Editor2 26 Mar 2024 141 Views 0 comment Goods and Services Tax | News

Introduction: The Goods and Services Tax (GST) Council convened its first National Conference of Enforcement Chiefs in New Delhi, marking a significant step in enhancing tax compliance and combating evasion. Led by the Hon’ble Union Minister for Finance and Corporate Affairs, the conference showcased notable achievements, including substantial strides in detecting tax evasion and fostering collaboration among tax authorities. This article delves into the key highlights and outcomes of the conference, shedding light on the evolving landscape of GST enforcement in India.

Introduction: The Goods and Services Tax (GST) Council convened its first National Conference of Enforcement Chiefs in New Delhi, marking a significant step in enhancing tax compliance and combating evasion. Led by the Hon'ble Union Minister for Finance and Corporate Affairs, the conference showcased notable achievements, including substantial strides in detecting tax evasion and fostering collaboration among tax authorities. This article delves into the key highlights and outcomes of the conference, shedding light on the evolving landscape of GST enforcement in India.

Detailed Analysis: The conference provided a platform for tax authorities to share insights and strategies in combating tax evasion effectively. Noteworthy achievements were highlighted, such as the detection of significant instances of Input Tax Credit (ITC) tax evasion, totaling billions of rupees, emphasizing the pressing need for stringent enforcement measures.

Thematic sessions explored various facets of GST evasion, underscoring the importance of leveraging technology and fostering collaboration to prevent fraudulent activities. Emphasis was placed on adopting a taxpayer-friendly approach, prioritizing evidence-based inquiries, and utilizing analytical tools to detect risky taxpayers.

Furthermore, the conference emphasized the exchange of experiences between States and the Central Government, emphasizing the pivotal role of technology in enhancing taxpayer services and rectifying system loopholes. Insights into proactive measures for early detection of potential evaders were shared, reflecting a concerted effort towards bolstering GST compliance nationwide.

The article also discusses the robust growth in GST revenue, reflecting a positive trajectory in fiscal performance. Breakdowns of revenue collections and inter-governmental settlements provide comprehensive insights into revenue trends, underlining the efficacy of GST in revenue generation.

Moreover, the article addresses concerns regarding fraudulent activities, such as fake summons for GST violations, and outlines measures undertaken by authorities to combat such malpractices. Cautionary measures and advisory notifications aim to educate taxpayers and mitigate the risks associated with fraudulent communications.

Conclusion: In conclusion, the GST Council conference signifies a significant milestone in strengthening tax enforcement mechanisms and fostering collaboration among stakeholders. The strides made in combating tax evasion, coupled with robust revenue growth, underscore the resilience of India's GST regime. However, challenges persist, particularly in mitigating fraudulent activities, necessitating ongoing vigilance and proactive measures. By prioritizing collaboration, leveraging technology, and maintaining a taxpayer-centric approach, the GST Council remains poised to navigate challenges effectively and sustainably drive India's economic growth trajectory.

*****

Goods and Services Tax Council

MESSAGE

The first-ever National Conference of Enforcement Chiefs of the State and the Central GST Formations was held in New Delhi on 4th of March, 2024. It was inaugurated by the Hon'ble Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman. This event provided one more step towards facilitating understanding and streamlining operations of the tax authorities in enforcement actions undertaken by different indirect tax authorities.

It showcased significant strides in combatting tax evasion across India. Notable achievements include the detection of ITC tax evasion amounting to Rs. 49,623 crore from fake registrations and bogus billing since mid-May 2023, and Rs. 1,14,755 crore from 2020 onwards. Thematic sessions explored various aspects of GST evasion and strategies for collaboration and utilizing technology to prevent fraudulent activities.

Insights on effective deterrent measures taken for menace of fake invoicing, and its associated issues like money laundering, identity theft, and circular trading were also shared. Emphasis was placed on adopting a taxpayer-friendly approach to enforcement focusing on avoiding unnecessary audits on issues involving prevalent trade practices and prioritising evidence-based inquiries. It was outlined that analytical tools are available to the tax officers to detect risky taxpayers and combat GST evasion. The conference also emphasized the importance of proactive measures for early detection of potential evaders.

The conference facilitated the exchange of experiences and knowledge transfer between States and the Central Government. It underscored the vital importance of leveraging technology to improve taxpayer services and rectify system loopholes. Emphasis was placed on sharing emerging best practices and ensuring smooth coordination among GST formations nationwide.

Lastly, the net GST revenue for the current fiscal year, after refunds, stands at tl 6.36 lakh crore, showing a growth of 13% over the same period last year, indicating continued growth momentum and positive performance in GST revenue.

Happy Holi to all our readers!

Pankaj Kumar Singh,

Additional Secretary

GST Revenue Collection

₹1,68,337 crore gross GST revenue collected during February 2024; records Year-on-Year (Y-o-Y) growth of 12.5%

Gross Goods and Services Tax (GST) revenue collected for February, 2024 is ₹1,68,337 crore, marking a robust 12.5% increase compared to that in the same month in 2023. This growth was driven by a 13.9% rise in GST from domestic transactions and 8.5% increase in GST from import of goods. GST revenue net of refunds for February, 2024 is ₹1.51 lakh crore which is a growth of 13.6% over that for the same period last year.

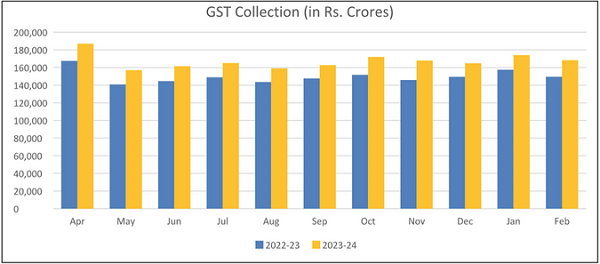

Strong Consistent Performance in FY 2023-24: As of February 2024, the total gross GST collection for the current fiscal year stands at ₹18.40 lakh crore, which is 11.7% higher than the collection for the same period in FY 2022-23. The average monthly gross collection for FY 2023-24 is ₹1.67 lakh crore, exceeding the ₹1.5 lakh crore collected in the previous year's corresponding period. GST revenue net of refunds as of February, 2024 for the current fiscal year is ₹16.36 lakh crore which is a growth of 13 % over that for the same period last year. Overall, the GST revenue figures demonstrate continued growth momentum and positive performance.

Breakdown of February 2024 Collections:

- Central Goods and Services Tax (CGST): ₹31,785 crore

- State Goods and Services Tax (SGST): ₹39,615 crore

- Integrated Goods and Services Tax (IGST): ₹84,098 crore, including ₹38,593 crore collected on imported goods

- Cess: ₹12,839 crore, including ₹984 crore collected on imported goods

Inter-Governmental Settlement: The Central Government settled ₹41,856 crore to CGST and ₹35,953 crore to SGST from the IGST collected. This translates to a total revenue of ₹73,641 crore for CGST and ₹75,569 crore for SGST after regular settlement.

The chart below shows trends in monthly gross GST revenues during the current year.

Chart: Trends in GST Collection

Source: PIB Press Release dated 01.03.2024

Caution against fake and fraudulent summons for GST violations

The Directorate General of GST Intelligence (DGGI), Central Board of Indirect Taxes and Customs (CBIC) has recently noticed that some individuals with fraudulent intent are creating and sending fake summons to the taxpayers who may or may not be under investigation by the DGGI. The fake summons that are being sent out might look real because they have a Document Identification Number (DIN), but these DIN numbers are not issued by DGGI in the case of these entities. To deal with this issue, DGGI has been taking serious steps by informing and filing complaint with the Police against those involved in creating and sending fake and fraudulent summons CBIC has issued Circular No. 122/41/2019-GST dated 05th November 2019 regarding generation and quoting of DIN on communications sent by CBIC officers to taxpayers. For the awareness of the taxpayers, it is reminded that taxpayers can verify the genuineness of any communication (including Summons) from the Department by using the 'VERIFY CBIC-DIN' window on the CBIC's website or the DIN Utility Search on the online portal of Directorate of Data Management (DDM), CBIC.

Individual taxpayers who get summons from DGGI/CBIC formations that seem suspicious or possibly fake are advised to immediately report them to concerned jurisdictional DGGI/ CBIC office also for verification, so that necessary action against those responsible for these fraudulent activities can be taken.

Source: PIB Press Release dated 07.01.2024

Notifications

> Notification No. 06/2024 – Central Tax dated 22.02.2024 seeks to notify "Public Tech Platform for Frictionless Credit" as the system with which information may be shared by the common portal based on consent under sub-section (2) of Section 158A of the Central Goods and Services Tax Act, 2017.

The Central Government vide the said Notification notified "Public Tech Platform for Frictionless Credit" as the system with which information may be shared by the common portal based on consent under sub-section (2) of Section 158A of the CGST Act, 2017.

The said Notification also defines "Public Tech Platform for Frictionless Credit" which means 'an enterprise-grade open architecture information technology platform, conceptualised by the Reserve Bank of India as part of its "Statement on Developmental and Regulatory Policies" dated the 10th August, 2023 and developed by its wholly owned subsidiary, Reserve Bank Innovation Hub, for the operations of a large ecosystem of credit, to ensure access of information from various data sources digitally and where the financial service providers and multiple data service providers converge on the platform using standard and protocol driven architecture, open and shared Application Programming Interface (API) framework.'

Section 158A has been introduced in the CGST Act vide the Finance Act, 2023. This section enables the consent-based sharing of information provided by a taxable person. It allows the common portal to share specific details furnished by a registered person with other systems as notified by the government, subject to fulfilment of prescribed conditions.

GST Portal Updates

Advisory: Enhanced E-Invoicing Initiatives & Launch of Enhanced https://einvoice.gst.gov.in portal

GSTN has revamped e-invoice master information portal https://einvoice.gst.gov.in. This enhancement is part of ongoing effort to further improve taxpayer services. New Features of the revamped E-Invoice Master Information Portal are as follows:.

i. PAN-Based Search: Users can check the e-invoice enablement status of entities using their Permanent Account Number (PAN) in addition to search with GSTIN.

ii. Automatic E-invoice exemption List: The portal now automatically publish updated list with all GSTINs that have filed for e-invoice exemptions at the start of the month and is available for users to download.

iii. Global Search Bar: A comprehensive search tab has been introduced that allows for quick access to the information across the portal.

iv. Local Search Capabilities: Enhanced search functionality within advisory, FAQ, manual, and other sections for efficient information access.

v. Revamped Advisory and FAQ Section: Now organized year-wise and month-wise for easier reference, offering comprehensive guidance.

vi. Daily IRN Count Statistics: The portal now includes statistics on the daily Invoice Reference Number (IRN) generation count.

vii. Dedicated Section on Mobile App: Information and support for the e-invoice QR Code Verifier app are readily available.

viii. Improved Accessibility Compliance and UI/UX: Adhering to the GIGW guidelines, the portal now offers improved features such as contrast adjustment, text resizing buttons, and screen reader support for enhanced accessibility.

ix. Updated Website Policy: The website policy has been thoroughly updated including the website archival policy, content management & moderation policy, and web information manager details.

Please click here for the complete advisory

Portal update on 21.02.2024

Instances of Delay in registration reported by some Taxpayers despite successful Aadhar Authentication in accordance with Rule 8 and 9 CGST, Rules, 2017

In accordance with Rule 9 of the Central Goods and Services Tax (CGST) Rules, 2017, pertaining to the verification and approval of registration applications, following is informed by GSTN:

Where a person has undergone Aadhaar authentication as per sub-rule (4A) of rule 8 but has been identified in terms of Rule 9(aa) by the common portal for detailed verification based on risk profile, the application for registration would be processed within thirty days of application submission.

Necessary changes would also be made to reflect the same in the online tracking module vis-à-vis processing of registration application.

> New GST Bhavan and Residential Quarters, Hyderabad foundation laid by the Revenue Secretary

Sh. Sanjay Malhotra, Revenue Secretary virtually laid the foundation stone for "New GST Bhavan and Residential Quarters, Hyderabad" today in presence of Members of the Board, DG, DGHRD (I&W/EMC), Chief Commissioner, Hyderabad Zone and officers of CBIC and the zone. Major features of New GST Bhavan, Hyderabad are:

- Largest office construction project of CBIC

- Tallest building ever by CBIC

Legal Corner

> Lex specialis derogat legi generali

'Lex specialis derogat legi generali' is a latin term which essentially means that more specific rules will prevail over more general rules. The maxim is generally accepted as constituting a general principle of law. It entails that, when two norms apply to the same subject matter, that which is more specific should prevail and be given priority over the more general rule.

Rationale of the principle: That special law has priority over general law is justified by the fact that such special law, being more concrete, often takes better account of the particular features of the context in which it is to be applied than any applicable general law. Its application may also often create a more equitable result and it may often better reflect the intent of the legal subjects.

The effect of lex specialis on general law: The application of the special law does not normally extinguish the relevant general law. That general law will remain valid and applicable and will, in accordance with the

principle of harmonization, continue to give direction for the interpretation and application of the relevant special law and will become fully applicable in situations not provided for by the latter.

Particular types of general law: Certain types of general law may not, however, be derogated from by special law. Moreover, there are other considerations that may provide a reason for concluding that a general law would prevail in which case the lex specialis presumption may not apply. These include the following:

- Whether such prevalence may be inferred from the form or the nature of the general law or intent of the parties, wherever applicable;

- Whether the application of the special law might frustrate the purpose of the general law;

- Whether third party beneficiaries may be negatively affected by the special law; and

- Whether the balance of rights and obligations, established in the general law would be negatively affected by the special law.

Upholding this principle helps maintain coherence and consistency within the legal system by avoiding contradictory interpretations. If a general law were to override a specific law in every case, it could undermine the purpose and effectiveness of the specific law, leading to confusion and inconsistency. When courts encounter conflicts between specific and general laws, they will typically apply the principle of lex specialis derogat legi generali to resolve the conflict. Courts will analyze the language, context, and legislative history of the laws involved to determine whether the specific law was intended to prevail in the particular circumstances at hand.