CBIC clarified that the head office has the option to distribute among branch offices the credit for taxes paid on common services procured by it.

CBIC clarified that the head office has the option to distribute among branch offices the credit for taxes paid on common services procured by it.

Premium

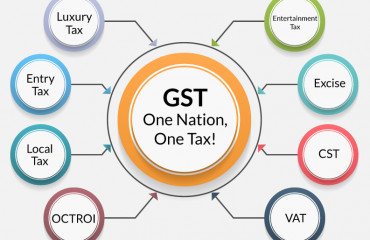

PremiumNew delhi: Free replacement of parts of goods under warranty does not attract GST but tax would be payable if customers are charged for new parts, the Central Board of Indirect Taxes and Customs (CBIC) said in an order, giving effect to the decisions of the Goods and Services Tax Council meeting earlier this month.

Free replacement of parts does not attract tax because its cost is included in the original sale of the item, CBIC said.

"The value of original supply of goods (provided along with warranty) by the manufacturer to the customer includes the likely cost of replacement of parts and (or) repair services to be incurred during the warranty period, on which tax would have already been paid at the time of original supply of goods," said the CBIC order, explaining that in such cases, no further tax is to be paid.

However, if any additional amount is charged by the manufacturer from the customer for replacement parts or for service, then GST is payable on the additional amount, the order said.

CBIC also clarified on how credits for taxes paid by the head office of a company for services procured for branch offices across states could be used. Branch offices in different states are treated as distinct entities under GST laws. CBIC clarified that the head office has the option to distribute among branch offices the credit for taxes paid on common services procured by it. However, it is not mandatory for the head office to distribute such input tax credit.