Introduction: In 2023, significant amendments were introduced to the Central Goods and Services Tax (GST) Rules, bringing about important changes and clarifications in the GST framework. These changes were aimed at streamlining the taxation system and enhancing compliance while aligning with the decisions of the GST Council. In this article, we will delve into the key updates resulting from these amendments.

Introduction: In 2023, significant amendments were introduced to the Central Goods and Services Tax (GST) Rules, bringing about important changes and clarifications in the GST framework. These changes were aimed at streamlining the taxation system and enhancing compliance while aligning with the decisions of the GST Council. In this article, we will delve into the key updates resulting from these amendments.

1. Uniform Taxation Framework: One of the primary objectives of the 2023 amendments to the GST Rules was to establish a more uniform taxation framework across various sectors. This move aimed to simplify compliance for taxpayers and provide greater clarity to stakeholders.

2. IGST Act Amendments: To ensure that online money gaming from foreign suppliers to domestic customers is subject to GST, the government inserted specific provisions in the Integrated Goods and Services Tax (IGST) Act, 2017. These provisions also include measures for blocking access to information in case of non-compliance. This step ensures a level playing field for domestic and foreign suppliers in this sector.

3. States' Implementation: The states are actively working to implement these changes, ensuring uniformity and consistency in GST regulations across the nation. This is a crucial step in promoting compliance and streamlining the taxation process.

4. Mera Bill Mera Adhikaar Scheme: This scheme, launched as a pilot project in select regions, gained significant attention and participation from government officials. It encourages consumers to demand GST invoices for their purchases, fostering transparency and accountability in commercial transactions.

5. Exemption of RCM on Ocean Freight: The 2023 amendments also exempted the applicability of Reverse Charge Mechanism (RCM) on ocean freight under specific circumstances, providing relief to certain businesses engaged in imports.

6. 6-Digit HSN in E-invoices: The implementation of the 6-digit Harmonized System of Nomenclature (HSN) in e-invoices and e-way bills has been deferred, giving businesses more time to adapt to this change.

7. Composition Scheme: Another noteworthy change is the extension of the benefit of the composition scheme to registered persons engaged in supplying goods through an E-commerce Operator (ECO), aligning with the government's commitment to support small businesses.

8. Revenue Growth: The consistent growth in GST revenue is a testament to the effectiveness of the GST framework. This growth has benefitted both consumers and state governments, contributing to economic stability.

Conclusion: The 2023 amendments to the Central Goods and Services Tax Rules represent a significant step towards enhancing the GST framework in India. By promoting uniformity, compliance, and transparency, these changes aim to simplify the taxation process and foster a more conducive environment for businesses to thrive. The Mera Bill Mera Adhikaar Scheme, in particular, underscores the government's commitment to empowering consumers and promoting honest business practices in the country. As the GST system continues to evolve, these amendments are expected to have a positive impact on India's economy and taxation landscape.

*****

GST Council

MESSAGE

The Government notified the Central Goods and Services Tax (Third Amendments) Rules, 2023 which have been operationalized w.e.f October 1st, 2023. The recent amendments to the GST laws aim to offer a uniform taxation framework for these sectors and provide clarity for the benefit of the stakeholders. This legislative action aligns with the decision made by the Goods and Services Tax (GST) Council during its 51st meeting on August 2nd, 2023. To ensure compliance, the Government has also notified Integrated Goods and Services Tax (Amendment) Rules, 2023 inserting specific provisions in the IGST Act, 2017 which deals with the liability to pay GST on the supply of online money gaming from foreign suppliers to domestic customers, along with measures for blocking access to any related information in case of non-compliance. The States are also in the process of implementing it soon.

In the past month, the newly launched Mera Bill Mera Adhikaar Scheme gained significant attention. It commenced as a pilot project in Assam, Haryana, Gujarat, and the Union Territories of Dadra & Nagar Haveli, Puducherry, and Daman & Diu. In order to provide further impetus to the said Scheme, the Deputy Chief Minister of Haryana accompanied by Revenue Secretary and other officials personally participated by uploading a bill from a Gurugram's grocery shop. Other states have also made noteworthy contributions: Puducherry's Chief Minister launched the scheme, Assam's Chief Minister informed citizens about its key features, and Gujarat's Finance Minister flagged it in Vapi.

The Government excluded the applicability of RCM on ocean freight on goods imported under certain circumstances w.e.f 01.10.2023. Additionally, the implementation of the 6-digit HSN in e-invoices and e-way bills has been deferred. The earlier notified specific conditions for exemption from obtaining registration, in the case of persons making supplies of goods through ECOs provided they have taken enrolment based number would also come into action w.e.f 01.10.2023. Similarly, the benefit of composition scheme which was earlier not eligible to the registered person engaged in supplying goods through an ECO shall now be extended to them and put into action as of the same date, alongside other updates highlighted in this newsletter.

GST has been consistently witnessing a commendable boost in revenue buoyancy, benefiting both ordinary consumers and state governments alike. This enduring surge in revenue within the GST framework exemplifies its effectiveness.

Pankaj Kumar Singh

Additional Secretary

GST Revenue Collection

₹1,62,712 crore gross GST revenue collected during September, 2023; records 10% Year-on-Year growth

The gross GST revenue collected in the month of September, 2023 is ₹1,62,712 crore out of which CGST is ₹29,818 crore, SGST is ₹37,657 crore, IGST is ₹83,623 crore (including ₹41,145 crore collected on import of goods) and cess is ₹11,613 crore (including ₹881 crore collected on import of goods).

The Government has settled ₹33,736 crore to CGST and ₹27,578 crore to SGST from IGST. The total revenue of Centre and the States in the month of September, 2023 after regular settlement is ₹63,555 crore for CGST and ₹65,235 crore for the SGST.

The revenues for the month of September, 2023 are 10% higher than the GST revenues in the same month last year. During the month, the revenues from domestic transactions (including import of services) are 14% higher than the revenues from these sources during the same month last year. It is for the fourth time that the gross GST collection has crossed ₹1.60 lakh crore mark in FY 2023-24.

The gross GST collection for the first half of the FY 2023-24 ending September, 2023 [₹9,92,508 crore] is 11% higher than the gross GST collection in the first half of FY 2022-23 [₹8,93,334 crore]. The average monthly gross collection in FY 2023-24 is ₹1.65 lakh crore, which is 11% higher than average monthly gross collection for first half of FY 2022-23 where it was ₹1.49 lakh crore.

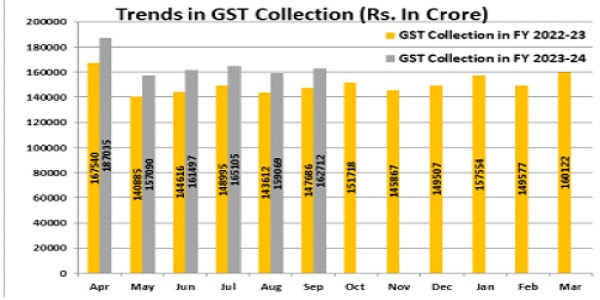

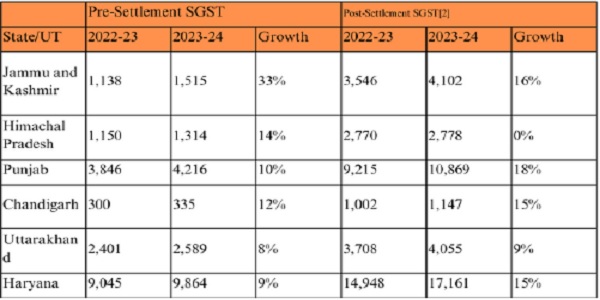

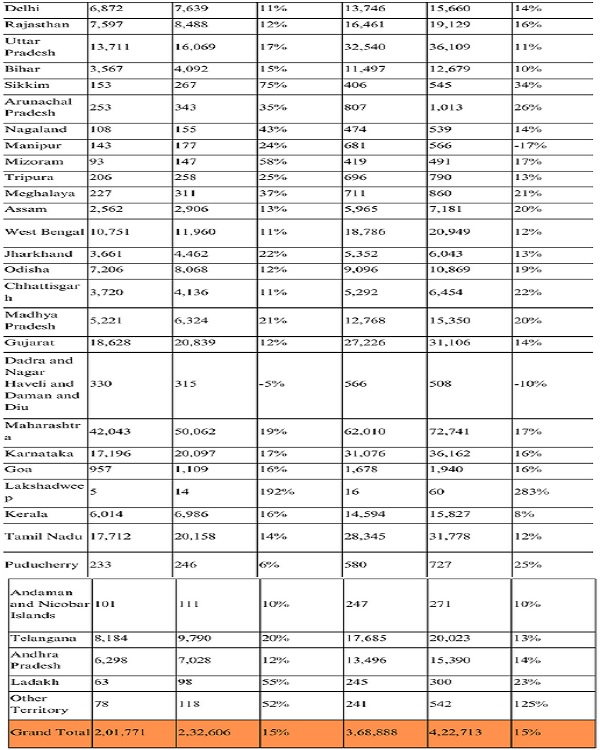

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of post settlement GST revenue of each State till the month of September 2023.

Chart: Trends in GST Collection

Table 1: SGST & SGST portion of IGST settled to States/UTs April-September (Rs. in crore)

Mera Bill Mera Adhikar Campaign in Gurugram

More than 1.51 lakh downloads of Mera Bill Mera Adhikaar app with active participation of consumers in pilot scheme as on 01.09.2023. A system of awards launched for customers to popularise the Scheme

In order to encourage the culture of generation of GST invoice/bills on payments, Hon'ble Deputy Chief Minister of Haryana, Shri Dushyant Chautala, participated in the Mera Bill Mera Adhikaar campaign in presence of Shri Sanjay Malhotra, Secretary, Department of Revenue (DoR), Government of India; and Shri Sanjay Aggarwal, Chairman, Central Board of Indirect Taxes and Customs (CBIC) in Gurugram on 01.09.2023.

Hon'ble Deputy Chief Minister of Haryana, Shri Dushyant Chautala, along with senior officials of the DoR, visited a marketplace in Gurugram to encourage customers to demand a GST invoice on their purchases.

The Mera Bill Mera Adhikaar scheme became active from 12.00 AM on 1st September 2023 and has already gathered pace with more than 1.51 lakh downloads of the app with consumers actively participating in the pilot scheme.

On the occasion, Hon'ble Deputy Chief Minister of Haryana, Shri Dushyant Chautala said, "I laud the GSTN for starting this new initiative from Gurugram in an effort towards making taxation more rewarding for the taxpayers. This scheme will encourage the citizens to ask for the invoice/bills after payment. This will also ensure that the taxpayer's money reaches its desired destination in the Government."

Informing about the details of the scheme, Hon'ble Deputy Chief Minister of Haryana, Shri Dushyant Chautala said, "A corpus of Rs. 30 crore has been made available towards the fund under this initiative on an annual basis. Every Quarter of year, there will be 2 awards worth Rs. 1 crore each, which translates to 8 awards of Rs. 1 crore in a year, will be given to the winners through draw of lots. Every month, there will be 10 awards of Rs. 1 lakh each, and 800 awards of Rs. 10,000 each."

Concluding his address, Hon'ble Deputy Chief Minister of Haryana, Shri Dushyant Chautala appealed to all the businessmen to encourage customers to take their invoice/bill at the time of purchase and participate in the Mera Bill Mera Adhikaar scheme and make it a big success in Haryana.

In his address on the occasion, Shri Sanjay Malhotra, Secretary, DoR, said, "The main purpose of this scheme is to encourage customers to use their right to demand for an invoice/bill. This will ensure that they will participate in the Mera Bill Mera Adhikaar scheme and also induce them to use bills for other purposes related to the product."

"We started this scheme on a pilot basis in 3 States and 2 Union Territories and going forward we'll implement this scheme across India on the basis of the outcomes and learnings from this pilot scheme," Shri Malhotra said.

Shri Sanjay Aggarwal, Chairman, CBIC, and Shri Shashank Priya, Member, CBIC, also made purchases in the marketplace and received their GST bills to participate in the Mera Bill Mera Adhikaar scheme.

Mera Bill Mera Adhikaar Scheme shows the commitment of the Government of India to empower the consumer as it is designed to encourage consumers to demand bills for their purchases from vendors, thereby protecting their rights and promoting transparency in commercial transactions.

This Scheme is built on a foundation of incentives and awareness campaigns, with a multi-pronged approach towards transforming consumer behaviour and fostering accountability among sellers. By facilitating consumers in obtaining and recording their bills, the government is actively involving citizens in combating tax evasion and promoting honest business practices.

On the occasion, Smt. Renu K. Jagdev, DG, Directorate General of Taxpayer Services (DGTS); Shri Upender Gupta, Chief Commissioner, CGST, Panchkula Zone; Shri D. S. Kalyan, Principal Secretary, Excise & Taxation Haryana, and other senior officials of Ministry of Finance, Government of India, and Government of Haryana were present.

All B2C invoices issued by GST registered suppliers (registered in the States of Assam, Gujarat & Haryana and UTs of Puducherry, Dadra Nagar Haveli and Daman & Diu) to consumers will be eligible for the scheme. Minimum value for invoices to be considered for a lucky draw has been kept at Rs. 200.

Source: PIB Press Release dated 01.09.2023

Notifications

> Notification No. 45/2023 – Central Tax dated 06.09.2023, issued to make amendments (Third Amendment, 2023) to the CGST Rules, 2017

The Central Government vide the said Notification has inserted two new rules to the CGST Rules, 2017 namely Rule 31B which deals with the value of supply of online gaming, including supply of actionable claims involved in online money gaming and Rule 31C is related to the value of supply of actionable claims in casino.

> Notification No. 46/2023 – Central Tax dated 18.09.2023, issued to appoint common adjudicating authority in respect of show cause notice issued in favour of M/s Inkuat Infrasol Pvt. Ltd

The Central Government vide the said Notification appoints Joint or Additional Commissioner, CGST and Central Excise Thane Commissionerate [holding the charge of adjudication of DGGI cases] to act as the Authority to exercise the powers and discharge the duties conferred or imposed on Joint or Additional Commissioner, CGST and Central Excise Bhiwandi Commissionerate in respect of noticee M/s Inkuat Infrasol Pvt. Ltd., 1stFloor, H.No. 2067/8, Flat No. 101, E-Wing, Roopkamal Plaza, opp. Rajlaxmi kalher Thane, Bhiwandi, Thane- 421302 for the purpose of adjudication of notice 39/PK/Inkuat/2021-22 dated 25.03.2022.

> Notification No. 47/2023 – Central Tax dated 25.09.2023, issued to amend Notification No. 30/2023-CT dated 31.07.2023

The Central Government vide the said Notification has provided that the special procedure notified vide Notification No. 30/2023-CT dated 31.07.2023 for all the registered persons engaged in manufacturing of Pan Masala & Tobacco products shall be effective from 01.01.2024.

> Notification No. 48/2023 – Central Tax dated 29.09.2023 and Notification No. 02/2023 – Integrated Tax dated 29.09.2023, issued to notify the provisions of the Central Goods and Services Tax (Amendment) Act, 2023 and Integrated Goods and Services Tax (Amendment) Act, 2023 respectively

The Central Government vide the said Notifications has notified 01.10.2023 as the date on which the provisions of the said Central Goods and Services Tax (Third Amendments) Rules, 2023 and Integrated Goods and Services Tax (Amendment) Act, 2023 shall come into force. The Acts are regarding various aspects related to online gaming, race courses and casino, including definition of online gaming, specified actionable claims.

> Notification No. 49/2023 – Central Tax dated 29.09.2023, issued to notify supply of online money gaming, supply of online gaming other than online money gaming and supply of actionable claims in casinos under section 15(5) of CGST Act

The Central Government vide the said Notification on the recommendations of the Council, notified the following supplies under the said sub-section, namely:—

(i) supply of online money gaming;

(ii) supply of online gaming, other than online money gaming; and

(iii) supply of actionable claims in casinos

The notification shall come into force on the 1st day of October, 2023.

> Notification No. 50/2023 – Central Tax dated 29.09.2023, issued to amend Notification No. 66/2017-Central Tax dated 15.11.2017 to exclude specified actionable claims

The Central Government vide the said Notification has provided that the time of supply for specified actionable claims such as online money gaming would be earlier of the date of issue of invoice or the date on which supplier receives the payment.

> Notification No. 51/2023 – Central Tax dated 29.09.2023, issued to make amendments (Third Amendment, 2023) to the CGST Rules, 2017 in supersession of Notification No. 45/2023 dated 06.09.2023

The Central Government vide the said Notification made amendments (Third Amendment, 2023) to the CGST Rules, 2017 in the following

Rules:

(i) Amendment in Rule 8: Rule 8 of the CGST Rules, 2017, is amended to include person supplying online money gaming from a place outside India to a person in India referred to in section 14A under the Integrated Goods and Services Tax Act, 2017 in the list of persons which are not required to declare their Permanent Account Number (PAN) and State or Union Territory in Part A of FORM GST REG-01 on the common portal, either directly or through a Facilitation Centre notified by the Commissioner, before applying for registration.

(ii) Amendment in Rule 14: Rule 14 is amended to include persons supplying online money gaming from outside India to a person in India within the scope of this rule.

(iii) New Rules 31B and 31C: Rules 31B and 31C are introduced, specifying the valuation methods for online gaming including online money gaming and actionable claims in case of casinos, respectively.

(iv) Amendment in Rule 46: Rule 46 clause (f), in the proviso, after the words "Provided that" the words "in cases involving supply of online money gaming or in cases" shall be inserted.

(v) Amendment in Rule 64: Rule 64 now states that the every registered person either providing online money gaming from a place outside India to a person in India, or providing OIDAR services from a place outside India to a non-taxable online recipient referred to in section 14 of the IGST Act, 2017 or to a registered person other than a non-taxable online recipient, shall file return in FORM GSTR-5A on or before the twentieth day of the month succeeding the calendar month or part thereof.

(vi) Amendment in Rule 87: Rule 87 is amended to include person supplying online money gaming from outside India to a person in India as referred to in Section 14A.

(vii) Changes in Form GST REG-10: Form GST REG-10 is revised to accommodate applications for registration of persons supplying online money gaming from outside India to a person in India.

> Notification No. 11/2023 – Central Tax (Rate), Notification No. 14/2023 – Integrated Tax (Rate) and Notification No. 11/2023 – Union Territory Tax (Rate) dated 29.09.2023, issued to amend Notification No. 01/2017- Central Tax (Rate), Notification No. 01/2017- Integrated Tax (Rate) and Notification No. 01/2017- Union Territory Tax (Rate) dated 28.06.2017 respectively

The Central Government vide the said Notifications introduced amendments to Schedule IV of the Central Goods and Services Tax (CGST) Act, 2017, addressing specified actionable claims. The specified actionable claim, as defined, now encompasses various activities, including betting, casinos, gambling, horse racing, lottery, and online money gaming.

> Notification No. 04/2023 – Integrated Tax dated 29.09.2023 issued to provide Simplified registration Scheme for overseas supplier of online money gaming

The Central Government vide the said Notification, notified that the Principal Commissioner of Central Tax, Bengaluru West and all the officers subordinate to him as the officers empowered to grant registration in case of supply of online money gaming provided or agreed to be provided by a person located in non-taxable territory and received by a person in India. It is also provided that for the purposes of this said notification, "online money gaming" shall have the same meaning as assigned to it in clause (80B) of section 2 of the Central Goods and Services Tax Act, 2017. The notification shall come force on 01.10.2023.

> Notification No. 11/2023 – Integrated Tax (Rate), Notification No. 12/2023 – Integrated Tax (Rate) and Notification No. 13/2023 – Integrated Tax (Rate) dated 26.09.2023 issued to implement the decisions of 50th GST Council

The Central Government vide the said Notifications has amended the rate notifications in order to provide that IGST will not be levied on services supplied by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India under RCM w.e.f 01.10.2023.

GST Portal Updates

> Advisory: Time limit for Reporting Invoices on the IRP Portal

The Government has decided to impose a time limit on reporting old invoices on the e-invoice IRP portals for taxpayers with AATO greater than 100 crores. To ensure timely compliance, taxpayers in this category will not be allowed to report invoices older than 30 days on the date of reporting.

Please note that this restriction will apply to the all document types (Invoices/Credit note/Debit note) for which IRN is to be generated. For example, if an invoice has a date of November 1, 2023, it cannot be reported after November 30, 2023. The validation built into the invoice registration portals will disallow the user from reporting the invoice after the 30 days window. Hence, it is essential for taxpayers to ensure that they report the invoice within the 30 days window provided by the new time limit.

It is further to clarify that there will be no such reporting restriction on taxpayers with AATO less than 100 crores, as of now. In order to provide sufficient time for taxpayers to comply with this requirement, which may require changes to your systems, it is proposed to implement it from 1st November 2023 onwards.

Portal update on 13.09.2023

> Advisory: Geocoding Functionality for the Additional Place of Business

The geocoding functionality for the "Additional Place of Business" address is now active across all States and Union Territories. This builds upon the geocoding functionality earlier implemented for the principal place of business, operational since February 2023. To date, over 2.05 crore addresses have been geocoded for both principal and additional places of business by GSTN. Moreover, since March 2022, all new addresses are geocoded at the point of registration, ensuring consistent accuracy and standardisation from the beginning.

Here is a brief guide on how to utilize this feature:

i. Access: Navigate to Services>>Registration>>Geocoding Business Addresses tab on the FO portal to find this functionality.

ii. Usage: The system will display a system-generated geocoded address.

You have the option to accept this or modify it as needed. If a system-generated address is not available, you can input the geocoded address directly.

iii. Viewing: Saved geocoded address details can be found under the "Geocoded Places of Business" tab. After logging in, go to My Profile >> Geocoded Places of Business.

iv. One-time Submission: This is a one-time activity, and post-submission, address revisions are not permitted. Taxpayers who have already geocoded their addresses through new registration or core amendment would not be required to do this as on the GST portal their address will be shown as geocoded. Remember, changes to the address on your registration certificate can only be made through the core amendment process. This geocoding feature will not affect previously saved addresses.

v. Eligibility: This feature is accessible to normal, composition, SEZ units, SEZ developers, ISD and casual taxpayers whether they are active, cancelled, or suspended.

Portal update on 19.09.2023

> Advisory: Temporary /Short Period Pause in e-Invoice Auto Population into GSTR-1

The auto population of e-Invoice in GSTR-1 is temporarily halted due to essential system upgrades, which will involve the implementation of e-Invoice JSON download functionality. This will have a temporary impact on the e-Invoice data auto population in GSTR-1 which will not be available from 26th September 2023 to 29th September 2023 from all six I

RP portals. The data for this period will be auto-populated on 30th September 2023 and will not impact GSTR-1 filing for next month and please avoid manually adding invoices in this period as the break will be only of a temporary nature. Details about the e-invoice JSON download functionality will be shared shortly via a separate advisory.

Portal update on 27.09.2023

Best Practices across India

> Launch of 'Pratidin' in Thiruvananthapuram Zone and review of the progress of "Virtual GST Seva Kendra"

Shri Vivek Ranjan, Member, Tax Policy, Legal and South Region launched 'Pratidin' in TVM Zone. TVM zone is the first to include all Committes; GST, Customs, Customs(P), Audit, Appeals and CCO under 'Pratidin' for selected performance parameters. Shri Vivek Ranjan also inspected Container Scanning Facility at ICCT, Vallarpadam, Kochi and undertook review meeting of performance of CGST and Customs Thiruvananthapuram Zone.

In the Pictures above: Shri Vivek Ranjan, Member, Tax Policy, Legal and South Region launched 'Pratidin' along with other officials.

Also, Smt. V Rama Mathew, Special Secretary and Member, CBIC visited Thiruvananthapuram Zone on 18.09.2023 and reviewed the progress of "Virtual GST Seva Kendra" (VGSK). Specific timelines were discussed for its rollout.

In the Picture above: Smt. V Rama Mathew, Special Secretary and Member, CBIC along with other officials reviewing the progress of "Virtual GST Seva Kendra".

> The State Tax Department, Uttar Pradesh bags Star of Governance Skoch Awards and TIOL Awards 2023 Winners

The State Tax Department, Uttar Pradesh has been conferred with Star of Governance Skoch Award in Finance category in Constitution Club of India New Delhi on 26th August, 2023.

In the Picture: Sameer Kochhar, Chairman, SKOCH Group presenting the award to Ms. Ministhy S, Commissioner of State Tax, Uttar Pradesh.

Bengaluru, Chennai, and Thiruvananthapuram & Meerut Tax Commissionerate in the CGST Zone, have been honored as recipients of the prestigious TIOL Awards in 2023. These awards recognize their outstanding contributions and achievements in their respective domains.

Outreach programmes

> The 9th edition of FICCI CASCADE's international conference #MASCRADE2023

The 9th edition of FICCI CASCADE's international conference #MASCRADE2023 – Movement Against Smuggled & Counterfeit Trade, was held in New Delhi. Mr Sanjay Kumar Agarwal, Chairman, Central Board of Indirect Taxes and Customs (CBIC) was also present and during his speech he said – 'Illicit trade undermines national security, risks legitimate manufacturing, leaks government revenue, jeopardizes public health and safety, and erodes the trust of consumers and investors alike. Tackling this issue is fundamental for safeguarding India's economic stability, ensuring fair competition, and fostering an environment conducive to sustainable growth and ease of doing business. CBIC plays a crucial role in the fight against illicit trade in its entirety. An environment is being created so that the fraudsters are not allowed to enter the ecosystem and pollute it. The recent decisions taken in successive GST Council meetings, to make suitable changes in return filing are in that direction only, so that the menace of fake ITC is curbed.'

In the Pictures: Mr. Anil Rajput, Chairman, FICCI Cascade; Mr Sanjay Kumar Agarwal, Chairman, CBIC; Mr Anil Sinha, Former Director, CBIC

In-House Activities

We bid farewell to the esteemed officers of the organization, Ms. Priya Sethi, Supdt., Mr. Irfan Zakir, Supdt., Mr. Sachin Goel, Supdt. and Mr. Rohit Sharma, Inspector, as they embark on new journeys, and express gratitude for their valuable contributions during their tenure in this office.

In the Picture above(Left to Right): Mr. Joginder Singh Mor, Under Secretary; Mr. Saurav S. Shardool, Director; Ms. Ashima Bansal, Joint Secretary; Mr. Pankaj Kumar Singh, Additional Secretary; Ms. Priya Sethi, Supdt.; Ms. Sumidaa B. Devi, Joint Secretary; Mr. Kshitendra Verma, Director

In the Picture above: Mr. Pankaj Kumar Singh, Additional Secretary conveying appreciation to Mr. Rohit Sharma, Inspector

In the 1st Picture above: Mr. Pankaj Kumar Singh, Additional Secretary conveying appreciation to Mr. Sachin Goel, Supdt.

In the Picture above: Mr. Pankaj Kumar Singh, Additional Secretary conveying appreciation to Mr. Irfan Zakir, Supdt.

Welcome

We extend a warm welcome to Ms. Subhaga Ann Varghese, IRS (C&IT: 2016) appointed as Under Secretary in the GST Council Secretariat. Previously associated with Directorate General of GST Intelligence (DGGI), Kochi Zonal Unit, she brings a wealth of knowledge and experience in the field of indirect tax.

Additionally, we extend a cordial welcome to the officers newly joining, Mr. L. Sheikholen Haokip, SO, Mr. Sudhir Kumar, SO, Mr. Vineet Kumar, Supdt., Mr. Sandeep Kumar, Supdt., Ms. Sonia, Supdt., Mr. Mohan Lal, Supdt., Mr. Khupmang Neihsial, Supdt., Mr. Himanshu Bhardwaj, Supdt. And Mr. Om Meena, SO which would be a valuable addition to our team

In the Picture (left to right): Mr. Mohan Lal, Supdt.; Mr. Himanshu Bhardwaj, Supdt.; Mr. Shyam Bihari Meena, TA; Mr. Dharambir Singh, Supdt.; Mr. Irfan Zakir, Supdt.; Mr. Joginder Singh Mor, Under Secretary; Mr. Kshitendra Verma, Director; Mr. Sachin Goel, Supdt.; Mr. Rohit Sharma, Inspector; Ms. Subhaga Ann Verghese, Under Secretary; Mr. Sandeep Kumar, Supdt.; Mr. Vineet Kumar, Supdt.

Legal Corner

> Consensus ad idem

It signifies that for a contract to be valid, there must be a mutual agreement and understanding between the parties involved regarding the essential terms and conditions of the contract. In other words, both parties must be on the same page and have a clear understanding of what they are agreeing to. This common understanding is necessary for the contract to be legally enforceable. The legal principles associated with "consensus ad idem" in contract law:

- Mutual Agreement: For a contract to be valid, there must be a mutual agreement between the parties involved. This means that both parties must agree on the same terms and conditions of the contract. There should be a clear understanding and acceptance of what is being offered and accepted.

- Offer and Acceptance: The process of forming a contract typically involves one party making an offer, and the other party accepting that offer without any material changes. Both the offer and acceptance must align with the same terms and intentions for a contract to exist.

- Intention to Create Legal Relations: Both parties must have the intention to create legal relations. This means that they must intend for the contract to be legally binding. Social agreements or mere expressions of goodwill are generally not considered contracts.

- Genuine Consent: Consent must be freely given and not obtained through duress, fraud, misrepresentation, or undue influence. Parties must enter into the contract willingly and with a clear understanding of the terms and their implications.

- 'Consensus ad idem' is a fundamental concept in contract law, emphasizing the importance of a mutual understanding between parties when forming a contract or entering into a preliminary agreement like an MOU. Hence for a contract to be valid, consent should be unambiguous and free i.e if the agreement is induced by: Coercion, Undue Influence, Fraud, Misrepresentation or Mistake, the contract is voidable in the nature and cannot be enforced by the party guilty of it.

- However, a unilateral mistake is in principle no ground for rescission of contract. Unilateral mistake refers to a situation where only one of the contracting parties has mistaken beliefs towards essential facts of the agreement. For instance, A agrees to purchase a painting from B, thinking that the painting is a masterpiece of C. B agrees to sell the painting to A, knowing that the painting was actually created by D, but unaware of the fact that A mistook the painting to be a work of C's. A unilateral mistake does not render an agreement void unless the non-mistaken party manipulates the mistake to gain an advantage while being fully aware of it.

- Be that as it may, rectification is not an option when there is a unilateral mistake in a contract. Doing so would be unfair as the non-mistaken party would have to bear contractual consequences due to the mistake of the other party. In such circumstances, the contract is still legally binding on both parties though there has not been a meeting of the minds; this is to ensure fairness within the contractual relationship. Otherwise, a unilateral mistake might be used as an excuse by the mistaken party to avoid the contract.

- Certainty of Terms: The terms and conditions of the contract must be clear, definite, and certain. Vague or ambiguous terms can lead to disputes and may render the contract unenforceable.

- Offeror and Offeree: The party making the offer (the offeror) and the party accepting the offer (the offeree) must be on the same page regarding the essential elements of the contract. This includes the subject matter, price, quantity, time of performance, and any other significant terms.

- Objective Standard: The determination of whether consensus ad idem exists is typically based on an objective standard. It focuses on what a reasonable person would perceive from the words and actions of the parties involved, rather than on their subjective intentions

- Communication: Effective communication is crucial in achieving consensus ad idem. Both parties must communicate their intentions clearly and understand the communication from the other party.

'Consensus ad idem' is a fundamental concept in contract law, emphasizing the importance of a mutual understanding between parties when forming a contract or entering into a preliminary agreement like an MOU. Hence for a contract to be valid, consent should be unambiguous and free i.e if the agreement is induced by: Coercion, Undue Influence, Fraud, Misrepresentation or Mistake, the contract is voidable in the nature and cannot be enforced by the party guilty of it.

However, a unilateral mistake is in principle no ground for rescission of contract. Unilateral mistake refers to a situation where only one of the contracting parties has mistaken beliefs towards essential facts of the agreement. For instance, A agrees to purchase a painting from B, thinking that the painting is a masterpiece of C. B agrees to sell the painting to A, knowing that the painting was actually created by D, but unaware of the fact that A mistook the painting to be a work of C's. A unilateral mistake does not render an agreement void unless the non-mistaken party manipulates the mistake to gain an advantage while being fully aware of it.

Be that as it may, rectification is not an option when there is a unilateral mistake in a contract. Doing so would be unfair as the non-mistaken party would have to bear contractual consequences due to the mistake of the other party. In such circumstances, the contract is still legally binding on both parties though there has not been a meeting of the minds; this is to ensure fairness within the contractual relationship. Otherwise, a unilateral mistake might be used as an excuse by the mistaken party to avoid the contract.