karnataka), Bengaluru