THE MAHARASHTRA STATE GOVERNMENT BUDGET SPEECH PART II DATED 11TH MARCH, 2022 BY HONOURABLE DEPUTY CHIEF MINISTER (FINANCE) SHRI AJIT PAWAR

THE MAHARASHTRA STATE GOVERNMENT BUDGET SPEECH PART II DATED 11TH MARCH, 2022 BY HONOURABLE DEPUTY CHIEF MINISTER (FINANCE) SHRI AJIT PAWAR

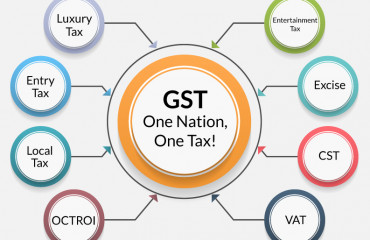

Speaker Sir, I now present Part II of the Budget before the House. 1. Tax revenue of the State, as per the revised estimates for the year 2021-22 is expected to be rupees two lakh seventy five thousand four hundred ninty eight crore. This includes revised estimates of rupees one lakh fifty five thousand three hundred seven crore on account of the Goods and Services Tax (GST), Value Added Tax (VAT), Central Sales Tax (CST), Profession Tax (PT) and other important taxes.

2. After Covid-19 Global Pandemic, the State Economy is now gearing up slowly. However, current Russia-Ukraine war is affecting international economy catastrophically, which will definitely affect agriculture, industry and service sector in our State. Hence, it will not be easy to achieve the revised estimates. Inspite of this, the Government will make sincere efforts to achieve the revised target in revenue collection.

3. To provide relief to the common citizen, the industry and business, I propose the following measures in various sectors :— Tax Concession Proposals :—

4. Amnesty Scheme for GST Department I propose Amnesty Scheme, for Goods and Services Tax Department. This Amnesty Scheme will be called as "Maharashtra Settlement of Arrears of Tax, Interest, Penalty or Late Fee Scheme-2022". This Scheme is applicable regarding concessions on various taxes levied by Sales Tax Department before introduction of GST Act and duration of this Amnesty Scheme will be from April 1, 2022 to September 30, 2022. Report this ad I am completely waiving off the arrears in cases where arrears are Rs. 10,000 or less per year as per any statutory order passed under the various tax laws implemented by the department. As a result small dealers will be benefited in almost one lakh cases by this relief. Dealers having arrears as on the 1st April 2022 up to Rs. 10 lakhs or less as raised in the statutory orders will have the option to pay a lump sum amount of 20 per cent of the total arrears instead of calculating the amounts payable on account of undisputed tax, disputed tax, interest, penalty as per the proportions provided in the Scheme. On payment of lump sum amount of 20%, waiver will be granted to the remaining 80 per cent of the arrears. As a result medium dealers will be benefited in almost two lakh and twenty thousand cases.

5. Reduction of VAT rate on Natural Gas Environment friendly Natural Gas is largely used for domestic piped gas and CNG powered motor vehicles, auto-rickshaws, taxis and private vehicles. It is proposed to reduce the rate of value added tax on natural gas from 13.5 percent to 3 percent to encourage the use of environment friendly natural gas and to provide relief to the citizens. As a result, the State may incure a revenue reduction of about rupees 800 Crore.

6. Increase in period for adjustment of stamp duty With the view to incentivize the construction business, time period in which stamp duty paid on earlier deed to be adjusted against subsequent deed, is increased from one year to three years as per the provision of article 5 (g-a) (ii) of Maharashtra Stamp Act.

7. Stamp Duty exemption on Gift deeds without consideration to corporations and institutions If any donor is transferring land without consideration to the corporations, local self-governing bodies under jurisdiction of State of Maharashtra free of cost, then current Stamp Duty of 3 percent on gift deed or 5 percent on sale deed is being fully exempted under Section 9 of the Maharashtra Stamp Act. As a result, the State may incure a revenue reduction of about rupees 21 Crore.

8. Stamp Duty Amnesty Scheme 2022 Amnesty Scheme under Stamp Act is proposed from 1st April 2022 to 30th November, 2022 for pending penalty dues. Due to this concession under Amnesty Scheme 2022, there will be shortfall of rupees 1500 Crores out of outstanding penalty dues.

9. Waiver of Stamp Duty on Gold and Silver imports To give impetus to the Gold and Silver jewellery industry, refineries and exports and to generate employment in the State and curb tax evasion, it is proposed to waive the current Stamp Duty of 0.1 percent levied under the Maharashtra Stamp Act on gold-silver delivery order documents imported into the State of Maharashtra. Due to the above tax concession, there will be revenue shortfall of around rupees 100 Crores.

10. Relief on taxes levied by Maharashtra Maritime Board In order to promote water transport in the State, the tax levied by the Maharashtra Maritime Board on passengers as well as pets, vehicles, goods etc. travelling by ferries and Ro-Ro boats operating on newly launched waterways from 1st January, 2022 under the jurisdiction of the Maharashtra Maritime Board, is being waived for three years.