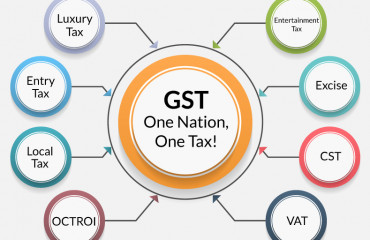

The government's goods and services tax (GST) collections, taken by analysts as a high-frequency indicator, has witnessed a strong rebound since the first wave of the pandemic. Mint takes a look at what is driving this revenue growth and its implications.

The government’s goods and services tax (GST) collections, taken by analysts as a high-frequency indicator, has witnessed a strong rebound since the first wave of the pandemic. Mint takes a look at what is driving this revenue growth and its implications.

The government's goods and services tax (GST) collections, taken by analysts as a high-frequency indicator, has witnessed a strong rebound since the first wave of the pandemic. Mint takes a look at what is driving this revenue growth and its implications.

What is the current GST collection trend?

In the first half of FY22 when the second covid-19 wave raged, GST collections were less severely impacted than the first wave, which had severely depressed revenues in the first half of FY21. For most of FY22, barring May and June, GST revenue receipts remained over ₹1 trillion as the curbs were local and less harsh. Revenue receipts saw a significant improvement in the latter half of FY22 as the economy recovered and the pent-up demand drove consumption. GST collection had remained above ₹1.3 trillion in six of the months in FY22. Figures for April, which represents sales that took place in March, show a record collection at ₹1.68 trillion.

What is the reason for a surge in collections?

According to the Centre, economic recovery and anti-evasion steps, especially in the case of those dealing in fake invoices, have been contributing to GST revenue buoyancy. The GST Council also took steps to resolve the issue of tax anomalies in sectors such as mobile phones and footwear that brought inefficiency into the tax system. Experts, however, have flagged the role of high commodity prices and inflation boosting revenue from the indirect tax levied as a percentage of the price. Also, a series of steps taken to scale up oversight of economic activity has led to improved return filing and tax payment compliance.

How has rising inflation impacted GST collection?

A surge in commodity prices has been supporting indirect tax receipts, according to experts. Retail inflation measured by the consumer price index (CPI) touched a 17-month high of 6.95% in March, while the wholesale price index (WPI)-based inflation has been in double digits all through FY22, with the figure at 14.55% in March.

Was there any change in tax compliance?

One major challenge that the tax sleuths have been grappling with is the gap between the actual sales, based on which the buyer claims tax credit, and what is reported to the government. The extensive use of technology and reporting requirements have made it difficult for material and service suppliers to keep their sales under wraps and pocket the taxes collected from the buyer. Thus, compliance by suppliers has significantly improved. In April, 10.6 million GSTR 3B returns were filed, up from 9.2 million returns a year ago.

What are the implications?

The growth in GST revenue collections is a relief to the central as well as state governments that badly need revenue buoyancy to finance economic recovery and provide public goods. Improved GST collection would mean states may be able to cope with the revenue gap that will arise when the GST compensation for the first five years of the 2017 indirect tax reform ends in June 2022. Also, the Centre may be able to plug any revenue gap arising from not meeting disinvestment targets.